[ad_1]

AppleInsider might earn an affiliate fee on purchases made by way of hyperlinks on our website.

Inventory analysts receives a commission to have opinions — and so they’re not at all times nice. Here is who was proper about Apple’s Christmas quarter — and who was incorrect.

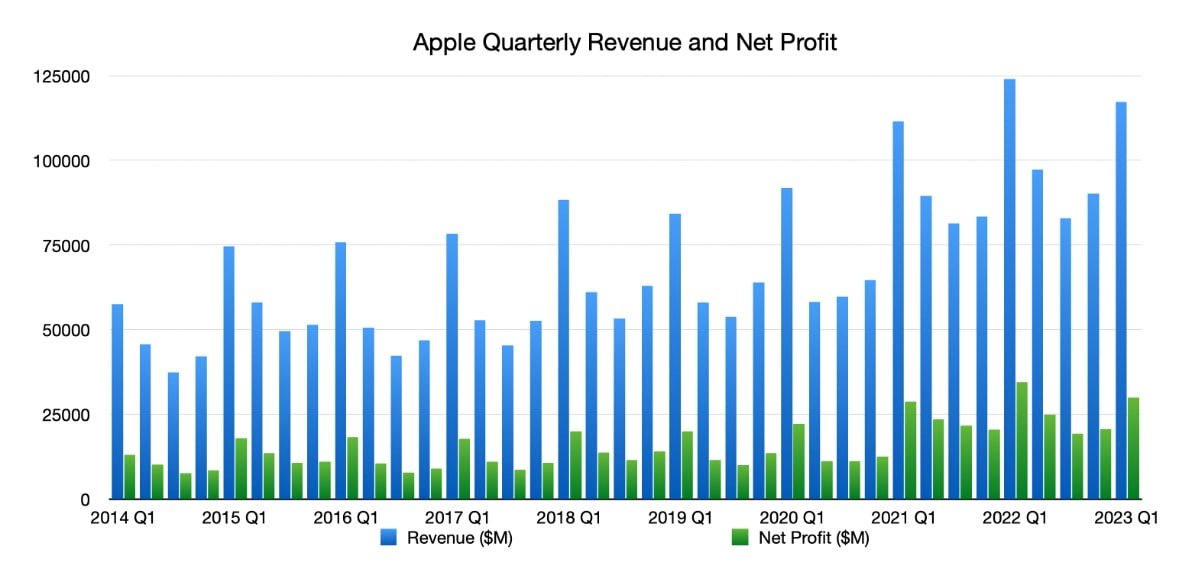

The corporate reported $117.15 billion in income for its first quarter outcomes of 2023, a decline from the $123.9 billion reported in quarter one in all 2022. The $1.88 earnings per share for the quarter is decrease than the $2.10 recorded in the identical interval final 12 months.

Earlier than the earnings name on Thursday, the Wall Avenue consensus on Apple’s shares earlier than the outcomes launch forecast a median income of $121.2 billion and an earnings-per-share of $1.94.

