[ad_1]

Authored by Simon White, Bloomberg macro strategist,

Longer-term bond yields proceed to replicate an atmosphere the place inflation ultimately comes again to focus on, and usually are not adequately pricing the chance it stays elevated and unstable.

PCE deflator information for the US is launched in the present day and we’ll learn the way intact the present disinflationary pattern is.

The pattern seems set to finish prior to anticipated, with world inflationary forces choosing again up as China recovers, reinforcing already sticky home inflation. If bond holders begin to demand extra premium to replicate a higher-inflationary world, yields will rise.

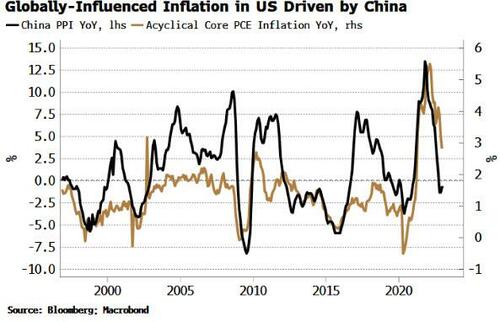

The San Francisco Fed splits up core PCE right into a cyclical and acyclical element. The cyclical element is made up of these elements of the PCE that correlate effectively with the economic system, i.e. that the Fed has extra affect over with financial coverage, and acyclical is what’s left, i.e. is extra globally pushed.

Acyclical inflation actually boils all the way down to China, with its PPI carefully matching it.

Easing in China lastly seems to be getting by way of, with cash progress and credit score information displaying that China is on the cusp of a cyclical upturn. The rise in yields in China exhibits that this upturn ought to result in greater PPI in China, which ought to increase globally-driven inflation within the US.

Core PCE’s fall has so far been pushed by the autumn in globally-driven inflation. Cyclical, aka domestically-driven, inflation continues to be close to its highs, however even when it begins to fall because the lags from financial coverage kick in, it’s prone to come when globally-driven inflation is rising once more, ending the US’s pattern in disinflation.

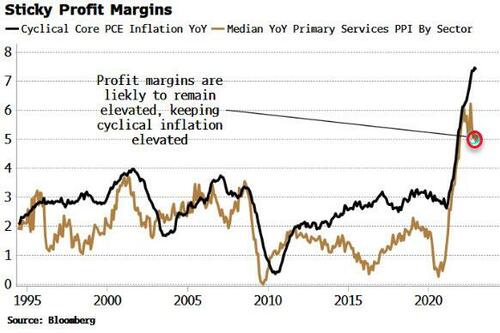

Including to troubles, cyclical inflation itself is poised to stay sticky. One of many largest drivers of inflation’s rise was the quickest bounce in revenue margins seen in many years as corporations took benefit of the distinctive circumstances of the pandemic. Though margins have come off their highs, they’re prone to stay elevated.

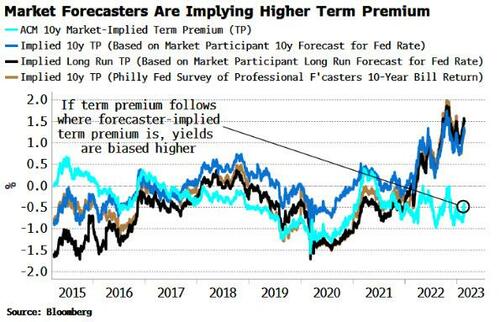

One outstanding function of the present cycle has been how comparatively contained longer-term bond yields have been regardless of the very best inflation for many years. Time period premium has remained effectively behaved, because the market has not, but, demanded an additional premium for inflation dangers.

However time period premium implied by forecasters is already rather more elevated than market-implied time period premium. Given the inflationary backdrop, there’s as but an unpriced threat bond holders might quickly begin to demand the next premium, taking yields greater.

Loading…

[ad_2]