[ad_1]

Authored by Mike Shedlock by way of MishTalk.com,

Client spending hit a brick wall within the US, EU, UK and Australia. Guess what which means…

Is the worldwide shopper beginning to capitulate?

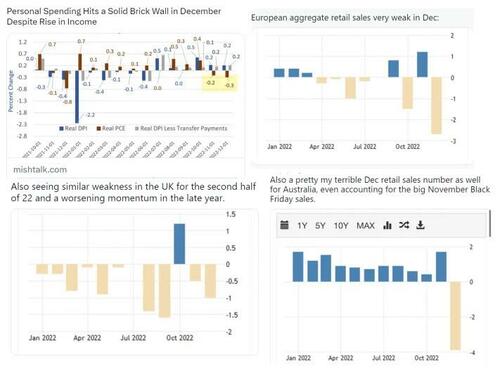

On a 12 months over 12 months foundation seeing very weak finish of the 12 months: pic.twitter.com/EqCD3MvsvI

— Bob Elliott (@BobEUnlimited) February 6, 2023

Not Simply EU

Additionally seeing related weak spot within the UK for the second half of twenty-two and a worsening momentum within the late 12 months. pic.twitter.com/1CctIETSqW

— Bob Elliott (@BobEUnlimited) February 6, 2023

What About Australia?

The buyer has been vital to creating this growth proceed. The indicators are that the drags from rising prices and unfavorable actual wage development is beginning to weigh on demand. There are limits to the quantity of spending that may proceed when financial savings is being drawn down.

— Bob Elliott (@BobEUnlimited) February 6, 2023

“There are limits to the quantity of spending that may proceed when financial savings is being drawn down.“

A number of months in the past I penciled out the surplus financial savings for the US shopper and it regarded like summer season 23 was when the patron would begin to run into points. If these pce figures are correct it appears like shoppers could also be transferring sooner than initially guessed. https://t.co/mTh5d2Mdlz

— Bob Elliott (@BobEUnlimited) February 6, 2023

“If these PCE figures are correct, it appears like shoppers could also be transferring sooner than initially guessed.”

Query and Reply of the Day

“If the patron capitulates, what’s going to drive development?”

Nothing

Private Spending Hits a Strong Brick Wall in December Regardless of Rise in Earningshttps://t.co/h3wvEpnOdd

— Mike “Mish” Shedlock (@MishGEA) February 6, 2023

Welcome to the World Recession!

Welcome to the World Recession!

December Was One other Retail Gross sales Catastrophe, Even Worse With Adverse Revisionshttps://t.co/34NC2ptpHD

— Mike “Mish” Shedlock (@MishGEA) February 6, 2023

Bob Elliott and I’ve been in a operating debate for a few months over jobs and a recession.

I comply with him as a result of he at all times makes a robust case for his standpoint: No Recession.

Elliott could be very knowledge dependent, and cautious. That is the primary I’ve seen him waver.

My “welcome” remark was not supposed to be mocking, it is merely how I really feel.

To be honest, I used to be early once more, however not as early as some. I didn’t chunk on the 2 consecutive quarters of unfavorable GDP to begin the 12 months, however I did pencil in a recession beginning in Might.

In October, retail gross sales compelled me to confess my error. However in December, industrial manufacturing and retail gross sales put me again within the recession camp.

Let’s go over the information.

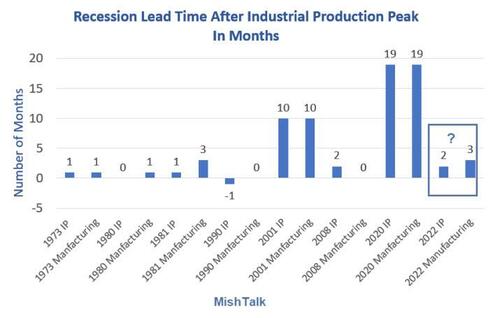

Indicators Say Industrial Manufacturing Has Peaked and so a Recession is Imminent

Recession lead occasions in months based mostly on Fed knowledge.

On January 18, 2023, I commented Indicators Say Industrial Manufacturing Has Peaked and so a Recession is Imminent

Industrial manufacturing decreased 0.7 % in December and 1.7 % at an annual price within the fourth quarter.

