[ad_1]

Goldman Sachs raised the likelihood of recession from 25% to 35% in gentle of the SVB associated turmoil (though their guess continues to be decrease than the consensus). This prompted me to marvel what was the web impact of the turmoil and Fed response (much less tightening) on financial exercise.

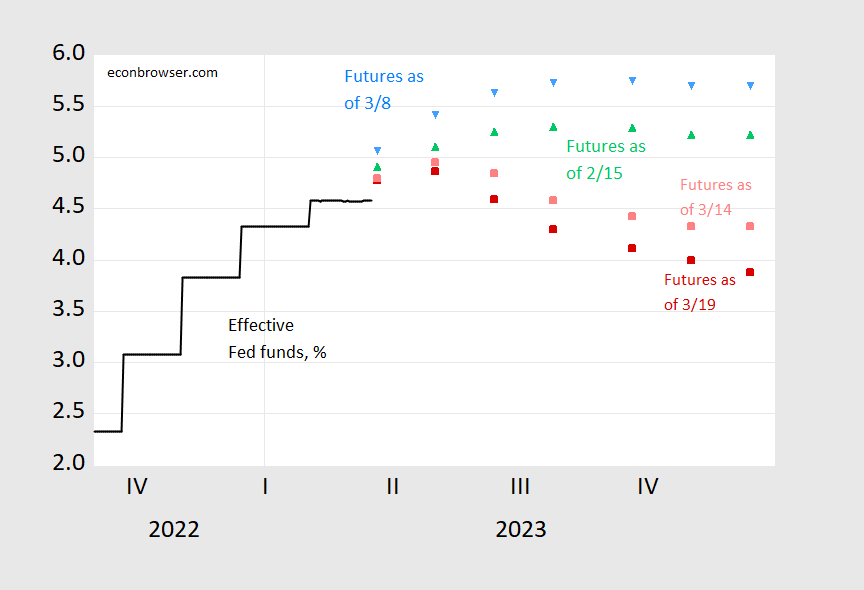

First, the trail of Fed funds — as perceived by the market — Sunday vs. a pair weeks in the past.

Determine 1: Efficient Fed funds (black), implied Fed funds as of March 19 4:30CT (pink sq.), March 14, 1:30 CT (pink sq.), March 8 (sky blue inverted triangle), and February 15 (inexperienced triangle). Supply: Fed through FRED, CME Fedwatch and creator’s calculations.

By years-end, the implied Fed funds is about 180 bps decrease than what was seen nearly two weeks in the past. Bauer and Swanson (AER 2023) estimate a 100 bps shock ends in a 0.24 to 0.60 ppts lower in development fee. In fact, 180 bps decrease fee will not be actually a “shock” as thought-about within the VAR literature (the discount relies on an inferred response operate that takes under consideration dimmer development prospects), however let’s take this quantity as a ballpark determine. That suggests much less pronounced tightening provides round 0.4 to 1 proportion level development. Say half of 180 bps is a “shock” within the sense it’s motivated by concern in regards to the banking system. Then that takes the constructive affect one thing between 0.2 to 0.5…

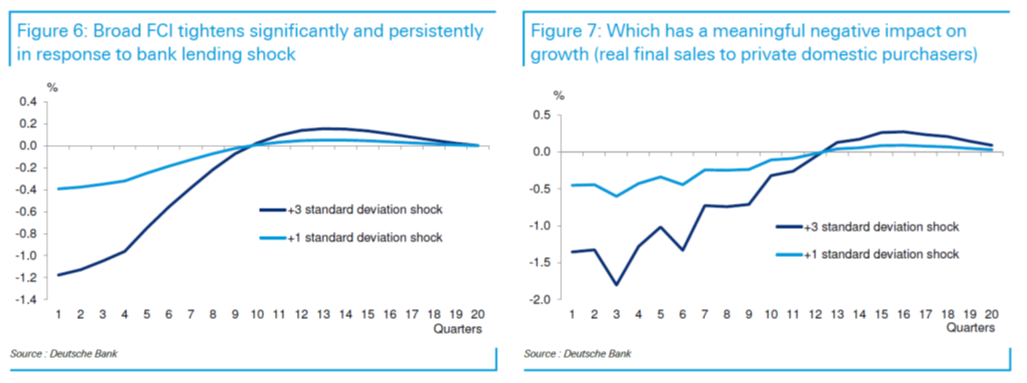

Set in opposition to that, the shock to the banking system is prone to cut back financial institution lending, and therefore development. Luzetti et al. at Deutsche Financial institution (“(Credit score) crunching the numbers”, 20 March 2023) estimate a ten level improve within the Senior Mortgage Officer Survey (SLoOS) of lending circumstances (which was typical within the 1990’s and early 2000’s recessions) would end in a 0.4 proportion level development discount at a 4 quarter horizon.

Notes: 10 level improve in SLoOS roughly equals 1 std deviation shock to FCI. Supply: Luzetti, et al. (2023).

I wouldn’t take these as something greater than a back-of-the-envelope calculation, however it does remind us that there are offsetting results of latest developments.

[ad_2]