[ad_1]

Physics has been in search of a grand “Unified Discipline Principle” that may clarify the whole lot within the universe. I generally marvel if we can not discover a comparable overarching principle about all dangerous decision-making. The closest I’ve discovered as that single level of failure is the Dunning Kruger impact.

Recall final week, we had been discussing excited about the influence of retiring Child Boomers on the fairness markets and of rising charges on housing. Rereading that this morning, I spotted I buried an important a part of the dialogue:

“Each questions are an interesting reveal of how a standard understanding of complicated topics barely scratches the floor of the wealthy complexities that lay beneath. All too usually, the superficial narrative fails to seize the fact beneath.”

The dialogue was actually about how preliminary appearances will be deceptive on account of complexity we could not even pay attention to; the housing query about charges — that are clearly vital — led us to acknowledge they’re removed from the only driver of the residential actual property market. Certainly, many different issues will be much more vital.

Our personal lack of depth in a selected skillset is why we miss that complicated actuality. Our tendency as a species in the direction of overconfidence can mix with a bit bit of data; in the end, this results in elementary misunderstandings.

Can this one-two punch clarify why it’s so straightforward to get a lot flawed within the capital markets so usually?

Let’s think about one other query, this one on U.S. fairness valuations:

“Child-boomers’ large circulation of 401K plan contributions helped to drive equities larger; now that ~70 million Boomers are retiring, when do demographics flip this from an enormous constructive to a internet drag?”

The demographic query touches on an enormous challenge: $6 trillion {dollars} in 650,000 (401k) retirement plans held by 10s of tens of millions of Individuals. The preliminary assumption is the retiring boomers matter an incredible deal, however a deeper dive into the construction of fairness possession means that it in all probability doesn’t.

