[ad_1]

Authored by David Stockman through InternationalMan.com,

There’s nothing extra substantive than Bernanke’s unique finger-in-the-air proposition that the Fed wanted a 200 foundation level cushion within the inflation fee so as to steer the economic system away from the dreaded 0.0% inflation line, the opposite aspect of which allegedly amounted to a black gap of deflationary demise.

However right here’s the factor. There’s not a shred of historic proof that the US economic system wants a 2.00% inflation guardrail to thrive, or any fastened fee of inflation in any respect.

As an illustration, even throughout probably the most tough interval of the twentieth century—from 1921 to 1946 when the US economic system skilled the Roaring Twenties increase, the Nice Despair bust and the WWII rebound—there was plentiful internet financial development over the interval as an entire, accompanied by zero inflation.

The truth is, the US economic system almost tripled in dimension throughout that quarter-century interval. Actual GDP expanded at a strong 3.64% every year fee, and actual GDP per capita rose by 2.55% every year.

In contrast, between the 2007 pre-crisis peak and 2021, actual GDP grew at solely half that fee (1.72% every year), whereas per capita actual GDP elevated by simply 1.04% per yr. That was simply two-fifths of the speed of annual achieve throughout 1921-1946.

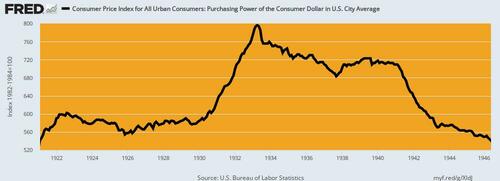

Evidently, it didn’t take any 2.00% inflationary guard rails to generate the salutary outcomes cited above for 1921-1946. The CPI index proven under posted at 542 in February 2021 and 541 1 / 4 century later in Might 1946.

Buying Energy of the Greenback, 1921 to 1946

Because it had unfolded, there was zero CPI inflation through the Roaring Twenties; a extreme deflation through the Nice Despair, which merely reversed the battle inflation of 1915-1920; after which a return to the 1921 value stage through the booming however regimented economic system of WWII.

Nonetheless, by the spring of 1946 the greenback’s buying energy was 100% of what it had been in early 1921. It had not taken any internet inflation in any respect to generate a close to tripling of the nation’s financial output.

The implication is easy. To wit, the Fed doesn’t want a pro-inflation goal of two.00% every year. Nor does it want any of its different macroeconomic targets for unemployment, jobs development, precise versus potential GDP or the remainder of the Keynesian coverage equipment. All of these variables are the job of the individuals interacting on the free market, producing no matter outcomes their collective actions occurred to generate.

Certainly, macro-economic outcomes should not correctly the enterprise of the state in any respect. The Fed’s job is way extra slender. As initially conceived by its nice architect, then Congressman Carter Glass, its mission was to maintain the buying energy of the greenback nearly as good because the gold to which it was to be linked, and the banking system liquid and secure, as pushed by the free market of debtors and lenders.

As we’ve defined on different events, Congressman Glass known as this a “bankers’ financial institution” and the time period couldn’t be extra diametrically against the central planners’ financial institution of Greenspan, Bernanke, Yellen, Powell and Brainard.

As Carter Glass noticed it, no academician wanted to stay his finger within the air and divine an inflation goal. Nor did any modeler must goal-seek his/her equations till they steered the optimum U-3 unemployment fee relative to an arbitrary inflation goal.

The very fact is, the free market working with sound gold-backed cash was by no means inflationary. In that context, rates of interest have been additionally not a coverage “instrument” of the central financial institution, however the results of a market-clearing balancing of provide and demand.

As Carter Glass had organized it, the Fed was not allowed to personal authorities debt, nor did it have an activist arm now generally known as the FOMC empowered to intervene within the cash and capital markets by shopping for and promoting debt securities.

On the contrary, its avenue of operation was the low cost window on the 12 regional Federal Reserve banks. The latter have been approved to advance funds to member banks, however solely at a penalty unfold above the free market rate of interest, and in addition solely on the premise of sound, self-liquidating collateral within the type of industrial paper that matured inside a matter of months.

Given this mechanism, the dynamics of Fed coverage have been the other of right now. Beneath the Glassian association, the Fed’s steadiness sheet was the passive consequence of free market exercise by industrial bankers and foremost road debtors, not a mechanism to proactively steer the extent of combination commerce and enterprise exercise.

Accordingly, the Fed’s worth added stemmed not from wild-ass guesses concerning the inflation fee by PhDs like Lael Brainard, however from the grunt work of green-eyeshade accountants. Their job was to confirm that financial institution mortgage collateral introduced for funding on the low cost window represented the obligations of sound debtors, not speculators and excessive flyers, who would reliably repay beneath the phrases of the underlying financial institution mortgage, thereby making certain that the Fed’s low cost loans could be repaid at time period, too.

What this meant was that the Fed’s steadiness sheet was meant to mirror the ebb-and-flow of decentralized commerce and manufacturing on foremost road, not a centralized judgment by 12 individuals gathered on the banks of the Potomac about whether or not inflation and unemployment have been too excessive, too low or simply proper.

That’s to say, beneath the bankers’ financial institution association the free market put an computerized verify on CPI inflation. That’s as a result of unsound speculative loans couldn’t be simply made within the first place, since they weren’t eligible for low cost on the Fed window.

And if demand for even sound loans received too frisky, rates of interest would rise sharply, thereby rationing accessible financial savings till extra of the latter could possibly be generated or demand for the previous was curtailed.

* * *

The reality is, we’re on the cusp of an financial disaster that might eclipse something we’ve seen earlier than. And most of the people received’t be ready for what’s coming. That’s precisely why bestselling writer Doug Casey and his workforce simply launched a free report with all the small print on tips on how to survive an financial collapse. Click on right here to obtain the PDF now.

Loading…

[ad_2]