[ad_1]

One month in the past, when wanting on the CME’s little identified housing worth futures, we famous that a minimum of in accordance with the market, housing has now bottomed. So much has modified since then, and whereas the Might 23 Housing Value Futures contract has continued to ascent confirming the market stays optimistic in a backside…

… the current surge in mortgage could quickly spoil the bullish outlook.

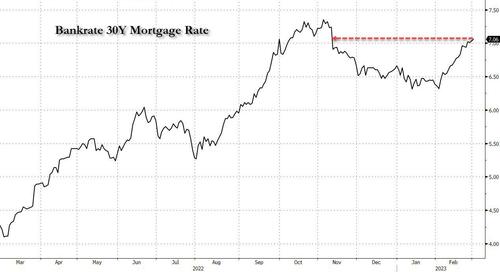

In accordance with Bankrate, the common price on the 30-year fastened mortgage jumped again over 7%, rising to 7.06% (7.10% in accordance with Mortgage Information Each day), the best degree since early November.

“Charges proceed to maneuver on the suggestion of financial knowledge, and the information hasn’t been pleasant. That is scary contemplating this week’s knowledge is insignificant in comparison with a number of upcoming studies,” stated Matthew Graham, chief working officer at Mortgage Information Each day.

When charges went over 7% final October – the best degree in additional than 20 years – the housing market was being learn its final rites, which was additionally one of many explanation why many anticipated the Fed to ease again on its tightening. However charges then pulled again within the following months, as inflation seemed to be easing. By mid-January charges had been touching 6%, spurring an enormous bounce in consumers signing contracts on current properties.

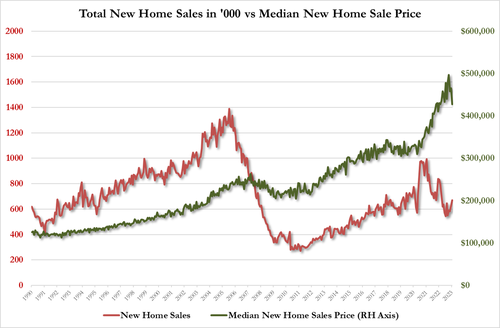

Since then, varied housing indicators have proven a large enchancment together with new house gross sales , largely the results of a plunge in costs…

… in addition to pending house gross sales which rose an unexpectedly robust 8% from December, in accordance with the Nationwide Affiliation of Realtors. However the previous 4 weeks have been tough, with charges transferring sharply some 100bps for the reason that begin of February.

That implies that for a purchaser buying a $400,000 house with 20% down on a 30-year fastened mortgage, the month-to-month cost, together with principal and curiosity, is now roughly $230 a month greater than it could have been a month in the past. In contrast with a 12 months in the past, when charges had been within the 4% vary, right this moment’s month-to-month cost is about 50% increased, in accordance with CNBC’s Diana Olick.

Because of this, mortgage purposes from homebuyers have been falling for the previous month and final week hit a 28-year low.

“The current bounce in mortgage charges has led to a retreat in buy purposes, with exercise down for 3 straight weeks,” stated Bob Broeksmit, president and CEO of the Mortgage Bankers Affiliation. “After strong good points in buy exercise to start 2023, increased charges, ongoing inflationary pressures, and financial volatility are giving some potential homebuyers pause about getting into the housing market.”

Initially of this 12 months, with charges barely decrease, it appeared the housing market was beginning to recuperate simply in time for the historically busy spring season. However that restoration has now stalled, and rising charges are solely a part of the image.

“Customers have taken on a document quantity of debt, together with mortgage, private, auto, and scholar loans,” famous George Ratiu, senior economist at Realtor.com. “With rising rates of interest, monetary burdens are anticipated to extend, making shopper decisions tougher within the months forward.”

Which, in fact, is simply what the Biden admin and the Fed need.

Loading…

[ad_2]