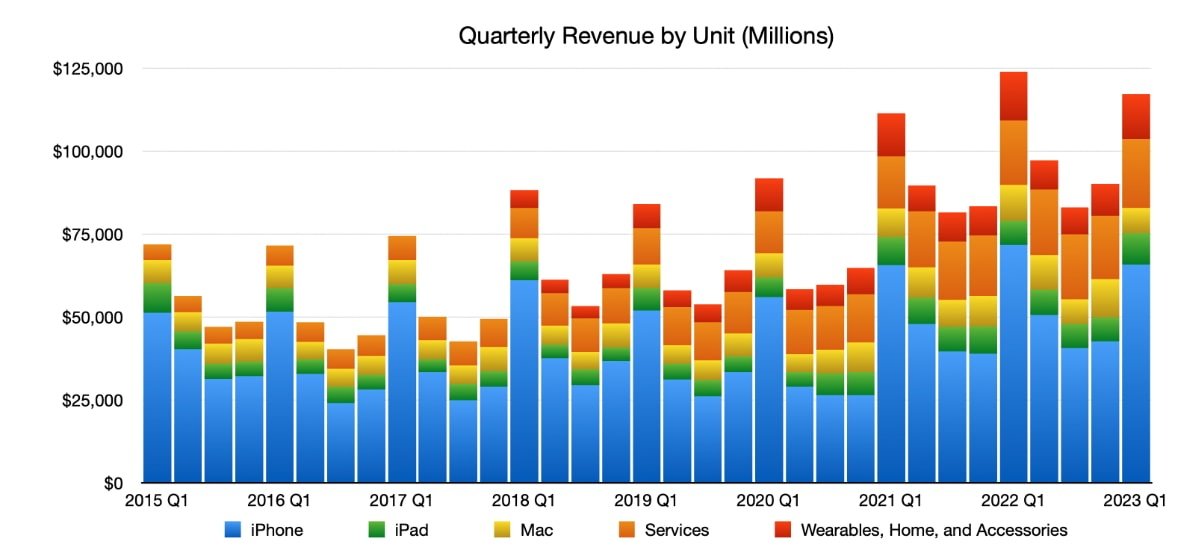

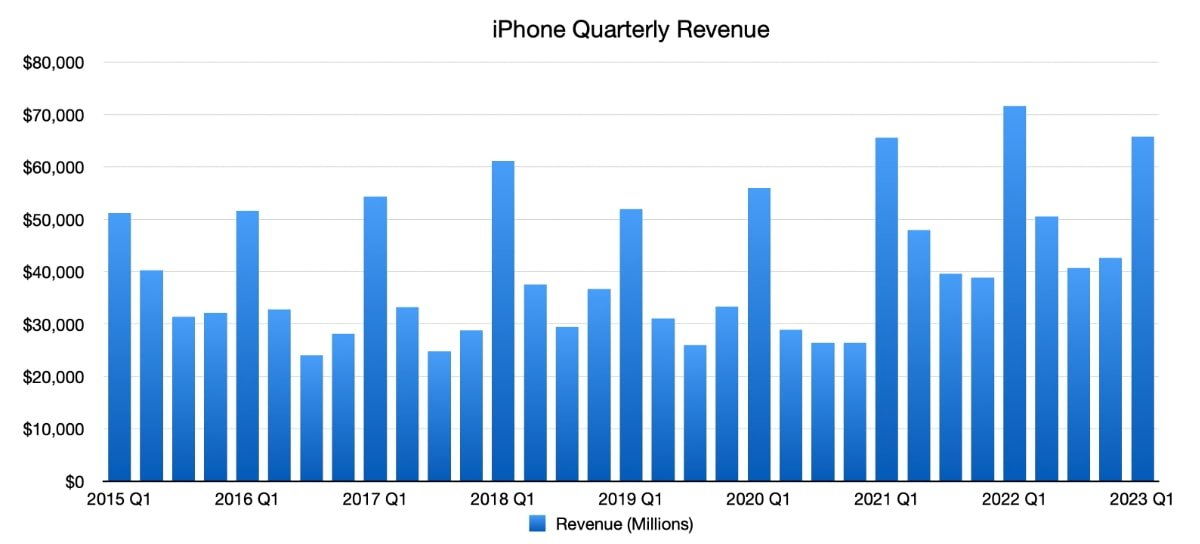

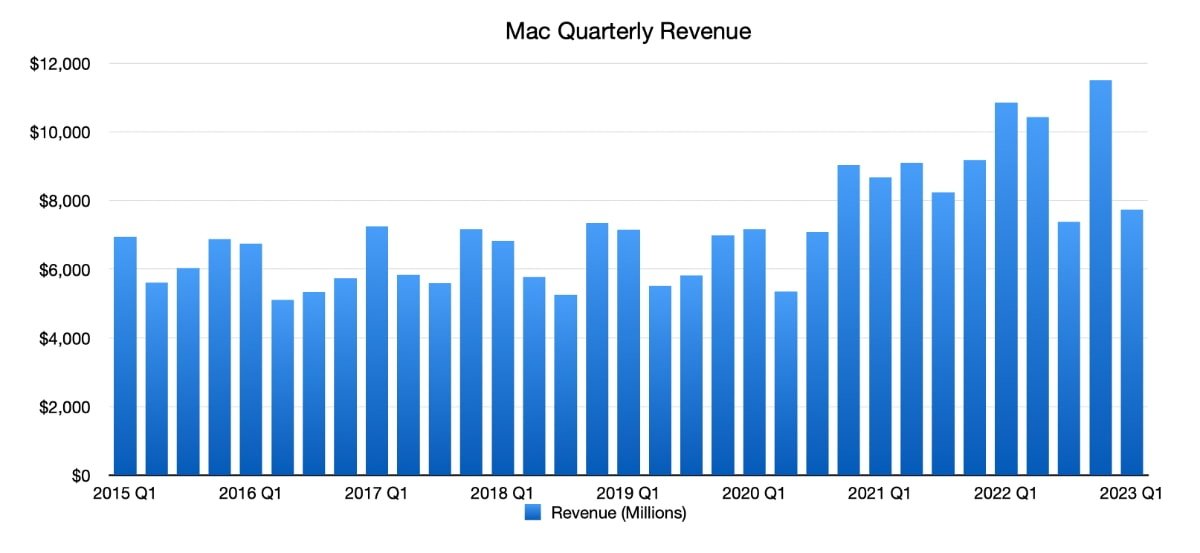

The iPhone introduced in $65.78 in income for the quarter, down from $71.6 billion seen the year-ago quarter, whereas Mac revenues have been down year-on-year at $7.74 billion versus $10.8 billion.

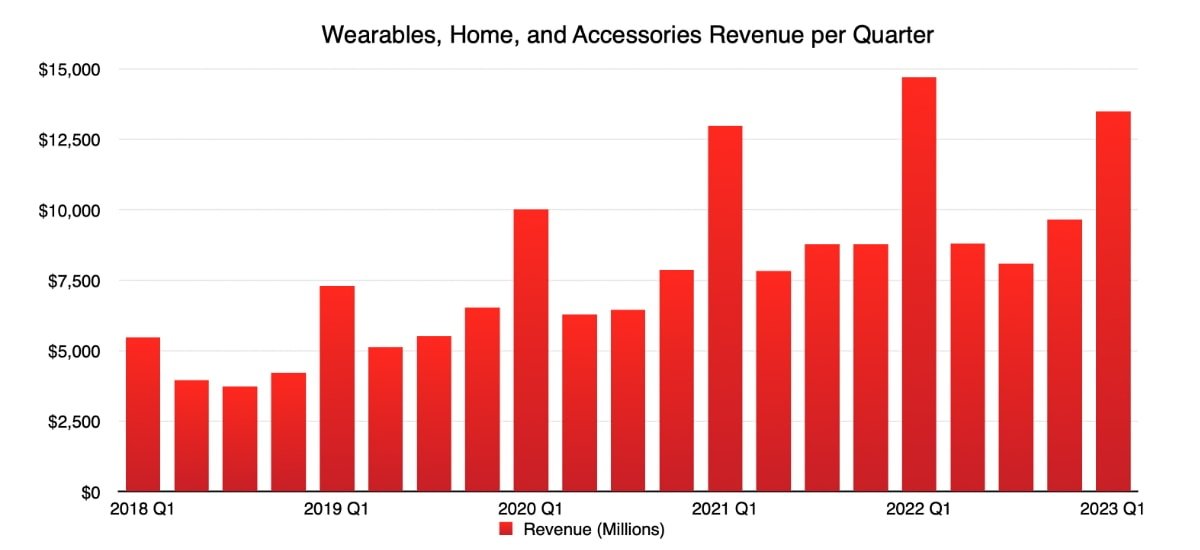

Income from iPad rose to $9.4 billion from $8.4 billion final 12 months. Wearables, Residence, and Equipment reached $13.48 billion, down year-on-year from $14.7 billion.

The Companies companies continued its progress to $20.77 billon for the quarter, up from $19.5 billion.

Listed below are a number of the predictions from analysts earlier than the earnings name and the way correct they have been.

Wedbush

Analysts Daniel Ives and John Katsingris believed that demand for the iPhone 14 Professional was extra steady than anticipated, however Apple CEO Tim Cook dinner stated iPhone manufacturing points have been the main cause for the earnings miss.

Particularly, the iPhone 14 Professional confronted vital challenges associated to COVID-19 and overseas foreign money trade charges as a consequence of a powerful greenback.

Wedbush had lowered its value goal for AAPL from $200 to $175, although analysts stated “Apple stays our favourite tech title” and maintained their Outperform score.

After the earnings name, it raised its goal to $180, citing steady iPhone progress.

JP Morgan

Samik Chatterjee of JP Morgan warned buyers it believed demand was falling barely throughout the whole Apple product catalog.

Excessive demand for the iPhone 14 Professional fashions was a consider manufacturing challenges, although it did catch up with demand in January.