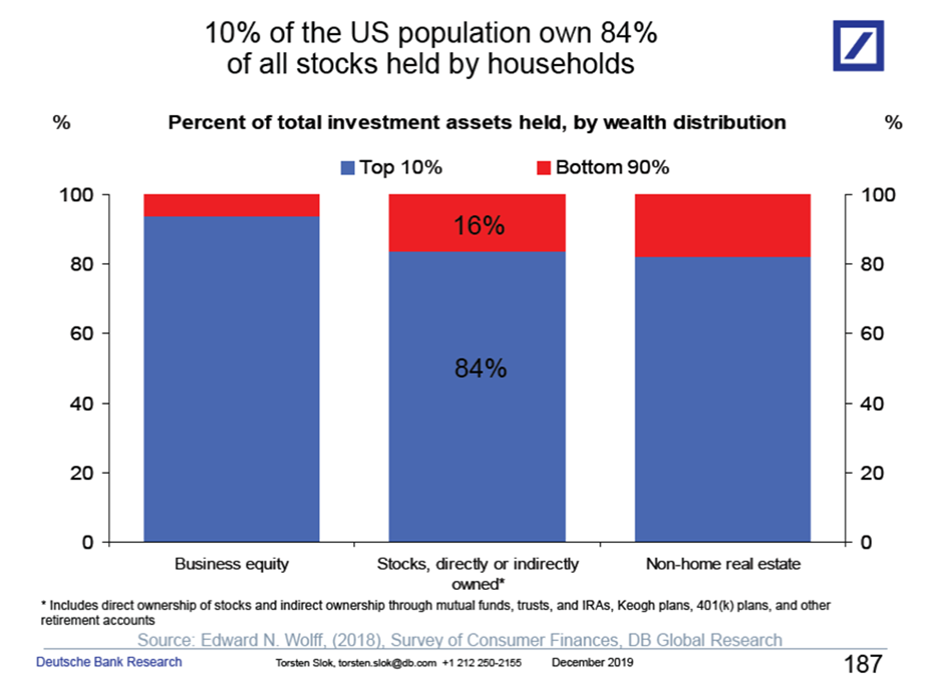

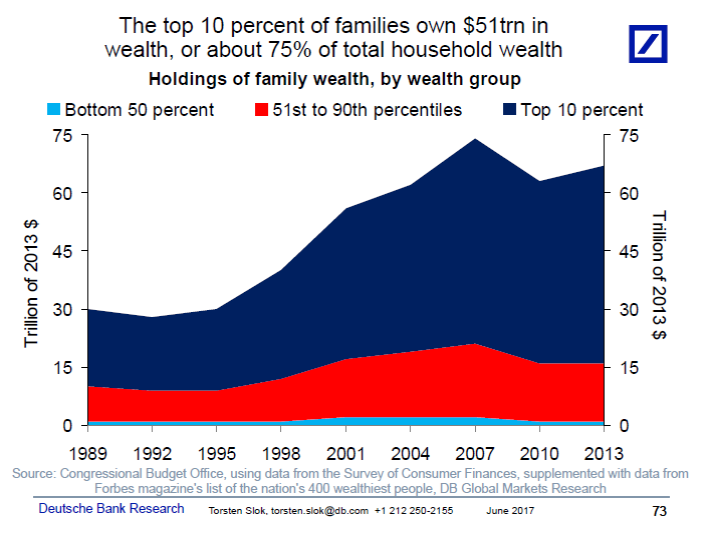

I believe most of us have a distorted viewpoint of the common investor versus the entire capital out there. Because the charts under present, the overwhelming majority of equities are held by the highest 1% and 10%. This demographic cohort is solely not a vendor on account of retirement – the tax bills can be too nice. As an alternative, a complete method to managing generational wealth switch, philanthropy, presents, trusts, and so on. happens.

