[ad_1]

At the moment, we current a visitor put up written by David Papell and Ruxandra Prodan, Professor and Educational Affiliate Professor of Economics on the College of Houston.

The Federal Open Market Committee (FOMC) raised the goal vary for the federal funds fee (FFR) by 25 foundation factors to between 5.0 and 5.25 % in its Could 2023 assembly. This adopted fee will increase totaling 4.75 share factors between March 2022 and March 2023 preceded by two years on the Efficient Decrease Sure (ELB). The FOMC didn’t present any steerage in regards to the future path of the FFR past the March 2023 Abstract of Financial Projections (SEP).

There may be widespread settlement that the Fed fell “behind the curve” by not elevating charges when inflation rose in 2021, forcing it to play “catch-up” in 2022. “Behind the curve,” nonetheless, is meaningless and not using a measure of “on the curve.” Within the newest model of our paper, “Coverage Guidelines and Ahead Steerage Following the Covid-19 Recession,” we use knowledge from the SEP’s from September 2020 to March 2023 to check coverage rule prescriptions with precise and FOMC projections of the FFR. This offers a exact definition of “behind the curve” because the distinction between the FFR prescribed by the coverage rule and the precise or projected FFR. We analyze 4 coverage guidelines which are related for the longer term path of the FFR within the put up:

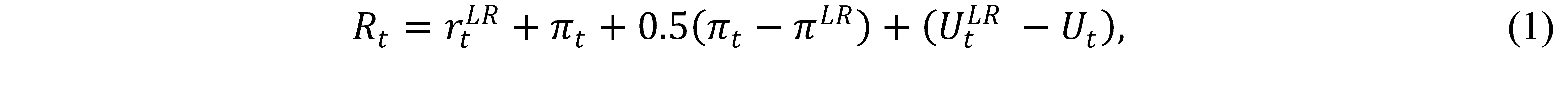

The Taylor (1993) rule with an unemployment hole is as follows,

the place is the extent of the short-term federal funds rate of interest prescribed by the rule, is the inflation fee, is the two % goal stage of inflation, is the 4 % fee of unemployment within the longer run, is the present unemployment fee, and is the ½ % impartial actual rate of interest from the present SEP.

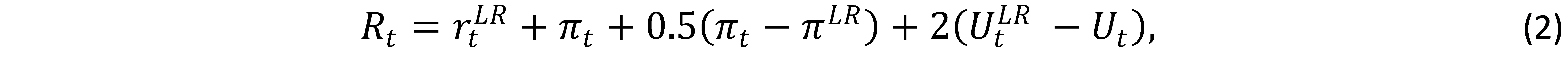

Yellen (2012) analyzed the balanced method rule the place the coefficient on the inflation hole is 0.5 however the coefficient on the unemployment hole is raised to 2.0.

The balanced method rule obtained appreciable consideration following the Nice Recession and have become the usual coverage rule utilized by the Fed.

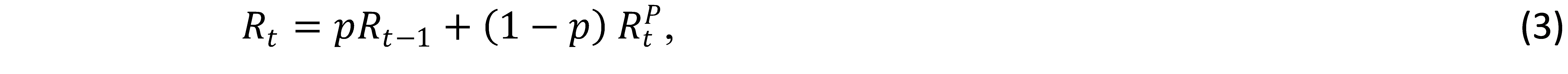

These guidelines are non-inertial as a result of the FFR totally adjusts every time the goal FFR adjustments. This isn’t in accord with FOMC follow to easy fee will increase when inflation rises. We specify inertial variations of the foundations based mostly on Clarida, Gali, and Gertler (1999),

the place p is the diploma of inertia and is the goal stage of the federal funds fee prescribed by Equations (1) and (2). We set as in Bernanke, Kiley, and Roberts (2019). equals the speed prescribed by the rule whether it is optimistic and nil if the prescribed fee is detrimental.

