[ad_1]

By Simon White, Bloomberg Markets Stay reporter and strategist

Inflation pressures and financial-stability dangers will doubtless immediate the BOJ to drag again on its bond-buying coverage ahead of anticipated, boosting the yen.

Kazuo Ueda, nominee for the following BOJ governor, made clear he isn’t planning to reverse course on the central financial institution’s easing program, in remarks made in the present day to the parliamentary listening to as a part of the affirmation course of. Nonetheless, he could find yourself having to just do that as inflation rises and the BOJ impedes easy market functioning within the JGB market.

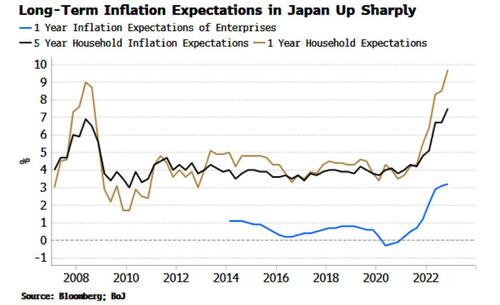

Each core and headline inflation in Japan have raced greater to multi-decade highs. The expectation is that that is non permanent, however inflation that continues to be elevated for an prolonged time period can turn out to be persistent and endemic. In Japan, longer-term inflation expectations of households and companies have risen sharply, risking changing into unanchored.

The BOJ continues to purchase bonds to maintain the 10y yield beneath 0.5%, however that is changing into more and more futile as different yields across the 10y level are pulled greater, leaving the 10y JGB’s yield trying anomalous.

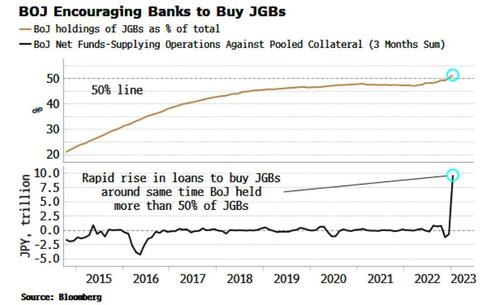

Moreover, the BOJ itself seems to be uncomfortable that it now owns half the JGB market. Since that threshold was crossed, there was a speedy rise in loans it makes to business banks, not directly encouraging them to make use of the proceeds to purchase authorities or company debt.

Liquidity circumstances within the JGB market are already deteriorating, and stress is liable to intensifying as US and international yields present indicators they’re starting to consider a larger premium for a world the place inflation is a characteristic, not only a bug.

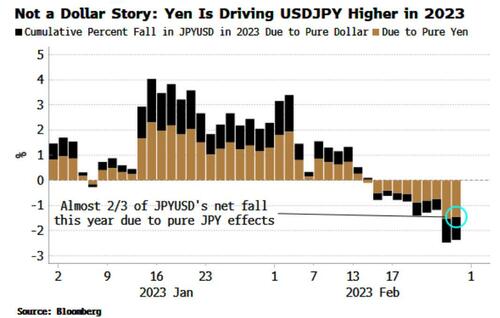

USDJPY has rallied since Ueda’s nomination was introduced. That is partly as a result of rise within the greenback, however it’s primarily a results of a weaker yen.

This leaves USDJPY susceptible to resuming its selloff, because the BOJ in the end has to renege on its easing coverage ahead of Ueda infers, or the market expects.

Loading…

[ad_2]