[ad_1]

For a proxy of how little media curiosity there’s within the slow-moving public pension disaster, go to Twitter and search on “public pension underfunding”. The tweets I get, in 12 months order, are 2016, 2020, 2020 2021, 2015, 2021, 2015. 2009, 2012, 2012.

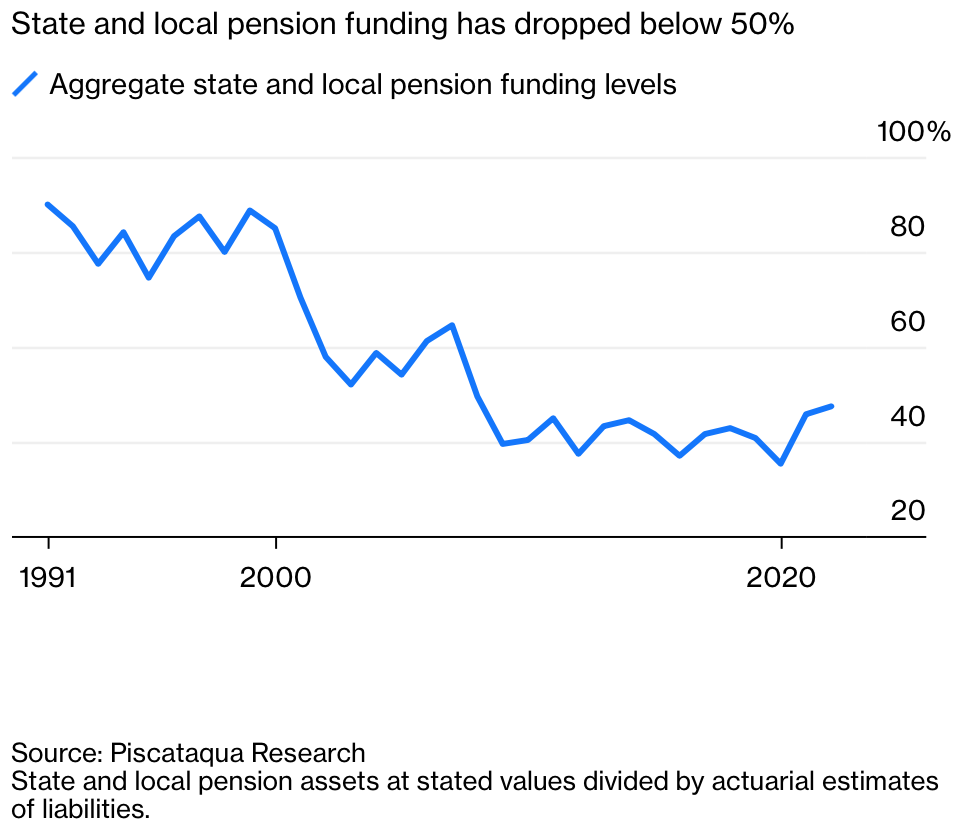

No, sports activities followers, the shortage of present intereest shouldn’t be as a result of the issue has gotten higher. With the Fed making an attempt not merely to whip inflation but in addition to get the US on an enduring foundation out o a ZIRP-y coverage regime, the outlook for monetary belongings for the subsequent foreseeable whereas shouldn’t be so sizzling. And that’s earlier than attending to the affect of local weather change and useful resource pressures on company income. As we’ll talk about in additional element quickly, a brand new Bloomberg op-ed by Aaron Brown, former MD and head of analysis at AQR reveals that the state of public pension funding is extra dire than most understand. As an illustration:

The widespread failure of the general public pension mannequin raises questions concerning the viability of the saving for retirement mannequin. Neoliberalism calls for labor mobility and weakens neighborhood ties. It additionally will increase the burden on already fragile nuclear households. The retirement mannequin within the period of subsistence farming was dwelling with kids and grandchildren or different prolonged members of the family. Folks might nonetheless be useful even when they have been secondary gamers in offering for family wants, by little one care, mild cooking and cleansing, and different assist. Within the publish World Warfare II period, the company and labor elite received beneficiant pensions, whereas others might nonetheless save for retirement by shopping for a home. 30 12 months mortgage phrases matched the same old working lie. A retiree might reside mortgage free or promote his home and transfer right into a smaller abode.

