[ad_1]

Linda Goldberg and Signe Krogstrup have a revised model of a paper entitled “Worldwide Capital Circulate Pressures and International Elements”. They write:

we revisit these points by recognizing that the noticed responses of portions of capital flows, trade charges, and home financial coverage to international components are interdependent and in lots of international locations can’t be studied in isolation. In international locations with totally versatile trade

charge regimes, trade charges transfer rapidly in response to incipient adjustments in capital flows, supplementing and even obviating the adjustment observable in capital circulation volumes (Chari, Stedman and Lundblad, 2021). In distinction, in fastened trade charge regimes, managed floats, and even in some de jure versatile trade charge regimes, central banks use coverage interventions akin to home rate of interest adjustments and official overseas trade interventions to scale back the realized trade charge response to international components (Ghosh, Ostry and Qureshi, 2018).1 In such instances, capital circulation pressures might present up in overseas trade interventions or in coverage charge adjustments reasonably than in trade charges. Accordingly, viewing capital circulation responses to international components individually from the trade charge or coverage response will present an incomplete image of the particular capital circulation pressures at play.To account for the interdependencies between capital flows on the one hand, and trade charge adjustments, overseas trade interventions and coverage charge adjustments on the opposite, we first current a brand new measure of worldwide capital circulation pressures, which is a revamped model of an Change Market Stress (EMP) index. EMP indices are weighted and scaled sums of trade charge depreciation, official overseas trade intervention, and coverage charge adjustments. Earlier variations of trade market strain indices have been utilized in a broad vary of purposes within the literature, from finding out steadiness of funds crises (Eichengreen, Rose and Wyplosz 1994) to financial coverage spillovers (Aizenman, Chinn and Ito 2016b) and classifying trade charge regimes (Frankel 2019). Nonetheless, the weighting and scaling of the inputs have problematic options, main these indices to mischaracterize the patterns of pressures throughout international locations and over time, as mentioned extra extensively within the Appendix.

Our development as a substitute derives the related weighting and scaling phrases throughout the index by an strategy that makes use of key relationships in steadiness of funds equilibrium, worldwide portfolio calls for for overseas belongings, and valuation adjustments on portfolio-related wealth.2 …”

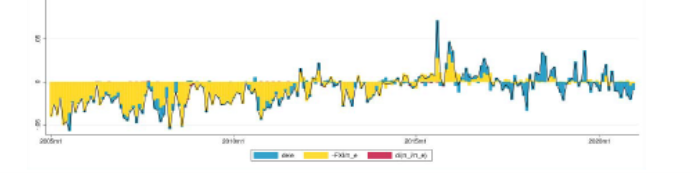

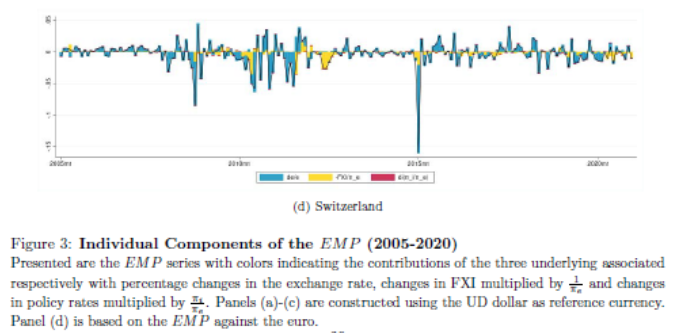

The paper describes intimately the (concerned) calculation of their index. Determine 3 within the paper depicts the time sequence for 4 international locations. I reproduce panel b and d (China and Switzerland, respectively) under.

Supply: Goldberg, Krogstrup (2023).

One remark based mostly on their indices:

Through the highest stress episodes, international locations on common enable extra trade charge variation to soak up capital circulation pressures than throughout regular instances and even throughout in any other case elevated threat sentiment. Some international locations would possibly acknowledge that intervention within the overseas trade market will not be as efficient during times of maximum stress when foreign money pressures are massive and would possibly entail dropping massive portions of official overseas foreign money reserves, in order that they take a minimum of a brief foreign money depreciation.

“International trade intervention accounts for almost all of the EMP that’s not attributed to trade charge actions. The rate of interest element accounts for nearly all variation for only a few international locations. The contribution of the rate of interest element is most pronounced in international locations with excessive inflation and coverage charges that haven’t been constrained by the efficient decrease sure and nil decrease sure. Central banks in these international locations have been in a position to make use of the coverage charge extra actively in response to capital circulation pressures. …”

Some contrarian findings concerning secure haven currencies:

“…determinants related to secure belongings discovered little help within the knowledge, with the scale of the general public debt and gross overseas positions sometimes and weakly displaying vital associations. Monetary market improvement and monetary openness adjustments over time, with nation fastened results in specs, don’t differentiate threat habits of realized extra returns.”

Some Econbrowser posts on standard EMPs, and Russia underneath sanctions, trilemma, managing inflows.

[ad_2]