[ad_1]

The S&P 500 (SP500) on Friday ended the week 1.6% increased, with its accompanying SPDR S&P 500 Belief ETF (NYSEARCA:SPY) additionally up 1.6%, as sentiment improved after the Federal Reserve meet on Wednesday. The S&P 500 posted beneficial properties in 4 out of 5 weeks this 12 months.

Nevertheless, whereas Fed President Jerome Powell mentioned progress had been made in opposition to inflation, a surprisingly strong jobs report renewed fears that the Fed will probably preserve charges increased for longer as labor market imbalances persist.

This week was stuffed with disappointing earnings from Wall Avenue bigwigs, together with Amazon (AMZN), Apple (AAPL) and Alphabet (GOOG) (GOOGL). Nevertheless, Meta (META) and GM (GM) each reported stellar outcomes.

As earnings season continues, reviews from Walt Disney (DIS), Uber (UBER) and PepsiCo (PEP) subsequent week shall be amongst these most carefully watched.

Traders digested a bunch of financial knowledge this week together with an surprising drop in preliminary jobless claims, weaker client confidence, and a bigger-than-expected decline in ISM manufacturing. In the meantime, This fall productiveness climbed above consensus, ISM companies rose greater than anticipated and the PMI Manufacturing Index confirmed a shock enhance.

Additionally, dwelling costs slipped as anticipated, whereas mortgage purposes have been down. However decrease mortgage charges has introduced some homebuyers again.

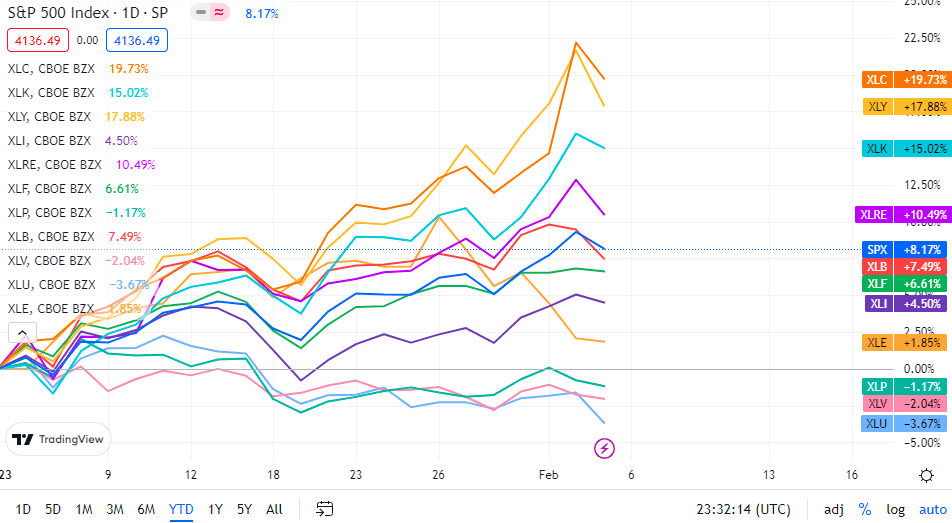

Of the 11 S&P 500 (SP500) sectors, eight ended the week increased. Communication companies sector led beneficial properties, pushed by Meta’s (META) encouraging outcomes. Vitality sector was the highest loser as crude oil costs dropped. See under a breakdown of the weekly efficiency of the sectors in addition to their accompanying SPDR Choose Sector ETFs from Jan. 27 near Feb. 3 shut:

#1: Communication Providers +5.3%, and the Communication Providers Choose Sector SPDR Fund (XLC) +5.3%.

#2: Data Expertise +3.7%, and the Expertise Choose Sector SPDR ETF (XLK) +3.7%.

#3: Client Discretionary +2.2%, and the Client Discretionary Choose Sector SPDR ETF (XLY) +2.3%.

#4: Industrials +1.7%, and the Industrial Choose Sector SPDR ETF (XLI) +1.7%.

#5: Actual Property +1.5%, and the Actual Property Choose Sector SPDR ETF (XLRE) +1.5%.

#6: Financials +0.9%, and the Monetary Choose Sector SPDR ETF (XLF) +0.9%.

#7: Client Staples +0.6%, and the Client Staples Choose Sector SPDR ETF (XLP) +0.7%.

#8: Supplies +0.03%, and the Supplies Choose Sector SPDR ETF (XLB) +0.01%.

#9: Well being Care -0.1%, and the Well being Care Choose Sector SPDR ETF (XLV) -0.1%.

#10: Utilities -1.5%, and the Utilities Choose Sector SPDR ETF (XLU) -1.4%.

#11: Vitality -5.9%, and the Vitality Choose Sector SPDR ETF (XLE) -5.8%.

Under is a chart of the 11 sectors’ YTD efficiency and the way they fared in opposition to the S&P 500. For buyers wanting into the way forward for what’s taking place, check out the Looking for Alpha Catalyst Watch to see subsequent week’s breakdown of actionable occasions that stand out.

[ad_2]