Industrial Manufacturing Synopsis

-

Industrial manufacturing peaked in October

-

Manufacturing peaked in April with a double high in September

-

Client sturdy items peaked in April

-

Manufacturing sturdy items peaked in September

-

Motor automobiles and components peaked in October

Recession lead occasions vs industrial manufacturing are typically very small, usually 1-2 month. 2001 and 2020 have been notable exceptions.

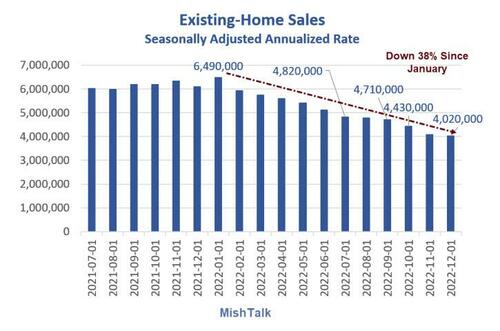

Current Dwelling Gross sales Decline for the Eleventh Straight Month

Current dwelling gross sales from the Nationwide Affiliation of Realtors by way of St. Louis Fed

It was practically a clear sweep for current dwelling gross sales in 2022, down each month besides January.

For particulars, please see Current Dwelling Gross sales Decline for the Eleventh Straight Month

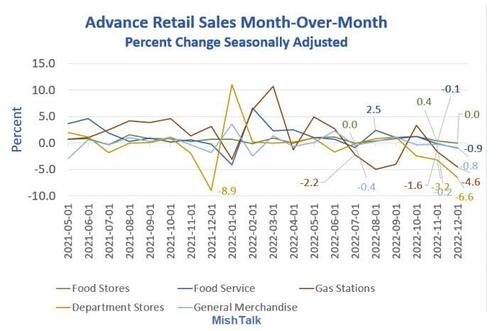

December Was One other Retail Gross sales Catastrophe

Retail gross sales from commerce division, chart by Mish

Month-Over-Month Advances and Declines

-

Meals Service: -0.9 %

-

Meals Shops: +0.0 %

-

Fuel Stations: -4.6 %

-

Normal Merchandise: -0.8 %

-

Excluding Motor Autos and Fuel: -0.7 %

-

Excluding Motor Autos: -1.1 %

-

Nonstore (Assume Amazon): -1.1 %

-

Motor Autos: -1.2 %

-

Division Shops: -6.6 %

For additional dialogue, please see December Was One other Retail Gross sales Catastrophe, Even Worse With Adverse Revisions

The BEA agreed with the advance numbers.

Private Spending Hits a Strong Brick Wall in December Regardless of Rise in Earnings

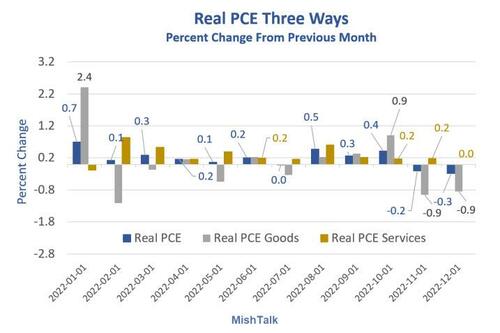

Actual Private Consumption Expenditures from BEA, chart by Mish

On January 27, I famous Private Spending Hits a Strong Brick Wall in December Regardless of Rise in Earnings

Brick Wall

-

Customers actually hit the brick wall then went into reverse in November and December.

-

Actual PCE fell 0.2 % in November and 0.3 % in December.

-

Actual PCE Items have been unfavorable 0.9 % in each months.

-

Actual PCE Companies rose 0.2 % in November and was flat in December.

Knowledge Constant With Recession

Please see Alice Debates the Mad Hatter and the Crimson Queen on Timing the Recession

If for some motive you consider fourth-quarter GDP was strong, please see 4th Quarter 2022 GDP Is A lot Weaker Than Headline Numbers, Recession Is Not Off.

Knowledge is in keeping with a recession beginning in November or December.

When is the final time housing was down for a full 12 months, industrial manufacturing down two months, and actual spending down two months and the the economic system was not in recession?

Think about a decline in shopper spending within the EU, UK, and Australia and the place are US exports headed?

And with shopper spending falling off the cliff, how lengthy will jobs keep robust? Robust sufficient to forestall a recession that historical past suggests has already began?

In Wonderland, jobs will save the day, assuming you consider the December Jobs knowledge, however I do not.

* * *

Loading…

[ad_2]