[ad_1]

For a lot of the waning days of 2022, the broader theme in markets was a downbeat one, particularly for one group of ordinary gamblers traders: after a stellar 2021 when nothing made sense and the junkiest of firms exploded increased steamrolling shorts, for retail traders 2022 felt just like the polar reverse: a relentless sequence of intestine punches which knocked the air out of basement dwelling daytraders and crushed among the hottest retail names.

And certainly, a fast search of headlines from mid/late 2022 confirmed that the retail spirit had been damaged:

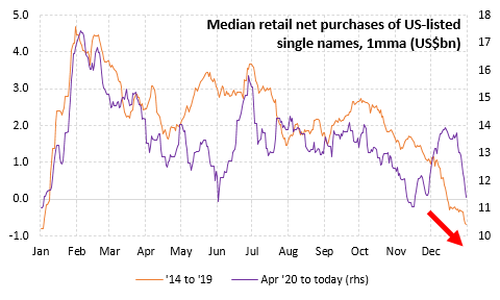

All of it culminated with the close to file year-end liquidation when along with momentum, tax loss promoting prompted retail traders to dump single shares at an unprecedented tempo as described Retail Buyers Slamming The Bid Amid Tax-Loss Promoting Capitulation

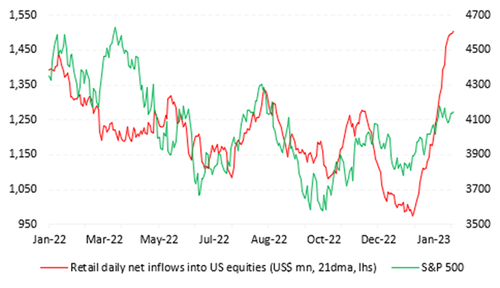

Nevertheless, this file promoting movement wouldn’t final lengthy, and certainly, only one month later, we wrote that with LO establishments and hedge funds extending their bearish positioning, it was retail traders that picked up the BTFD torch in January, including that “if retail is as soon as once more a extra highly effective worth setter than establishments and hedge funds (thanks zero market liquidity), and we face one other Jan 2021-type meltup, then be careful above even when not one of the abovementioned technicals go into play.”

On reflection we had been proper, however not even we had any thought simply how a lot we had been proper.

That is as a result of in line with the newest report from retail orderflow specialist Vanda Analysis, January was a blowout, file month for retail consumers available in the market.

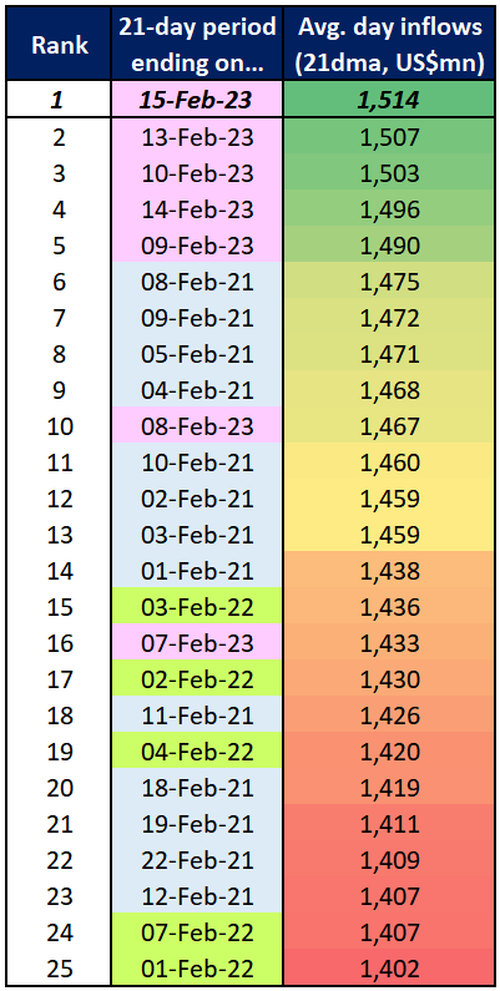

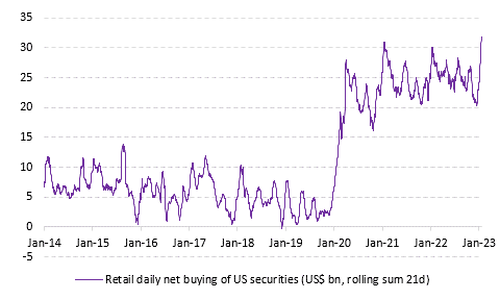

As Vanda’s Mario Iachini writes, “within the final month, retail traders poured a median of $1.51bn/day into the US markets, the best quantity ever recorded.” And as we anticipated, this group of traders “has continued driving US fairness market swings for the reason that second half of final 12 months.”

