[ad_1]

The Biden administration’s new inventory buyback tax can have little impression on the general inventory market. It’d even truly assist it. I’m referring to the new 1% excise tax on share repurchases that went into impact on Jan. 1.

This tax has set off alarm bells in some corners of Wall Road, on the speculation that buybacks have been one of many largest props supporting the previous decade’s bull market — and something weakening that prop might result in a lot decrease costs.

Much more alarms went off after President Joe Biden telegraphed his intent to quadruple federal taxes on buybacks, to 4%.

Learn: Biden’s State of the Union: Listed below are key proposals from his speech

Whereas this proposal is taken into account useless on arrival on Capitol Hill, the give attention to presumably growing this tax from 1% reduces the chance that will probably be eradicated anytime quickly.

Tax applies to internet repurchases

But stock-market bulls shouldn’t fear. One motive is that the brand new excise tax — whether or not 1% or 4% — is utilized to internet buybacks — repurchases in extra of what number of shares the company could have issued.

As has been broadly reported for years, the shares that many corporations are shopping for again typically are barely sufficient to compensate for the brand new shares they subject as a part of their compensation of firm executives. In consequence, internet repurchases — on which the brand new tax can be levied — are an order of magnitude smaller than gross repurchases.

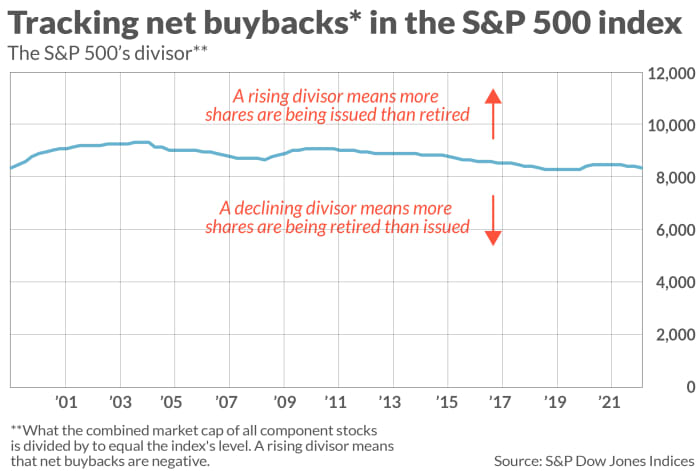

The chart beneath supplies the historic context. It plots the S&P 500’s

SPX,

divisor, which is the quantity used to divide the mixed market cap of all part corporations to provide you with the index stage itself. When extra shares are issued than repurchased, the divisor rises; the reverse causes the divisor to fall.

Discover from the chart that, although there have been some year-to-year fluctuations within the divisor, the divisor’s end-of-2022 stage was just about unchanged from the place it was on the high of the web bubble.

There’s a lot irony within the excise tax’s software to internet repurchases. A lot of the political rhetoric that led to the creation of the tax was based mostly on the grievance that corporations have been repurchasing their shares merely to cut back the share dilution that may in any other case happen when executives are given shares as a part of their compensation packages. Nevertheless it’s exactly when share repurchases equal share issuance that’s the tax wouldn’t apply.

The buyback tax would possibly encourage increased dividends

The rationale why the brand new tax on share repurchases would possibly truly assist the inventory market traces to the impression it might have on corporations’ dividend coverage. Up till now, the tax code offered an incentive for companies to repurchase shares somewhat than pay dividends after they wished to return money to shareholders. By not less than partially eradicating that incentive, corporations going ahead could flip to dividends greater than they did beforehand. The Tax Coverage Heart estimates that the brand new 1% buyback tax will result in “a roughly 1.5 p.c improve in company dividend payouts.”

This is able to be excellent news as a result of, greenback for greenback, a better dividend yield has extra bullish penalties than a better buyback yield. (The buyback yield is calculated by dividing per-share buybacks by share value.) To indicate this, I in contrast the predictive skills of both yield. I analyzed quarterly knowledge again to the early Nineties, which is when the full quantity of buybacks available in the market started to be vital.

The accompanying desk experiences the r-squareds of regressions wherein the completely different yields are used to foretell the S&P 500’s return over the next 1- or 5-year intervals. (The r-squared measures the diploma to which one knowledge sequence explains or predicts one other.) Discover that the r-squareds are markedly increased for the dividend yield than for the buyback yield

| When predicting S&P 500’s return over subsequent 1 yr | When predicting S&P 500’s return over subsequent 5 years | |

| Dividend yield | 4.2% | 54.9% |

| Buyback yield | 1.0% | 10.2% |

The underside line? Whereas the brand new buyback tax is unlikely to have a huge effect on the inventory market, the impression it does have could be extra constructive than adverse.

Mark Hulbert is an everyday contributor to MarketWatch. His Hulbert Scores tracks funding newsletters that pay a flat charge to be audited. He will be reached at mark@hulbertratings.com

Extra: Biden targets inventory buybacks — do they assist you to as an investor?

Additionally learn: The bond market is flashing a warning that U.S. shares could possibly be headed decrease

[ad_2]