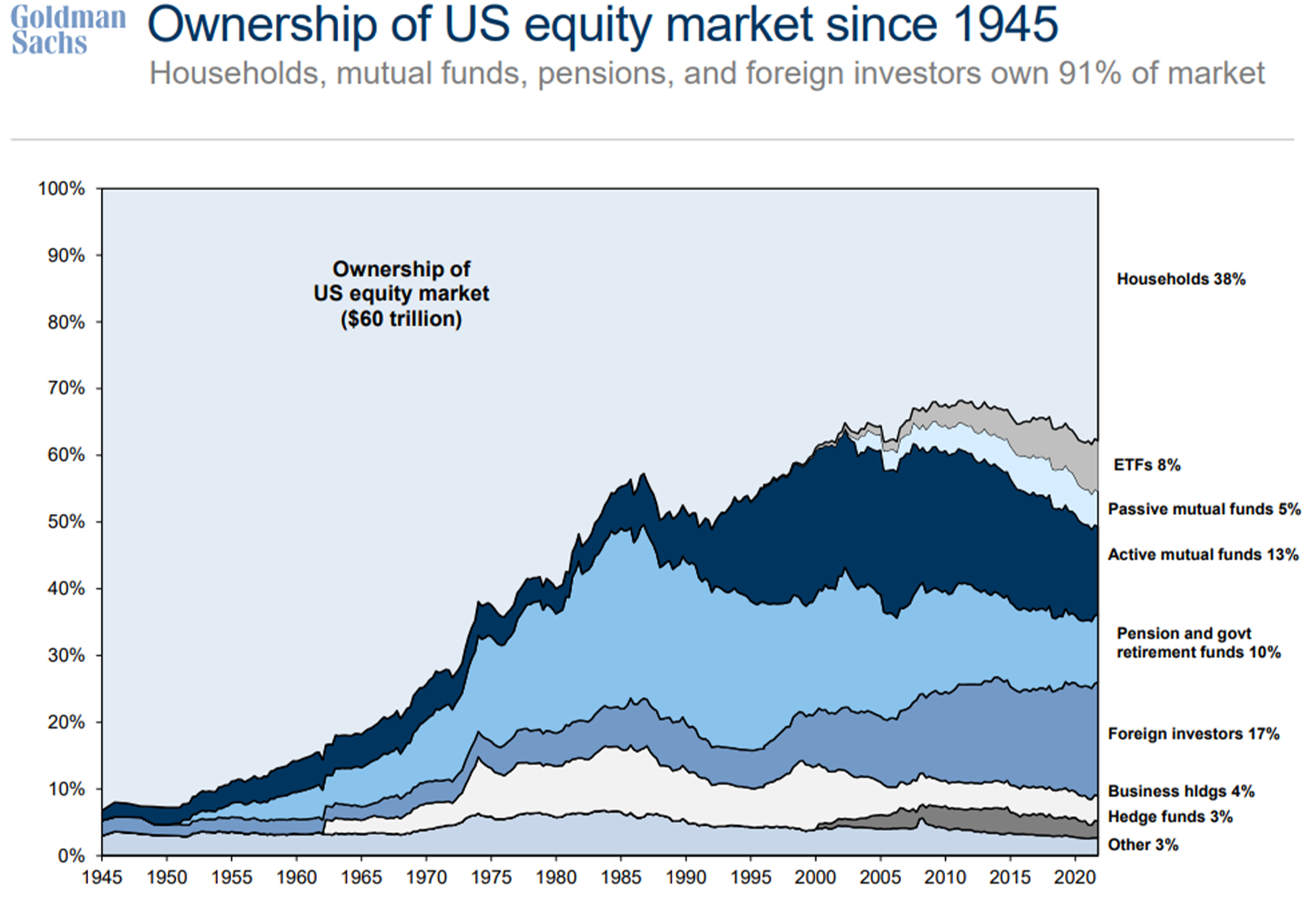

Including a layer of complexity, at one cut-off date, all of those shares had been owned immediately by people as particular firm inventory. As Ben identified by way of his favourite chart at high, possession of U.S. fairness market since 1945 has shifted dramatically to completely different funding autos. U.S. households as soon as owned 95% of all shares individually in brokerage accounts; at this time, possession is is by way of ETFs, mutual funds, pensions, hedge funds, international traders, and so on.

Property taxes are why appreciated fairness is transferred this manner. These situations don’t often contain a a lot inventory promoting. However as now we have seen, most individuals have little thought about precisely how high heavy fairness possession is. The market is way larger, extra professionalized, and institutionalized.

~~~

Just a few years in the past, a buddy got here out with a improbable thought for an Index and ETF; even higher, he managed to snag a tremendous inventory image. (I’m purposefully omitting the specifics and the names of the fund managers, sponsors, banks, and so on.) It had an ESG twist, and so was a possible match for foundations, endowments, household places of work, and so on. He put collectively an incredible board of advisors, a intelligent thought for adjusting the index, it was all so sensible. The index even outperformed it’s S&P500 benchmark all 5 years operating. Nevertheless it discovered little choose up regardless of the recent sector it was in. Right here we’re 5 years later, and whereas the thought + ticker are nonetheless nice, the fund shut down on account of lack of curiosity.

I requested my buddy if he had any curiosity in promoting the stub (property embrace identify, mental property, board, ticker image, and so on.) for pennies on the greenback. I like the thought, and picture how straightforward it could be to show it into a large success, a $ billion greenback ETF.

Earlier than placing any time or capital in danger, I needed to debate it with an skilled. In my circles, no one is aware of extra in regards to the ETF trade than Dave Nadig. We appeared on the thought and who the potential ETF/index consumers is perhaps. We kicked round how the goal demographic males these choices, how they test which field, who they seek the advice of with, what different events advise the decision-makers. Final, we thought of why different like-minded funds equally failed to draw a lot capital. The important thing conclusion was this was regardless of the attractive thought and inventory ticker and nice efficiency, it was solely a so-so investing car, unlikely to draw a lot capital.

Therefore, I used to be saved plenty of time and work and headache and capital, all as a result of I had some small consciousness of my very own astonishing ignorance. I don’t often consider humility as my sturdy go well with, however I might chalk this one as much as a mixture of concern, worry and recognition of my lack of competency on this area.

I think about {that a} big win…

~~~

Some folks have instructed that realizing about cognitive biases doesn’t assist in the struggle in opposition to them. I by no means need to be on the other facet of an mental argument with Danny Kahneman; nonetheless, I’m hopeful that if we take into consideration issues much less when it comes to what we do know, and extra when it comes to what we would not know, maybe we will make higher choices.

Beforehand:

What If EVERYTHING Is Narrative? (June 21, 2021)

The Hidden World of Failure, aka All the pieces is Survivorship Bias (October 23, 2020)

Inventory Possession:

Distribution of Family Wealth within the U.S. since 1989 (March 10, 2020)

Inventory Possession within the USA (January 14, 2020)

Wealth Distribution Evaluation (July 18, 2019)

Composition of Wealth Differs: Center Class to the High 1% (June 5, 2019)

Wealth Distribution in America (April 11, 2019)

US Wealth Distribution, Inventory Possession Version (June 30, 2017)

[ad_2]