Echoing verbatim our personal ideas, Vanda writes that “with current surveys displaying the institutional investor group remaining broadly bearish on shares, it will be unwise to underestimate the significance of the retail cohort” as so many bearish hedge funds discovered the very arduous method in early 2021. “That’s in line with retail gross sales and jobs knowledge for January, suggesting that buyers retain spectacular ranges of shopping for energy. Whereas the jury remains to be out on whether or not that’s resulting from a strong job market or extra financial savings from pandemic stimulus, the underside line is that traders ought to heed alerts from the ‘unsophisticated cash’ crowd.”

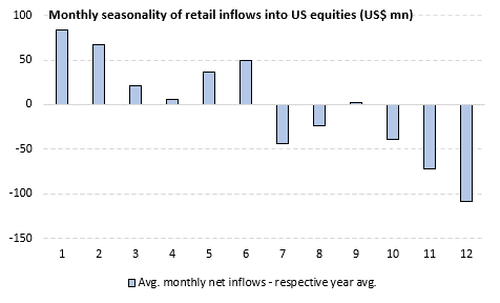

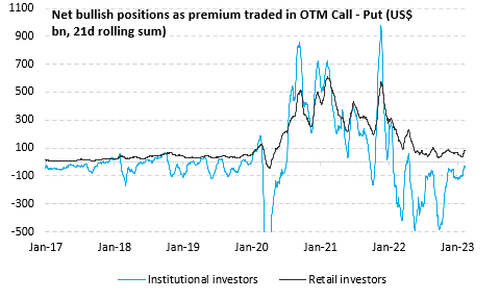

Having stated that, seasonality means that flows may abate considerably within the weeks forward as earnings season falls within the rear-view mirror and traders begin making ready for Tax Day in mid-April. Nevertheless, if broad fairness markets proceed to carry out effectively, we could as a substitute see flows shifting in direction of smaller, extra speculative firms (that is already occurring to an extent). And whereas the identical may happen within the choices market, particularly with the dominance of 0DTE choice exercise, Vanda doesn’t anticipate a repeat of the 2020-21 bubble, provided that we’re nonetheless within the late phases of the financial cycle.

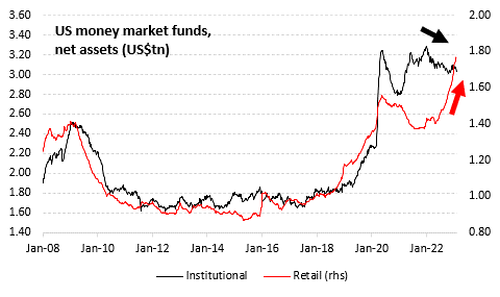

Lastly, opposite to standard perception, retail cash market funds’ web belongings at an all-time excessive recommend that retail traders nonetheless have loads of capital to allocate to riskier investments, offered that market situations stay supportive.

Vanda discusses this and different associated matters in additional element under.

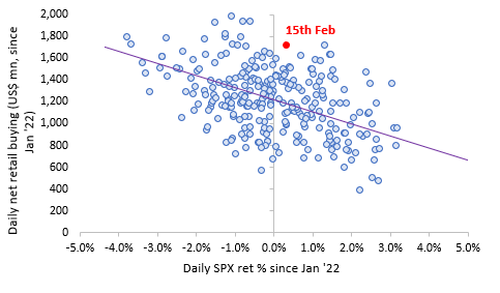

Whole web purchases of US securities exceeded expectations by a big margin on Wednesday. If we solely contemplate durations when the S&P 500 closed in optimistic territory, Wednesday’s combination purchases surpassed the earlier file set on February eighth. Usually, Vanda would anticipate this this stage of inflows on a day when the S&P 500 experiences a every day decline between -1% and -4%. As a substitute, “one of these habits suggests retail merchants are FOMO-ing greater than any sentiment current survey would present.”

The flipside to the current retail euphoria is that Vanda expects retail flows into money equities to lower within the weeks forward, as seasonality means that March-April are usually middle-of-the-road months through the calendar 12 months.

Moreover, when taking a look at a rolling one-month interval, inflows have by no means been increased for the reason that dataset started in 2014 (second chart under). Sustaining such a strong every day tempo will show difficult nevertheless it gained’t imply the tip of the present bull market if institutional traders decide up the slack.

On the similar time, and opposite to standard perception (particularly amongst bears), the above doesn’t imply that retail traders are operating out of capital to allocate to dangerous investments. Certainly, from a inventory stage perspective, the chart under means that retail traders have loads of dry powder within the type of capital parked in cash market funds that could possibly be deployed within the fairness area as soon as confidence about future market returns will increase extra broadly.

Including insult to harm for the institutional bears – of which there’s a lot – there may be potential for bullish positions to be added within the choices market. Nevertheless, it’s unsure to what extent retail traders are keen to take part within the rally with leverage, given they’re nonetheless sitting on important losses (-25% on common). In any case, no person expects that the extent of hypothesis noticed through the 2020-2021 interval will likely be replicated as we’re nonetheless within the later phases of the market cycle. These dynamics usually tend to take maintain through the early restoration phases after a recession has occurred.

