[ad_1]

This text is an on-site model of our Unhedged publication. Enroll right here to get the publication despatched straight to your inbox each weekday

Good morning. Goldman Sachs’ investor day yesterday failed to provide a lot pleasure. Essentially the most fascinating factor about Goldman is that it simply isn’t that fascinating any extra, and its finest strategic possibility is changing into nonetheless much less fascinating. That tells you one thing necessary about how the finance business has modified. E-mail us: robert.armstrong@ft.com and ethan.wu@ft.com.

The housing recession, and the plain outdated recession

We test in on the housing market each few months, for a few causes. As a result of one thing like two-thirds of People have a giant chunk of their web price tied up within the housing market, it tells you one thing about how lots of people really feel, financially — a sense that elements into the efficiency of all different markets. Second, as a result of the housing market is fee delicate, the market tells you one thing in regards to the transmission of financial coverage into the actual financial system, an important challenge for the time being.

The housing market story all the time begins with mortgage charges, which have modified route recently, following inflation expectations again up; see the blue line, under. This mirrors, partly, the rise in 10-year Treasury yields. However discover additionally the pink line, which is the unfold between Treasury yields and mortgage charges. That unfold, as Jack Macdowell of the residential credit score specialist Palisades Group identified to us, is 130 bps larger than traditional. This displays anticipated fee volatility. When mortgage lenders assume charges would possibly transfer rapidly, they construct a buffer into their pricing:

When charges rise, housing affordability declines. Right here, from Capital Economics’ Sam Corridor, is a chart of US mortgage funds as a proportion of incomes. Homes have been final this unaffordable within the mid-Eighties.

Renting seems far more reasonably priced by comparability (chart from Goldman, which calculates affordability barely in a different way):

Increased charges are creating not a value crash, as one would possibly anticipate, however a frozen market. Measured by the Zillow house worth index, costs are off their August peak however are solely down a modest 1 per cent:

Costs could also be steady, however transactions are down, as each provide and demand really feel the nippiness. On the demand facet, mortgage fee sticker shock is scaring off would-be homebuyers, dragging down new mortgage functions. This 12 months’s shortlived dip in charges did give functions a bump, but it surely hasn’t lasted:

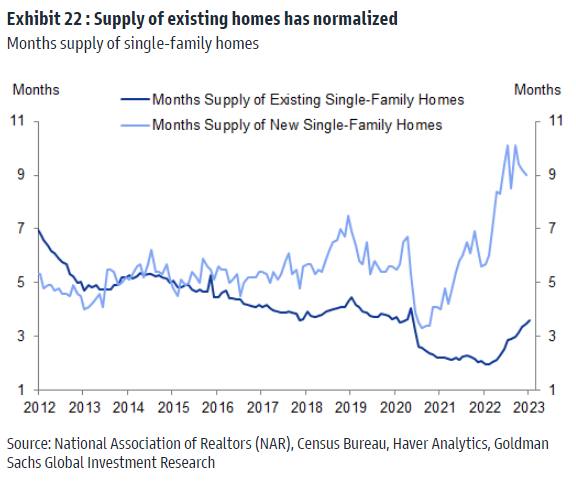

The dearth of prepared consumers at present costs signifies that current houses on the market simply aren’t getting offered. Stock is sitting round longer. The median single-family home listed on Zillow is greater than two months outdated, the longest since early 2020. Distinction the rising inventory of current houses on the market — which accounts for about 90 per cent of house gross sales — towards what number of are literally being offered. The quantity of current houses available on the market is again at pre-coronavirus pandemic ranges (chart from Goldman):

But current house gross sales (gray line under) are languishing at a fraction of 2019 ranges. The chart under from Renaissance Macro exhibits each current and pending house gross sales (pending tends to steer current). Although pending house gross sales did leap in January, that most likely displays the autumn in mortgage charges, which has reverted. Put collectively, current house gross sales look a bit caught:

The story is as a lot about provide as demand. Excessive mortgage charges, which comply with very low ones, create a lock-in impact. Owners (together with one Rob Armstrong) cling on for expensive life to their sub-3 per cent fixed-rate mortgages. It might take rather a lot to make them transfer. This limits how a lot of the prevailing house inventory will come to market. A robust labour market additionally means few distressed sellers attempting to dump their homes at a reduction. Until the financial system craters (might occur!) the prevailing house market could possibly be frozen for some time.

