[ad_1]

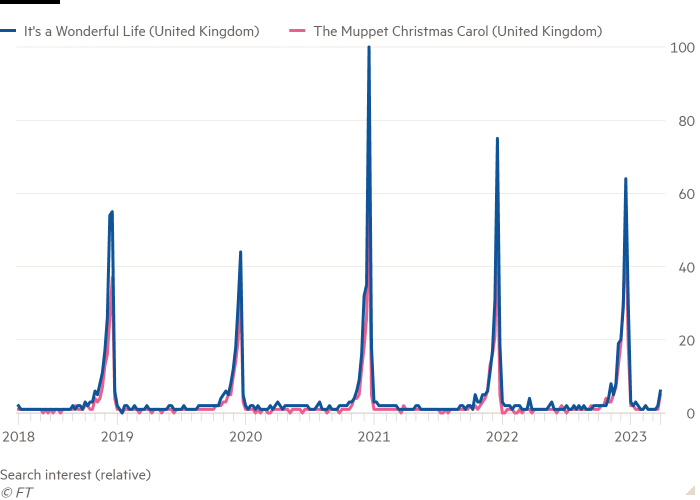

The chart beneath is the IAWL Indicator. It exhibits Google Developments search curiosity from the UK in It’s a Fantastic Life (1946):

As demonstrated, seasonality is an element. Extra attention-grabbing, maybe, is search efficiency excluding November to January, when there’s solely ever a baseline degree of worldwide curiosity in an All-American Christmas household staple.

The bit we care about within the above chart is the tick greater in March 2023, the place UK IAWL search curiosity hit a seasonally adjusted file excessive. Presumably, this was attributable to English-speaking readers chancing upon alarmist articles concerning the nature of financial institution runs that reference the plot of a 77-year-old film they’ve by no means seen.

For completeness we must always word, nevertheless, that IAWL benchmarked in opposition to The Muppet Christmas Carol (1992) exhibits curiosity in each movies spiking to seasonally adjusted file highs. An alternate studying is that Britain has been belatedly festive of late. Whether or not the IAWL Indicator measures perceptions of banking system stress or broader shopper sentiment has but to be decided.

All of which is a shameless bait-and-switch method to introduce yet one more publish about financial institution capitalisation.

SG Securities has a word out right now that places some historic context on the latest deposit flights and asks what it would imply for liquidity necessities. Analyst James Invine says:

We estimate that doubling deposit outflow components (a troublesome assumption) would reduce the sector’s liquidity protection ratio (LCR) from 142% to 82% and would require the sector to lift €2.6tn of funding to return to 110%. The direct influence could be to chop sector earnings by 5%, though the tighter ensuing LCR would doubtless additionally put upward strain on deposit betas.

A lot has been mentioned and written already about silent financial institution runs of 2023, how friction-free on-line banking has mixed with hysterical social media, and the way it contrasts with the queues exterior branches through the GFC. Northern Crock stays the collapse in opposition to which all others have to be judged, however the velocity and depth of latest runs trace at a digital Crock-isation of the broader sector:

The danger of malicious actors profiting from these vulnerabilities — equivalent to by weaponising panic or spoofing illiquid single-name CDS — is a priority regulators have acknowledged. The doubtless consequence is a toughening of the liquidity protection ratio, which measures the quantity of high-quality liquid belongings a financial institution holds relative to estimated confused internet outflows over a 30-day interval. Banks should preserve an LCR of over 100 per cent. See Robin’s publish earlier this week for a full explainer.

The issue with necessary liquidity ratios is that depositors don’t care. Credit score Suisse had an LCR of 192 per cent, but two badly chosen phrases nonetheless precipitated a giant chunk of its deposit base to vanish.

Sadly, the choice measures are in all probability worse. A extra beneficiant financial institution state deposit assure would include ethical hazard and unquantifiable potential liabilities. Radical reform, equivalent to permitting direct deposits with the Fed or limiting entry to cash market funds, could be too disruptive to too many livelihoods. Likewise central financial institution digital currencies. So, LCR it’s.

However when making an attempt to determine tips on how to make the prevailing run-risk ratios work higher, inconsistent stability sheet disclosure is an issue.

Utilizing secure retail deposits as a proxy for funds coated by state ensures in all probability overestimates the flight danger from banks with massive brokered deposit franchises, equivalent to Morgan Stanley, and from these with single-purpose excessive curiosity retail accounts, equivalent to Goldman Sachs and Paragon:

Invine suggests as an alternative to reference every financial institution’s weighted common deposit outflow issue, which is a metric already constructed into LCR calculations. As a result of within the common month SEB depositors pull out more cash than Paragon depositors, the previous wants to carry extra liquidity than the latter to keep up the 100 per cent ratio:

His base case entails a doubling of the deposit outflow assumption and a elevating of the LCR threshold to 110 per cent, leaving a €2.6tn gap that may should be stuffed.

The direct price of tapping wholesale markets for cash to park on the native central financial institution would on common reduce 2024 internet revenue by about 5 per cent. A few of that drag might be offset by operating smaller stability sheets with cleaner deposit mixes, the compulsion for which is the principle justification for altering the principles. But it surely comes with the numerous catch of severely restricted mortgage development and better fed funds pass-through charges to depositors:

Banks have been in a position to permit a lot of the good thing about rising charges to feed into internet curiosity margins as a result of sturdy funding positions imply that a bit of deposit outflow isn’t a big drawback. At a 110% LCR, nevertheless, banks would really feel considerably much less in a position to stand up to this and so deposit betas would doubtless rise.

The worst affected in SG’s evaluation could be banks with very giant and/or uninsured company deposit bases. For Citigroup, HSBC and Normal Chartered, 2024 consensus internet revenue could be reduce by between 10 and 14 per cent. Citi additionally has one of many widest liquidity gaps to shut:

Anyway, again to the IAWL Indicator.

The latest peak for Google UK search curiosity in It’s A Fantastic Life was on March 10, the day SVB failed. It has since levelled off to its long-term seasonally adjusted common, each on an absolute view and relative to The Muppet Christmas Carol:

Modifications to financial institution liquidity necessities as outlined above would take eternally to agree, twice as lengthy to implement, and doubtlessly an eternity to have any impact on depositor behaviour. Collective confidence is the one backstop that issues.

So, when taken together with the latest slowdowns in money-market fund inflows and US financial institution liquidity infusion measures, a normalised IAWL could be learn as a optimistic. No financial institution is a failure that has mates.

[ad_2]