[ad_1]

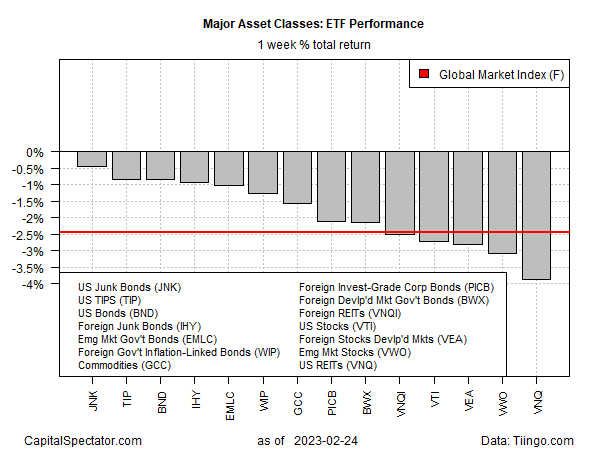

Sellers took a toll on all of the main asset lessons final week, primarily based on a set of ETF proxies.

US junk bonds posted the softest setback in buying and selling by Friday’s shut (Feb. 24). SPDR Bloomberg Excessive Yield Bond (JNK) edged down 0.4% for the week, marking the third straight weekly loss. Regardless of the current declines, JNK continues to commerce in a middling vary primarily based on costs for the previous 12 months.

The deepest loss final week: US actual property funding trusts. Vanguard Actual Property Index Fund (VNQ) tumbled 3.8%. Because the fund worth slides, it’s trailing one-year dividend yield rises and is at present 3.54%, in line with Morningstar.com. However that’s nonetheless nicely beneath the three.95% for the present 10-year Treasury yield, suggesting that the ETF remains to be susceptible so long as the Federal Reserve continues to carry rates of interest.

The market’s expectations for the Fed funds terminal fee “retains getting pushed increased and better,” says Al Bruno, affiliate portfolio supervisor for Morningstar Funding Administration. “Initially of the 12 months, the market was pricing within the Federal Reserve chopping rates of interest by the tip of the 12 months, now that’s now not the case.”

How is recession threat evolving? Monitor the outlook with a subscription to:

The US Enterprise Cycle Danger Report

The policy-sensitive 2-year Treasury yield rose to 16-year excessive on Friday. The rise lifted this extensively adopted fee above the efficient Fed funds fee, which is taken into account an indication that the market is now pricing in a higher-than-recently anticipated peak for the central financial institution’s terminal fee.

The International Market Index (GMI.F) took a 2.4% hit within the newest promoting wave, falling for a 3rd time in as many weeks. This unmanaged benchmark holds all the foremost asset lessons (besides money) in market-value weights by way of ETFs and represents a aggressive measure for multi-asset-class-portfolio methods.

All the foremost asset lessons at the moment are firmly below water for the trailing one-year efficiency. The declines vary from the gentle – a 4.7% slide for US shares (VTI) – to the extreme: a 19.0% loss for company bonds ex-US (PICB).

GMI.F is down 7.0% for the previous 12 months.

Evaluating the foremost asset lessons by a drawdown lens continues to point out comparatively steep declines from earlier peaks. The softest drawdown on the finish of final week: US junk bonds (JNK), which closed 11.0% beneath its earlier peak on Friday. On the reverse excessive: company bonds ex-US (PICB) with a 19% drawdown.

Be taught To Use R For Portfolio Evaluation

Quantitative Funding Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Danger and Return

By James Picerno

[ad_2]