[ad_1]

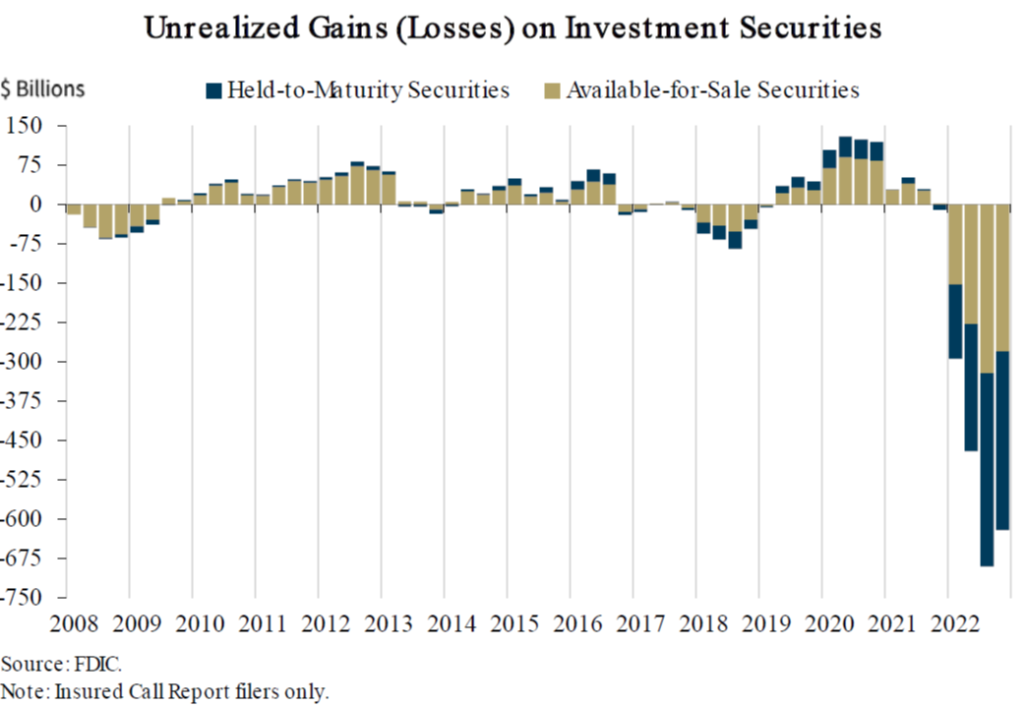

Contemplate the next graph of unrealized losses on securities held by reporting banks (from Rupkey/Monetary Markets This Week):

Supply: Rupkey, “Monetary Markets This Week,” March 20, 2023.

This made me marvel what would make these unrealized losses go to zero? Clearly a discount in rates of interest. I don’t have the information to do the calculation available, however I’ve marketable federal debt at par worth and at market worth. I can have a look at the ratio of these two and the way that ratio strikes with a given rate of interest.

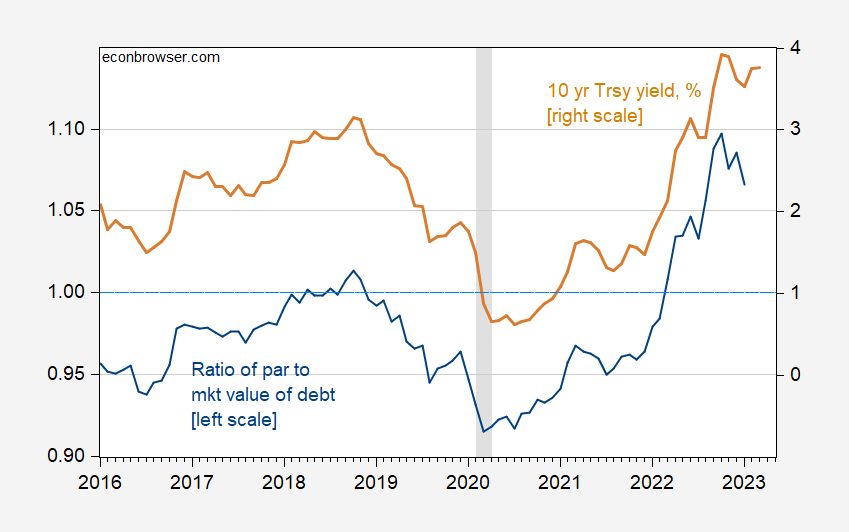

Determine 1: Ratio of par worth of marketable debt to market worth (blue, left scale), and ten 12 months Treasury yield, % (tan, proper scale). NBER outlined peak-to-trough recession dates shaded grey. Supply: Dallas Fed, Treasury, NBER, and creator’s calculations.

There’s an apparent correlation. From the regression:

ratio = 0.8817 + 0.0455(gs10)

adj-R2 = 0.83, NObs = 85, DW = 0.20

Utilizing this correlation, it seems a ten 12 months yield of two.6% will do the trick (thus far by means of March, they’re 3.8%, roughly the identical as February). Clearly, that is back-of-the-envelope (and the ratio of par to market shouldn’t be the identical because the ratio of bought worth to market worth), however you get the concept if yields fall, among the unrealized losses will disappear.

How cheap is that this end result? Not very, however I’ll be aware that the ten 12 months price has fallen by half a share level for the reason that starting of the March…

[ad_2]