[ad_1]

Buyers’ bets on the place UK rates of interest will peak have shot greater over the previous month, prompting an try by Financial institution of England governor Andrew Bailey to cease markets getting carried away.

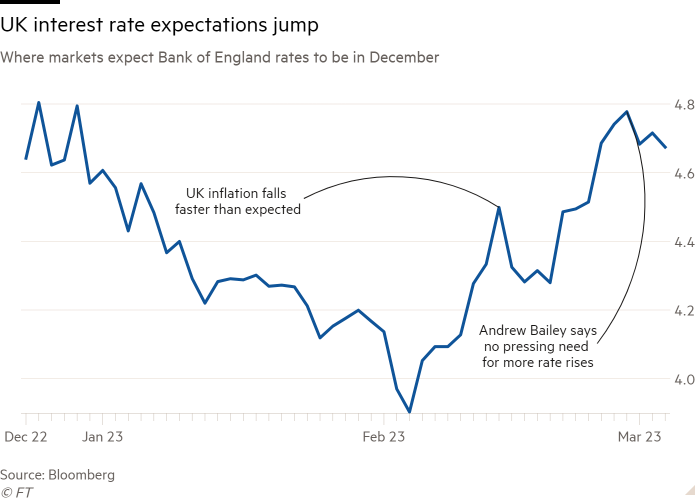

Futures markets are at present pricing in a leap within the BoE’s rate of interest to only above 4.6 per cent by December. Initially of February, charges have been anticipated to peak at across the present degree of 4 per cent and fall barely by the tip of the yr as traders anxious that the UK was heading right into a recession.

That’s regardless of a extra combined bag of UK financial information in latest weeks. Though headline inflation stays in double digits, home core inflation — which strips out unstable meals and power costs — declined greater than forecast to five.8 per cent in January from 6.3 per cent the earlier month. Enterprise surveys for February, in contrast, confirmed a quicker than anticipated pick-up in exercise.

Bailey pushed again this week towards the fast shift in expectations, arguing that the central financial institution had “moved away” from a “presumption” that extra charge will increase have been required. His feedback led to a small decline in charge expectations, however merchants are however betting that the BoE has grow to be much more hawkish than it was a month in the past.

Some analysts argue that markets are overdoing bets that UK charges will observe these within the US sharply greater.

“The consensus view seems to be that the BoE will largely mirror the US Federal Reserve over the subsequent few months”, mentioned Samuel Tombs, chief UK economist at Pantheon Economics. “It usually has been a mistake prior to now, nonetheless, to imagine the [BoE] will observe the Fed.”

February’s rebound in UK charge expectations got here after a blockbuster US jobs report initially of February, which shattered the impression of slowing financial exercise and hopes of an imminent finish to the Fed’s aggressive financial tightening marketing campaign. Merchants spent the subsequent month ramping up their expectations for the place US charges would possibly peak.

Bailey’s feedback “seemed positively dovish”, mentioned analysts at Rabobank, and stood in stark distinction with these from officers on the BoE’s friends in Europe and the US, the place headline inflation is decrease however proving stickier than beforehand forecast.

The case for anticipating the BoE to cease elevating charges quickly, and earlier than the Fed, “stays sturdy”, Tombs mentioned. Price modifications have a “proportionally greater” affect on exercise within the UK than they do within the US, since most UK company financial institution loans are floating reasonably than fastened charge, and “nearly all” UK mortgages should be refinanced inside 5 years.

These and different variations clarify why the Fed final month warned “ongoing will increase” could be wanted to convey down inflation whereas the BoE prompt UK charges might have peaked.

Bailey’s feedback this week “clarify” the central financial institution’s financial coverage committee “is putting extra emphasis on the substantial tightening already delivered”, Tombs mentioned, although he didn’t fully rule out the opportunity of an additional quarter proportion level charge rise later this yr.

“Within the US, it’s uncommon for Fed officers to go away markets second-guessing its subsequent coverage resolution,” Tombs mentioned. “However the MPC has a penchant for drama.”

[ad_2]