[ad_1]

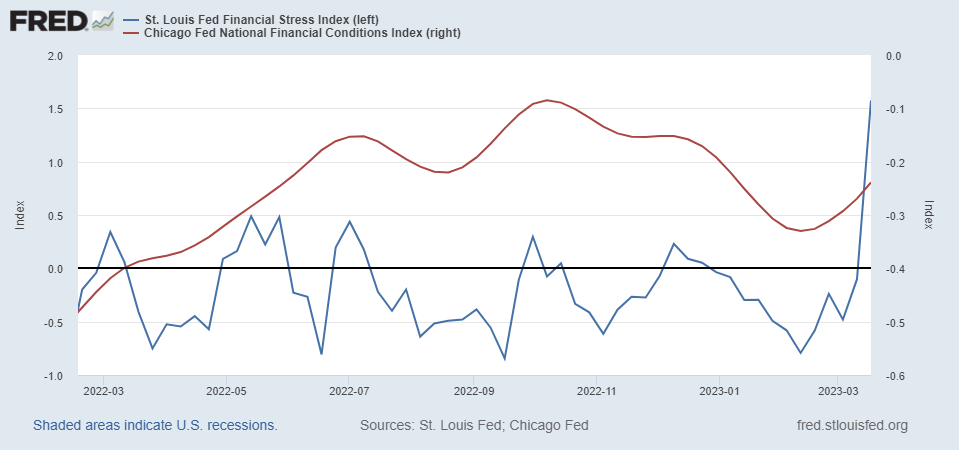

St. Louis Monetary Stress and Chicago Monetary Situations Indices.

Determine 1: St. Louis Fed Monetary Stress Index, v. 4.0 (blue, left scale), Chicago Nationwide Monetary Situations Index (purple, proper scale). “The STLFSI4 measures the diploma of economic stress within the markets and is constructed from 18 weekly information collection: seven rate of interest collection, six yield spreads and 5 different indicators. Every of those variables captures some facet of economic stress. Accordingly, as the extent of economic stress within the financial system modifications, the info collection are prone to transfer collectively.” “The Chicago Fed’s Nationwide Monetary Situations Index (NFCI) gives a complete weekly replace on U.S. monetary circumstances in cash markets, debt and fairness markets and the normal and “shadow” banking techniques. Constructive values of the NFCI point out monetary circumstances which might be tighter than common, whereas unfavorable values point out monetary circumstances which might be looser than common.” Supply: St. Louis Fed and Chicago Fed by way of FRED.

It’s arduous to see precisely what this implies, with out comparability to current durations of utmost monetary turmoil. Under is an image with an extended span of knowledge.

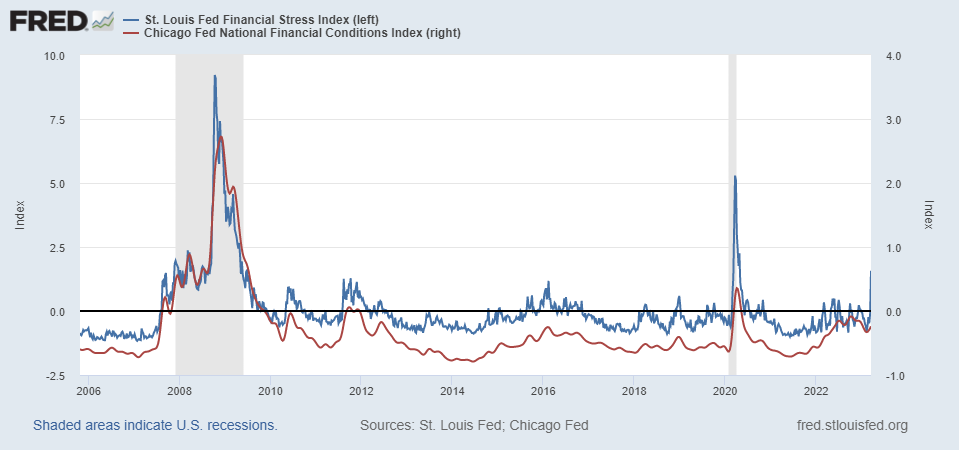

Determine 2: St. Louis Fed Monetary Stress Index, v. 4.0 (blue, left scale), Chicago Nationwide Monetary Situations Index (purple, proper scale). Supply: St. Louis Fed and Chicago Fed by way of FRED.

Therefore, whereas monetary stress — measured in two methods — is elevated relative to current historical past, they aren’t near ranges recorded in the course of the pandemic or the worldwide monetary disaster.

[ad_2]