On one other optimistic word, two out of each 5 tablets offered over the vacation quarter have been Apple’s iPad, and gross sales of the machine are nonetheless growing.

Apple had additionally stated that fashionable demand from prospects was a main consider the return of the HomePod. “We actually did hear from our prospects this rising curiosity for extra highly effective and richer acoustics of a bigger speaker,” an Apple spokesperson stated.

Canaccord

Canaccord Genuity Capital Markets lowered its value goal for Apple from $200 to $170 whereas sustaining a “purchase” advice for the corporate. It additionally forecasted $68.3 billion for first-quarter iPhone gross sales, with a full-year estimate of $199.6 billion.

Canaccord believed that demand for the iPhone 14 Professional fashions was “disappointing” however thinks some misplaced December gross sales can be pushed later into March.

The agency additionally estimates that different Apple {hardware} will face a decline in demand, resembling the brand new Macs Apple launched in January.

Apple had posted a year-over-year decline in Mac income at $7.74 billion versus $10.8 billion a 12 months in the past.

Morgan Stanley

Morgan Stanley believed a slight Companies overperformance would compensate for his or her prediction of an 11% year-over-year drop in iPhone income, together with higher than anticipated shipments for iPad and Mac.

The Companies enterprise did set a new file for Apple and surpassed the expectations set by Wall Avenue, and iPad gross sales had a powerful vacation quarter worldwide.

The corporate reported a income of $20.77 billion for the section versus the estimated determine of $20.67 billion, which was up 6.4% year-over-year. Apple Companies even have over 935 million subscribers, up from 900 million in 2022.

The agency estimated reported income of $122.8 billion, up from an earlier expectation of $120.3 billion, which was increased than consensus. Morgan Stanely believes that iPhone income can be down 4% year-over-year due to the $916 common promoting value.

Rosenblatt

On January 13, Rosenblatt Securities lowered its value goal by $24 right down to $165, with iPhone manufacturing delays and “macro providers headwinds” responsible. It additionally agreed with studies that income from the App Retailer has slowed.

For instance, a report on January 11 estimated a 7% to eight% drop in income primarily based on components resembling softness in digital promoting and gaming.

However Apple Companies continued its progress, although Apple did not escape the numbers from the App Retailer.

UBS

UBS had anticipated a December income of $120.3B and an EPS of $1.93, each of which have been extra optimistic than Apple’s precise outcomes of $117.15 billion and $1.88 EPS.

On account of weak vacation gross sales of Professional-model iPhones introduced on by the Zhengzhou plant issues, UBS predicts 79 million gadgets will ship within the quarter, down from the consensus projection of 80 million.

Nevertheless, regardless of the lowered gross sales, UBS believes that Apple’s monetary state of affairs might profit from the sturdy Euro, Pound, Yen, and Yuan currencies relative to the greenback.

Deutsche Financial institution

Deutsche Financial institution had minimize its value goal from $170 to $160 whereas sustaining a “purchase” score. It had anticipated Apple to report at or barely above its estimates.

The financial institution additionally believed that Apple would profit from a good overseas trade atmosphere, which might assist the Merchandise and Companies companies. That issue “ought to not less than offset the weaker shopper spending within the quarter,” analysts stated.

A January 12 report confirmed a decline in shopper spending for cell video games and apps. If that was true, different providers may need helped compensate for an App Retailer drop for the reason that section hit a brand new file of $20.8 billion.

Financial institution of America

Analysts predicted demand for the iPhone 14 Professional fashions could be weaker than anticipated within the first half of 2023, however provide and demand have since equalized.

They forecasted income of $120 billion, which was extra vital than Apple’s outcomes. Their steerage for the March quarter is $96 billion to $97 billion.

The financial institution maintains a impartial score for Apple with a lowered value goal from $154 to $153.

Cowen

Cowen analysts predicted a drop of roughly 8 million iPhone items to round 74 million in whole. The forecast was as a consequence of Foxconn manufacturing facility shutdowns in China that hampered manufacturing.

Nevertheless, they believed iPad gross sales would profit from seasonality and improved part availability, and the iPad did have a powerful vacation quarter, with gross sales nonetheless growing.

They forecast income of $118.8 billion which might be down 4% year-over-year, and an EPS of $1.90. The analysts have been near the mark, as Apple reported $117.15 billion in income and $1.88 EPS.

[ad_2]