[ad_1]

Hawkish… however not hawkish sufficient…

That is the preliminary message the market heard from Fed Chair Powell.

He confirmed his message from the post-FOMC presser message that disinflation has barely begun and there’s nonetheless a protracted solution to go.and that “monetary circumstances have tightened.”

He additionally reiterated that extra charge hikes are more likely to be wanted.

“This course of is more likely to take fairly a little bit of time,” Powell says. It’s not going to be clean.

However, he didn’t push again in opposition to any expectations that Rubinstein urged the market might have that The Fed will not get the place it thinks it would.

“We anticipate 2023 to be a yr of great declines in inflation,” Powell says.

“My guess is it would take actually into not simply this yr however subsequent yr” to get to 2%.

And as we warned…

— zerohedge (@zerohedge) February 7, 2023

Meaning just one factor…

Shares ripped…

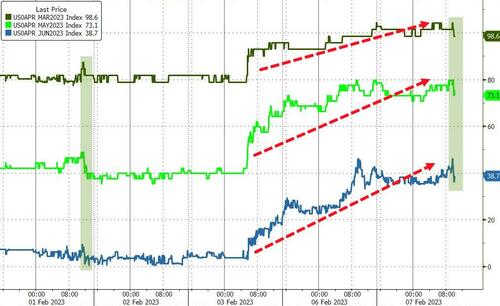

As shares soared, Fed rate-trajectory expectations shifted dovishly…

Price-hike expectations for March, Might, and June did fall very modestly…

Bloomberg’s Ira Jersey says he doesn’t hear very a lot new from Powell up to now within the interview:

“The market (may or not it’s algos?) once more appears to take the phrase ‘disinflation’ and provides it a better significance than it ought to have.”

However “the caveat of ‘early’ within the course of simply solidifies my view that the Fed received’t be reducing this yr, which is totally different than the market is pricing.”

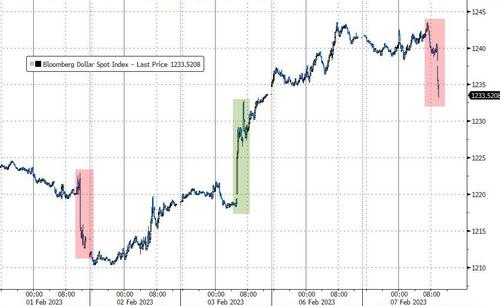

However, regardless of the hawkish shift in charge expectations, the greenback dived…

And bond yields tumbled…

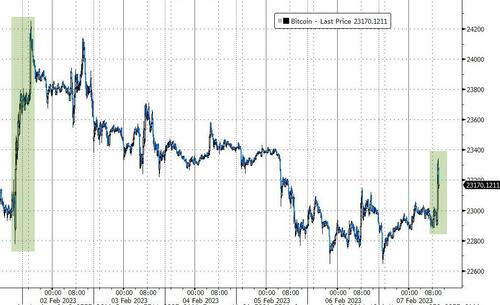

Bitcoin accelerated again above $23,000…

Neil Dutta of Renaissance Macro Analysis, weighs in:

“The Fed is wedded to a stale outlook. That’s dovish as a result of it provides the present momentum within the economic system extra room to run. He had the chance to lean in opposition to what occurred final week and he took a move. Inventory market buyers get it.”

Clearly, buyers are inspired that Powell hasn’t made any transfer to toughen his messaging to monetary markets.

However, after that preliminary kneejerk greater, we would notice that Powell later reiterated that “we now have a big street forward to get inflation all the way down to 2%.”

Moreover, Powell says the Fed might must hike charges greater than what’s priced within the markets if employment studies are available unexpectedly robust and inflation climbs.

His base case is that it received’t go away shortly and simply.

Loading…

[ad_2]