We must always acknowledge right here that the brand new houses market seems more healthy. New houses gross sales are rising and, due to the pandemic constructing growth, extra provide is coming on-line. Homebuilders, for his or her half, don’t have any alternative however to maneuver stock, and quick. In keeping with Rick Palacios of John Burns Actual Property Consulting, they’ve minimize costs, and people with mortgage lending offshoots are providing decrease charges to get individuals in homes. Homebuilders could nicely steal market share as from the prevailing house market.

However, once more, new houses solely make up about 10 per cent of the market, most likely too small to make a distinction. As Goldman’s Vinay Viswanathan wrote lately:

Report-low house owner emptiness charges have primarily depleted housing stock and materially tightened provide. On web, this suggests a muted impression from completions on the present provide/demand stability of housing and, in the end, costs. Even when each single house beneath building was accomplished and listed available on the market instantly, the months’ provide of houses (the ratio of stock to annual gross sales) would nonetheless be under historic averages.

So, what unfreezes the US housing market? Properly, the best thaw would come from falling rates of interest, which might restore affordability and assist consumers and sellers meet within the center. Another excuse to hope the deflation fairy will seem quickly, wand a-waving. However which may not occur, or occur quickly.

How a couple of decline in costs? When charges first started to rise, the consensus amongst housing pundits (so far as we might make it out) was that whereas value will increase would gradual or cease, a value decline was unlikely. The argument was that substantial value declines are pushed by pressured sellers, and there gained’t be many of those this time round, as a result of there are so few adjustable-rate mortgages now (lower than 8 per cent of the overall), and since mortgage credit score high quality has improved for the reason that monetary disaster.

Now that charges have run so far as they’ve, extra observers foresee solely a smallish lower in costs — 10 per cent or so down from the height. This is sensible, supplied we don’t get one other large leg up in charges (a chance we might not rule out). Provide is proscribed, after which there’s the lock-in impact. This ain’t 2008.

However even when charges stay excessive, sooner or later the outlook for the financial system ought to grow to be slightly clearer, and anticipated fee volatility ought to stabilise. At that time, the Treasury/mortgage fee unfold ought to head again in the direction of regular, supporting affordability. Together with a modest decline in costs, this might trigger a partial market thaw.

What does all this portend for the broader financial system? There are two questions right here. The primary is solely how a lot decrease housing exercise drags on the financial system. The second is extra sophisticated: is housing simply the a part of the financial system hit by larger charges first, with different elements of the financial system following in time?

On the primary query, Dhaval Joshi of BCA Analysis argues that the present housing recession will pull mounted funding in residential actual property down from about 4 per cent to 2 per cent of GDP, with one thing greater than half of the injury already completed. If that’s proper, lack of housing exercise shall be a perceptible, however not big, drag on GDP. Joshi’s argument is that housing funding is kind of cyclical, however reverts in the direction of a stage akin to the variety of households within the nation. We overshot that stage the pandemic growth, and are actually set to undershoot. His chart:

The query of whether or not the housing recession is simply step one in a rates-driven stoop is tougher. Joshi argues that since 1970, housing recessions (outlined as a 1 per cent decline in housing funding’s contribution to GDP) have all the time been adopted by common recessions. Housing is the “canary within the coal mine”, he says: it gained’t drag us into recession, but it surely exhibits what excessive charges will do to the remainder of the financial system ultimately.

We are likely to agree. Different sectors of the financial system are much less delicate to charges than housing. But when the financial system isn’t cooling by itself — and it doesn’t appear to be it’s — the Fed can have no alternative however to tighten coverage till what has occurred in actual property occurs elsewhere. (Armstrong & Wu)

One good learn

That notorious slap appears to be serving to Chris Rock’s profession. Good for him!

Beneficial newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the worldwide cryptocurrency business. Enroll right here

Swamp Notes — Professional perception on the intersection of cash and energy in US politics. Enroll right here

[ad_2]