[ad_1]

Authored by Lance Roberts by way of RealInvestmentAdvice.com,

Final week, we mentioned why the extra bullish technical formations have been at odds with the numerous recession forecasts. Not surprisingly, that article generated substantial pushback from readers, declaring numerous bearish basic measures.

As I mentioned in our newest “Bull Bear Report,” the technical backdrop has improved markedly because the October lows.

“I beforehand mentioned the inverse ‘head-and-shoulder’ sample already suggests a market backside has fashioned. A stable break above the downtrend line (with a profitable retest) would affirm the completion of that sample. Notably, the 50-DMA is quickly closing in on a cross above the declining 200-DMA. Such is named the ‘golden cross’ and traditionally signifies a extra bullish setup for markets shifting ahead.“

“The market surge final week bumped into resistance on Friday as markets pushed effectively into 3-standard deviations above the 50-DMA. Nonetheless, whereas the weak spot on Friday was not surprising, it’s also mandatory to find out whether or not the present breakout is respectable.“

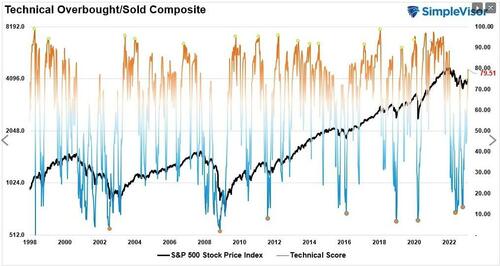

Moreover, our weekly technical composite gauge isn’t again into bull market mode because it has risen above a studying of 70. Such is the primary time that measure was reached in over a 12 months.

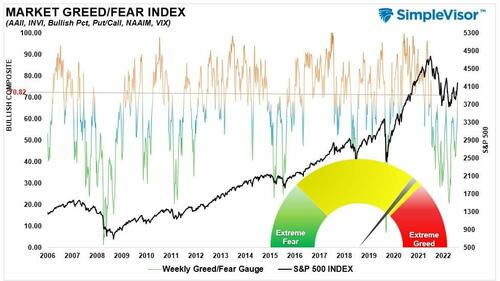

Additionally, investor sentiment has moved again into “bullish mode,” with our composite worry/greed gauge, which measures sentiment and positioning, pushing in the direction of “greed” ranges.

From a historic view, these technical measures have all the time preceded a continuation of a extra bullish pattern for the market. Nonetheless, the crucial level is that whereas the technical backdrop has improved, we should nonetheless acknowledge a threat to the technical bullish view. As I concluded:

“If the ‘bear market’ is ‘canceled,’ we are going to know comparatively quickly. To substantiate whether or not the breakout is sustainable, thereby canceling the bear market, a pullback to the earlier downtrend line that holds is essential. Such a pullback would accomplish a number of issues, from working off the overbought situations, turning earlier resistance into help, and reloading market shorts to help a transfer larger. The ultimate piece of the puzzle, if the pullback to help holds, shall be a break above the highs of this previous week, confirming the following leg larger. Such would put 4300-4400 as a goal in place.

A break BELOW the downtrend line, and the present intersection of the 50- and 200-DMA, will counsel the breakout was certainly a ‘head pretend.’ Such will affirm the bear market stays, and a retest of final 12 months’s lows is probably going.

Nonetheless, whereas the technicals are bullish close to time period, I cannot disagree with the reader’s basic arguments.

Elementary Issues

Greg Feirman made an fascinating commentary final week.

“These of us who take a extra basic method are left scratching our heads as a result of the value motion doesn’t match what we’re seeing from company earnings. Apple (AAPL) reported a 5.5% decline in income in its 4Q22 – and that quarter had 14 weeks in comparison with 13 within the 12 months in the past interval. Internet Revenue fell 13.4%. Whereas Google’s (GOOG/GOOGL) general income was +1%, in the event you dig a bit deeper income in its core promoting enterprise was really -4%. And whereas Meta (META) had an enormous reduction rally, the basics have been removed from stellar with income -4.5% and EPS -52% in comparison with a 12 months in the past.

And so all of it units up for a showdown in coming weeks. My competition is that “the market is a voting machine within the quick time period, and a weighing balance in the long run” (Ben Graham). That’s, worth will comply with the gang within the quick time period however the crowd will comply with fundamentals in the long run. So whereas the market might proceed to rally within the days and weeks forward, finally this rally will peter out and we are going to look again at it as simply one other bear market rally. In the event you’re on this debate between technicians and fundamentalists, listen as a result of we’re all about to be taught one thing a method or one other.”

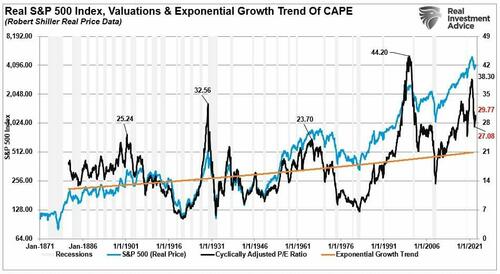

Greg is right. Because the starting of the 12 months, the rise out there has been purely a operate of valuation growth as each earnings, and earnings estimates, proceed to deteriorate. As proven, valuations are rising to 29x, trailing actual earnings, which is traditionally costly.

