[ad_1]

Hospitals delaying surgical procedure in Sri Lanka. Worldwide flights suspended in Nigeria. Automobile factories shuttered in Pakistan.

Article content material

(Bloomberg) — Hospitals delaying surgical procedure in Sri Lanka. Worldwide flights suspended in Nigeria. Automobile factories shuttered in Pakistan.

Commercial 2

Article content material

In a few of the world’s most weak growing nations, the conditions on the bottom are dire. Shortages of {dollars} are crimping entry to every little thing from uncooked supplies to drugs. In the meantime governments are battling their money owed as they chase rescue packages from the Worldwide Financial Fund.

Article content material

It’s forcing a rethink of the bullish emerging-market consensus that swept Wall Road just some months in the past. Granted, few anticipated the challenges dealing with sure frontier economies to be remedied this yr, however ache has deepened alongside a rebound within the dollar.

Whereas bother on the fringes of the growing world is unlikely to tug down the asset class as an entire, some say it’ll drive cash managers to be more and more tactical of their funding allocations within the months to return.

Article content material

Commercial 3

Article content material

“There’s an actual disaster brewing in these troubled nations and for some, issues can nonetheless get even worse,“ stated Hasnain Malik, an rising and frontier-market strategist at Tellimer in Dubai. “Traders will have to be much more vigilant in screening for vulnerability and differentiating nation threat to keep away from being shocked by the following Ghana or Sri Lanka.”

In Pakistan, factories have halted operations up to now months as they ran out of laborious forex to import uncooked supplies. In Sri Lanka, the federal government is setting a restrict of 20 liters of gas per particular person every week and authorities hospitals are suspending non-urgent surgical procedures as a result of scarcity of medication and different medical provides.

That’s to not point out the worldwide carriers that suspended flights to Nigeria as a result of issue in repatriating {dollars} from the nation. In Bangladesh, energy producers are in search of $1 billion of international forex from the central financial institution for gas imports to avert a looming power disaster. Malawi, too, is dealing with a scarcity of prescription drugs, fertilizer and diesel amid declining imports as a result of greenback crunch.

Commercial 4

Article content material

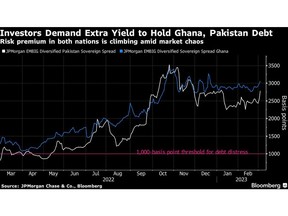

JPMorgan Chase & Co.’s Subsequent Technology Markets Index, which tracks the greenback debt of what it calls pre-emerging international locations, posted a 0.4% drop final month, the largest since September. And amid the greenback’s latest vigor, currencies from Ghana, Egypt, Pakistan and Zambia have crumbled way more this yr than their international friends.

That has some cash managers embracing extra cautious approaches, a break from the broad emerging-market optimism seen initially of the yr.

“These international locations are mired in financial collapse, and a few like Pakistan are teetering on the sting of one other default,” stated John Marrett, senior analyst on the Economist Intelligence Unit in Hong Kong. “Main elements of their economies are struggling. The currencies are value far much less too.”

Commercial 5

Article content material

Extra risk-averse cash managers, in the meantime, are as a substitute attempting to find enticing yields in debt from governments which have managed to maintain their fiscal deficits in examine and currencies comparatively steady. Barclays Plc has pointed to Mexico and Colombia as nations heading towards additional fiscal consolidation.

Harmful Cycle

For nations resembling Sri Lanka, the difficulty started years in the past as officers spent priceless hard-currency reserves to maintain native change charges artificially excessive.

But it surely was Russia’s warfare in Ukraine and the Federal Reserve’s aggressive coverage tightening, which drove the greenback to generational highs. That pushed many frontier economies nearer to the sting as hovering power and meals costs drained their coffers.

Commercial 6

Article content material

“It’s tempting to say there’s an EM disaster due to the Fed tightening, however that takes the human company away from policymakers in choose international locations that have been enacting unsustainable fiscal insurance policies,” stated Samy Muaddi, head of emerging-markets fastened revenue at T. Rowe Worth in Baltimore. “That stated, tighter monetary circumstances at the moment are exposing insurance policies in a few of these international locations which can be proving unsustainable.”

About two dozen nations are lining up for help from the Worldwide Financial Fund, although progress has been gradual for nations hobbled by debt negotiations. The yr has already seen a number of debt-laden international locations — together with Egypt, Pakistan and Lebanon — drop their change charges as they try and unlock rescue funding, with forex merchants bracing for a possible wave of devaluations.

Commercial 7

Article content material

For Brendan McKenna, an emerging-market economist and strategist at Wells Fargo Securities LLC in New York, those that are keen to take the chance can discover alternative in international locations with a transparent reform agenda and a path towards assist from official lenders, such because the IMF.

“Pakistan, Sri Lanka and Ghana — perhaps now is just not the time to deploy capital there,” he stated. “However Egypt might be a chance if the IMF program is profitable at supporting the economic system whereas robust reforms are applied.”

What to Watch

- China will likely be in focus because the Nationwide Folks’s Congress, slated to open on March 5, will set the financial and social agenda for the approaching yr. The nation may also launch information on exports, shopper worth inflation and factory-gate costs within the coming week.

- Merchants will monitor inflation figures from the Philippines, Thailand, Russia, Mexico and Chile.

- Poland’s central financial institution is prone to maintain the important thing rate of interest at 6.75% because the nation’s tightening cycle ends. Bloomberg Economics expects the following transfer will likely be a fee reduce, probably within the second half of 2023.

- Financial institution Negara Malaysia will in all probability maintain its benchmark fee on maintain.

- Peruvian policymakers will meet Thursday to resolve their key fee.

- Brazilian IPCA information for February will in all probability make clear the tempo of disinflation, in accordance with Bloomberg Economics.

—With help from Selcuk Gokoluk, Colleen Goko, Anusha Ondaatjie and Faseeh Mangi.

[ad_2]

Feedback

Postmedia is dedicated to sustaining a vigorous however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback might take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. We’ve got enabled e mail notifications—you’ll now obtain an e mail in the event you obtain a reply to your remark, there may be an replace to a remark thread you comply with or if a consumer you comply with feedback. Go to our Group Tips for extra info and particulars on how you can regulate your e mail settings.

Be a part of the Dialog