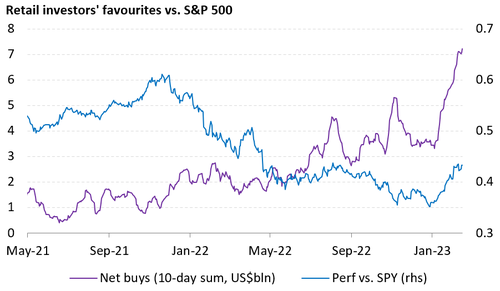

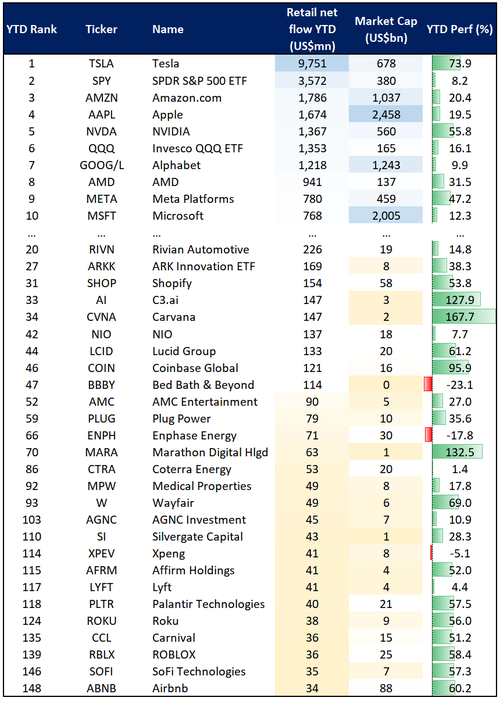

The hovering retail investor flows underpin the outperformance of their favourite shares. A basket of the highest 10 most-purchased retail shares over current months is experiencing a powerful rebound relative to the SPX in 2023. Retail flows have accounted for a +US$18.5bn capital injection YTD in these names (listed under the chart). Ought to optimistic momentum within the broad fairness market persist, it may push retail traders towards extra speculative names, that are extra inclined to such flows given their smaller market cap.

Many smaller-cap single shares are additionally starting to populate the highest a part of the retail leaderboard to this point in 2023. Certainly, the primary desk under reveals that past the highest 10 most-bought securities, there’s a number of smaller-cap names which have attracted important inflows this 12 months (~US$2.23bn in whole). Furthermore, the weighted common efficiency of this group of shares is roughly +50%, which is broadly outpacing the S&P500 whole return of 8.2%.

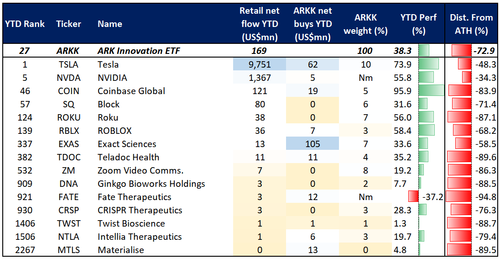

The opposite consequence of this dynamic is a pick-up in retail purchases within the ARKK ETF and a few of its underlying holdings. It was frequent again in 2020-21 for retail traders to purchase ARK ETFs whereas on the similar time piling in a few of their extra hyped underlyings. Whereas we don’t anticipate retail hypothesis to achieve these ranges for the explanations mentioned above, it’s noteworthy that retail traders are vastly outpacing Cathie Wooden and Co. relating to purchases throughout a few of these names.

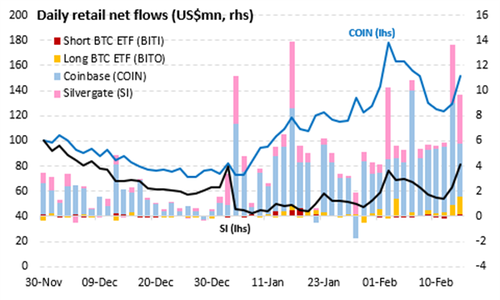

Vanda concludes its weekly retail monitoring by stating that crypto TradFi proxies are amongst among the finest performers week-to-date.

Silvergate Capital (SI) shares had been up 28.6% on the finish of buying and selling Wednesday after Citadel Securities introduced that it had taken a stake within the firm. Certainly, 13F filings present Citadel Securities purchased 5.5% within the digital forex banking firm. The shares are up 69% over the previous month however stay 91% under their all-time excessive. With the newest knowledge displaying 67% of SI’s shares held quick it’s seemingly that retail purchases have helped gas a short-squeeze over the past three buying and selling days. Given the scale of the quick e book, we wouldn’t be shocked to see retail merchants try and push the inventory additional within the coming days, though flows over the previous three months present that curiosity on this title tends to be sporadic and short-lived. In distinction, Coinbase (COIN) appears to take pleasure in stronger retail tailwinds as bullish exercise within the choices area is surging as effectively (second chart).

Lastly, right here is the mixture retail movement tracker”

Loading…

[ad_2]