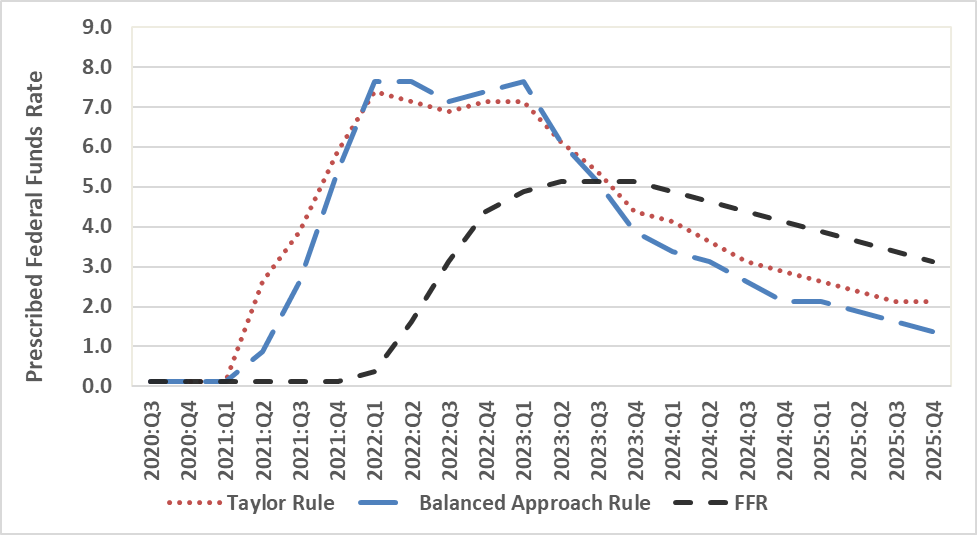

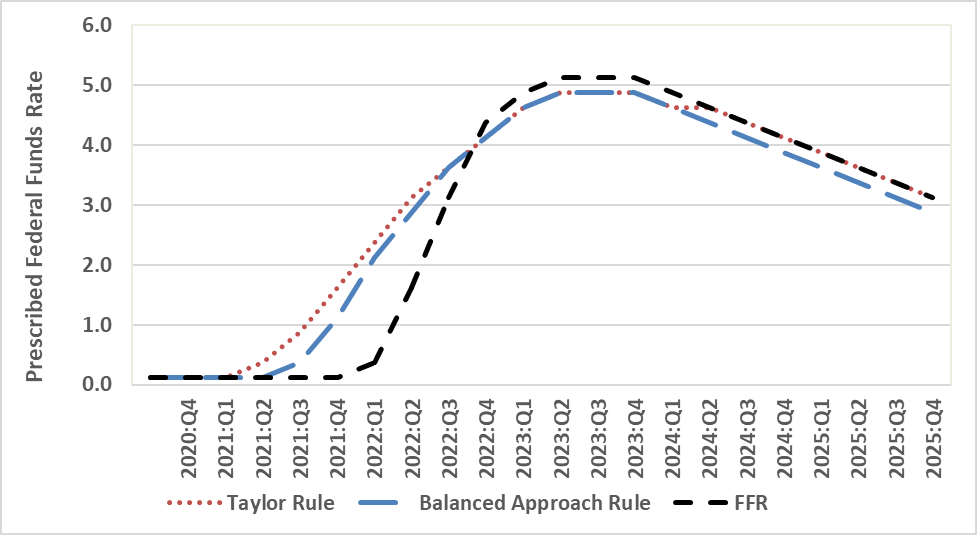

Determine 1 depicts the midpoint for the goal vary of the FFR for September 2020 to March 2023 and the projected FFR for June 2023 to December 2025 from the March 2023 SEP. Following the exit from the ELB to 0.375 in March 2022, the FFR rose to five.125 in Could 2023 earlier than being projected to fall in 2024 and 2025. The determine additionally depicts coverage rule prescriptions. Between September 2020 and Match 2023, we use real-time inflation and unemployment knowledge that was out there on the time of the FOMC conferences. Between June 2023 and December 2025, we use inflation and unemployment projections from the March 2023 SEP. The variations within the prescribed FFR’s between the inertial and non-inertial guidelines are a lot bigger than these between the Taylor and balanced method guidelines.

Coverage rule prescriptions are reported in Panel A for Determine 1 for the non-inertial Taylor and balanced method guidelines. They don’t seem to be in accord with the FOMC’s follow of elevating the FFR slowly when inflation rises. The prescriptions for the 2 guidelines are similar on the ELB by means of March 2021. The FOMC fell behind the curve beginning in June 2021 when the prescribed FFR elevated from the ELB of 0.125 to 2.625 for the Taylor rule and to 0.875 for the balanced method rule whereas the precise FFR stayed on the ELB. The coverage rule prescriptions sharply elevated by means of 2021 and peaked in March 2022 to 7.325 for the Taylor rule and seven.625 for the balanced method rule when the FFR first rose above the ELB to 0.375. The hole additionally peaked in March 2022 at 700 foundation factors for the Taylor rule and 725 foundation factors for the balanced method rule. The hole narrowed significantly between March 2022 and March 2023 because the FFR rose from 0.375 to 4.875 whereas the prescribed FFR’s have been nearly unchanged. Wanting ahead, the hole between the FFR projections and the coverage rule prescriptions is nearly zero in September 2023 and, beginning in December 2023, the FFR projections are above the coverage rule prescriptions by means of December 2025.

Determine 1, Panel A: The Federal Funds Charge and Coverage Rule Prescriptions, Non-Inertial Guidelines

Panel B studies the outcomes for the inertial Taylor and balanced method guidelines. They’re much extra in accord with the FOMC’s follow of elevating the FFR slowly when inflation rises. The prescriptions for the 2 guidelines are similar on the ELB by means of March 2021 and rise to 0.375 for the Taylor rule in June 2021. The FOMC fell behind the curve beginning in September 2021 when the prescribed FFR elevated to 0.875 for the Taylor rule and 0.375 for the balanced method rule whereas the precise FFR stayed on the ELB. The hole between the coverage rule prescriptions peaked in March 2022 at 200 foundation factors for the Taylor rule and 175 foundation factors for the balanced method rule. At that time, the prescribed FFR was 2.325 for the Taylor rule and a pair of.125 for the balanced method rule whereas the FFR first rose above the ELB to 0.375.

Determine 1, Panel B: The Federal Funds Charge and Coverage Rule Prescriptions, Inertial Guidelines

The Fed is not behind the curve. The hole narrowed steadily and, in December 2022, the FFR was 25 foundation factors above each coverage rule prescriptions. The inertial guidelines prescribe a a lot smoother path of fee will increase from September 2021 by means of December 2022 than that adopted by the FOMC. If the Fed had adopted the inertial Taylor or balanced method rule as a substitute of the FOMC’s ahead steerage, it may have averted the sample of falling behind the curve, pivot, and getting again on monitor that characterised Fed coverage throughout 2021 and 2022. Wanting ahead, the hole between the FFR projections and the Taylor rule prescriptions stays at 25 foundation factors between June 2023 and March 2024 and is zero between June 2024 and December 2025. The hole for the balanced method rule prescriptions stays at 25 foundation factors by means of December 2025. The Fed is following the inertial Taylor rule.

This put up written by David Papell and Ruxandra Prodan.

[ad_2]