[ad_1]

What’s in a reputation? Would a bundle of economic securities that characterize the fractional possession of some corporations by some other moniker carry out as sweetly? Apparently not.

Individuals more and more categorise equities not simply by sector or nation, however in keeping with “components” — principally what inventory market type they’re, and what drives them.

For instance, massive elements (although not all) of the expertise world are “development” shares, in that they are typically costlier, faster-expanding corporations. Vitality corporations, industrial conglomerates and automobile producers are typically “worth” shares as a result of they’re cheaper.

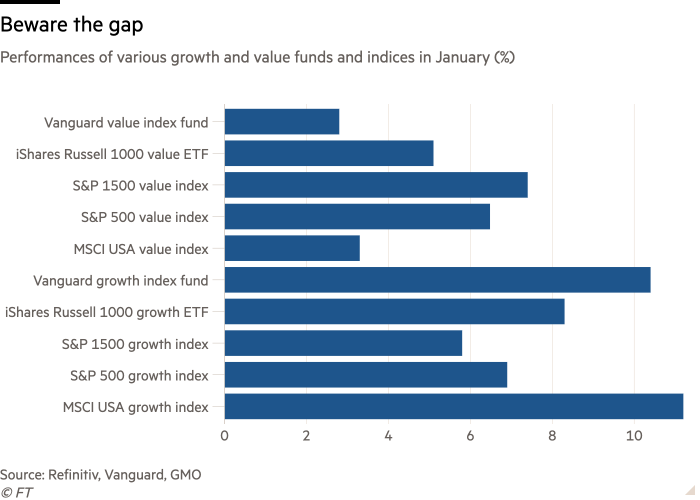

Nevertheless, how precisely you measure this stuff can generally have a big impact. Listed below are the relative January performances of assorted US worth and development indices and index-tracking funds.

Following Vanguard’s method of slicing and dicing inventory market components (they use CRSP indices), development outperformed worth by 7.6 share factors final month, whereas MSCI’s US worth and development indices additionally diverged markedly (3.3 per cent vs 11.2 per cent respectively). In distinction, the worth and development variations of the blue-chip S&P 500 carried out fairly equally in January.

Maybe most eye-catchingly, if one makes use of S&P’s broader inventory market benchmark — the S&P 1500 Composite index — then worth shares truly beat development by 1.6 share factors.

Discrepancies occur, however January’s divergences seems unusually sharp. Right here’s GMO’s asset allocation group — which alerted FTAV to the problem — on the topic:

• After a bruising 2022 for equities globally, Worth shares within the U.S. have change into engaging in an absolute sense and worthy of inclusion in a single’s portfolio. However the big selection in returns for varied Worth implementations in January 2023 raises the query, What are “Worth” shares?

• At GMO, we outline the Worth universe as these shares that commerce at a reduction relative to the market primarily based on our evaluation of underlying company fundamentals. When estimating company price, we

— modify reported (GAAP) information for metrics like e-book worth and earnings by capitalizing intangible property and accounting for the impression of share buybacks,

— acknowledge that higher-quality and faster-growing corporations deserve a valuation premium, and

— make the most of a number of valuation fashions to make sure a strong evaluation of total attractiveness.• Index suppliers take very completely different approaches, not simply relative to GMO’s strategy but additionally relative to one another. The efficiency of assorted indices’ Worth implementations in January 2023 makes this abundantly clear. Worth both outperformed by 1.6% or underperformed by 7.6%, relying on which index you comply with.

• Or, take a look on the price-to-earnings ratios and return-on-equity ranges. If you’re shopping for Worth passively, you may be paying 21x for a 19.5% ROE group of shares or 25x for a 13% ROE portfolio.

We took out GMO’s plug for one in every of its personal worth funds on the finish, however for reference it was up 8 per cent in January.

All in all, it’s an excellent reminder that even sincere efforts to attempt to impose some rigour and order to the chaos of markets usually fails as a result of human-made frameworks are inherently subjective as effectively.

Does that imply that components are ineffective? No. Because the statistician George Field as soon as quipped, “all fashions are improper, however some are helpful”. The issue framework is an imperfect, messy however nonetheless helpful method of markets.

[ad_2]