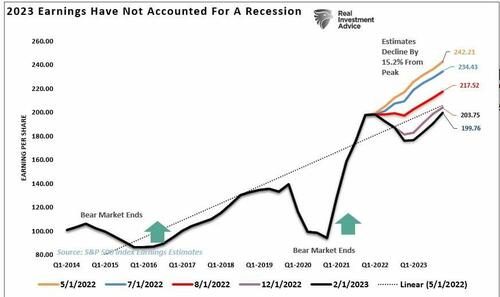

Such is going on as earnings and estimates proceed to deteriorate sharply, despite the fact that analysts stay optimistic a couple of restoration later within the 12 months.

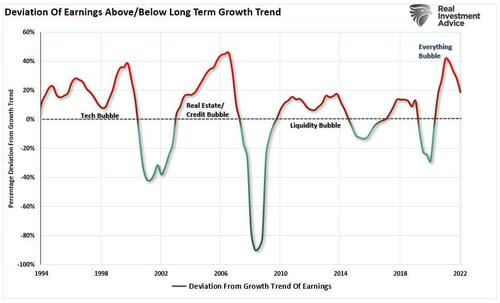

Nonetheless, the hoped-for earnings restoration is contingent on a a lot stronger financial setting to help that development in earnings. Provided that earnings stay 20% above their long-term development pattern. The anticipated restoration appears overly optimistic because of the large stimulus injections that pulled ahead consumption.

With a lot financial knowledge pointing to additional weak spot within the months forward, market fundamentals stay difficult to the technical bullish narrative.

Nonetheless, traditionally, the markets have a tendency to cost financial and basic recoveries 6-9 months prematurely. Such would counsel that the extra bullish optimistic views of a “delicate touchdown” situation within the economic system might be attainable.

The one concern with that view, once more from the elemental perspective, is that traditionally with inflation working effectively above 5% and the Federal Reserve persevering with to hike charges, “goldilocks outcomes” didn’t beforehand come to fruition.

Bull Now, Bear Later?

So, what ought to an investor due with such a dichotomy?

The reply is extra easy than it appears.

The market can defy financial and basic realities within the quick time period. Greg famous that the market is a “voting machine” within the quick time period. In different phrases, the market will reply to the “votes” of the herd out there. Nonetheless, the market will “weigh” the elemental measures and worth accordingly over the long run.

For traders, relying closely upon both the “votes” or the “weight” can result in extra disappointing outcomes over the long run. As I’ve famous beforehand, many traders missed out nearly solely available on the market’s advance from 2009 to the current for numerous legitimate, basic causes. Sure, they missed the crash in 2008 however misplaced way more in missed capital beneficial properties over the following decade.

“Far more cash has been misplaced by traders attempting to anticipate corrections than misplaced within the corrections themselves.” – Peter Lynch

Guidelines To Observe

For the second, the market is again in a extra bullish mode. As such, we want a algorithm to navigate that bullish pattern till it will definitely ends.

-

Minimize losers quick and let winners run. (Be a scale-up purchaser into energy.)

-

Set targets and be actionable. (With out particular targets, trades grow to be arbitrary and improve general portfolio threat.)

-

Emotionally pushed choices void the funding course of. (Purchase excessive/promote low)

-

Observe the pattern. (The long-term, month-to-month pattern determines 80% of portfolio efficiency. Whereas a “rising tide lifts all boats, ”the alternative can also be true.)

-

By no means let a “buying and selling alternative” flip right into a long-term funding. (Consult with rule #1. All preliminary purchases are “trades” till your funding thesis is proved right.)

-

An funding self-discipline doesn’t work if it isn’t adopted.

-

The percentages of success enhance considerably when the technical worth motion confirms the elemental evaluation. (This is applicable to each bull and bear markets)

-

Markets are both “bullish” or “bearish.” Throughout a “bull market,” be solely lengthy or impartial. Throughout a “bear market,” be solely impartial or quick. (Bull and Bear markets are decided by their long-term pattern)

-

When markets are buying and selling at, or close to, extremes do the alternative of the “herd.”

-

Do extra of what works and fewer of what doesn’t (Conventional rebalancing takes cash from winners and provides it to losers. Rebalance by decreasing losers and including to winners.)

Don’t Decide A Aspect

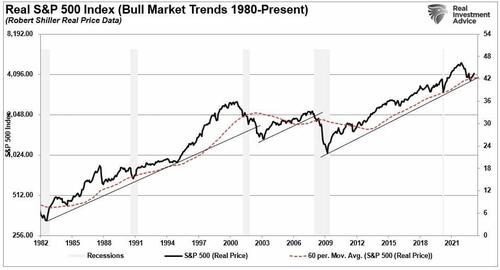

Be aware there are a number of references to the “long-term pattern” of the market. That pattern stays bullish as measured by each pattern strains and the 60-month shifting common. With the market not too long ago bottoming at these trendline helps, such suggests the longer-term bull market stays intact.

Sure, the basics will finally matter, and they’re going to matter far more than many at the moment suppose. Nonetheless, for the now, the bulls stay answerable for the market.

Put aside the concept of being both “bullish” or “bearish.”

When you choose a aspect, you lose objectivity to what’s occurring inside the market.

How lengthy with the technical bull run final? I don’t know.

However when it ends, and the basics start to re-emerge, we may have loads of warning to regulate accordingly.

Loading…

[ad_2]