Quick job tenures, dear housing resulting in a lot later preliminary house purchases, and howeowners being inspired to extract fairness by way of tax-advantaged second mortgages have undermined the “house as financial savings automobile mannequin.” Now people are exhorted to save lots of and spend money on monetary markets.

However market touts neglect that the inventory market took till the mid Fifties to get well from the 1929 crash. And the publish World Warfare II interval was distinctive, with the US initially at 50% of world GDP in a position to implement governance construction of its liking and beneath its thumb. After the stagflationary Nineteen Seventies, the US then had a really future of falling coverage rates of interest that resulted in Might 2007. Declining rates of interest increase monetary asset costs, significantly of typically-levered belongings like actual property and dangerous belongings like shares. Asset costs received one other lease on life with the Fed and different central banks driving and conserving rates of interest in unfavourable actual yield territory.

The issue is that investing for retirement has just about nada to do with productive funding. Secondary market securities buying and selling is a tiny fraction of latest safety gross sales to fund firm operations. One inform of how little public corporations do in the best way of investing of their companies is their stage of inventory buybacks. We identified in 2005 how corporations had turn into so brief time period oriented that they have been unwilling to pony up even for tasks with one 12 months paybacks, frightened of the affect of upper bills on the subsequent quarter’s earnings. Which means many executives have deemed probably the most engaging path to be slow-motion liquidation by way of utilizing price cuts as their principal engine for revenue progress from current operations.

The rationale that public pensions are a part of this drawback is that public pensions executives and trustees, like many particular person buyers, have been inspired to assume long-term funding returns of seven% have been completely affordable. However it’s not affordable to anticipate investments to maintain returning greater than GDP progress. The oblique proof of that fallacy is the diploma to which investments, as in capital, has engaged an increasing number of rentier actions to the detriment of labor. Within the US, income as a share of GDP have been roughly 6%, a stage Warren Buffett deemed to be unsustainably excessive. In the previous few years, income in comparison with GDP have risen by almost 2x. So elevated labor crushing as a tailwind to inventory costs can also be doubtless on the wane.

Thoughts you, not all public pension funds are in unhealthy form. Brown’s knowledge appears significantly dire in comparison with different overviews, however these usually look solely at state pension plans, whereas he contains municipal plans. From his piece:

State and native pension funding is a kind of perennial crises that all the time appear to loom however solely sometimes produce restricted precise disasters in locations like Detroit, Puerto Rico or the smaller however more moderen Chester, Pennsylvania. Primarily all Twenty first-century municipal bankruptcies within the US are resulting from underfunded pension plans. However not one of the defaults up to now have led to falling dominoes: hovering municipal bond yields, taxpayer revolts or common authorities worker strikes. Will state and native pensions stagger alongside for the subsequent few many years, bankrupting the odd declining metropolis or three however not triggering a common political or financial disaster? Or are we, in Jim Steinman’s immortal phrases, “dwelling in a powder keg and giving off sparks”?

Notice that one motive the day of reckoning appears gradual to reach is that pensioners in outlined profit plans, due to latest appellate and Supreme Courtroom rulings, can’t sue plan sponsors or trustees for breach of fiduciary obligation and different misconduct till, actually, they don’t get their full advantages. The fund needs to be so depleted that it may possibly’t make mandated funds earlier than the beneficiaries have standing. That is utterly totally different than outlined contributions land, the place a discount in beneficiary balances that may be attributed to fund supervisor unhealthy acts does confer standing.

Along with your entire “make investments to retire” scheme being questionable, many public pensions have self-inflicted wounds. Christine Todd Whitman, as New Jersey governor within the early Nineties, began the vogue of deliberate underfunding, based mostly on the barmy concept that fancy market footwork would fill any shortfall. New Jersey has been rewarded with some of the underfunded methods within the US.

Brown notes that public pensions as an entire have made the large mistake of reducing contributions when the inventory market was robust; CalPERS declared a contribution vacation in the course of the dot-com period. Once more from Brown:

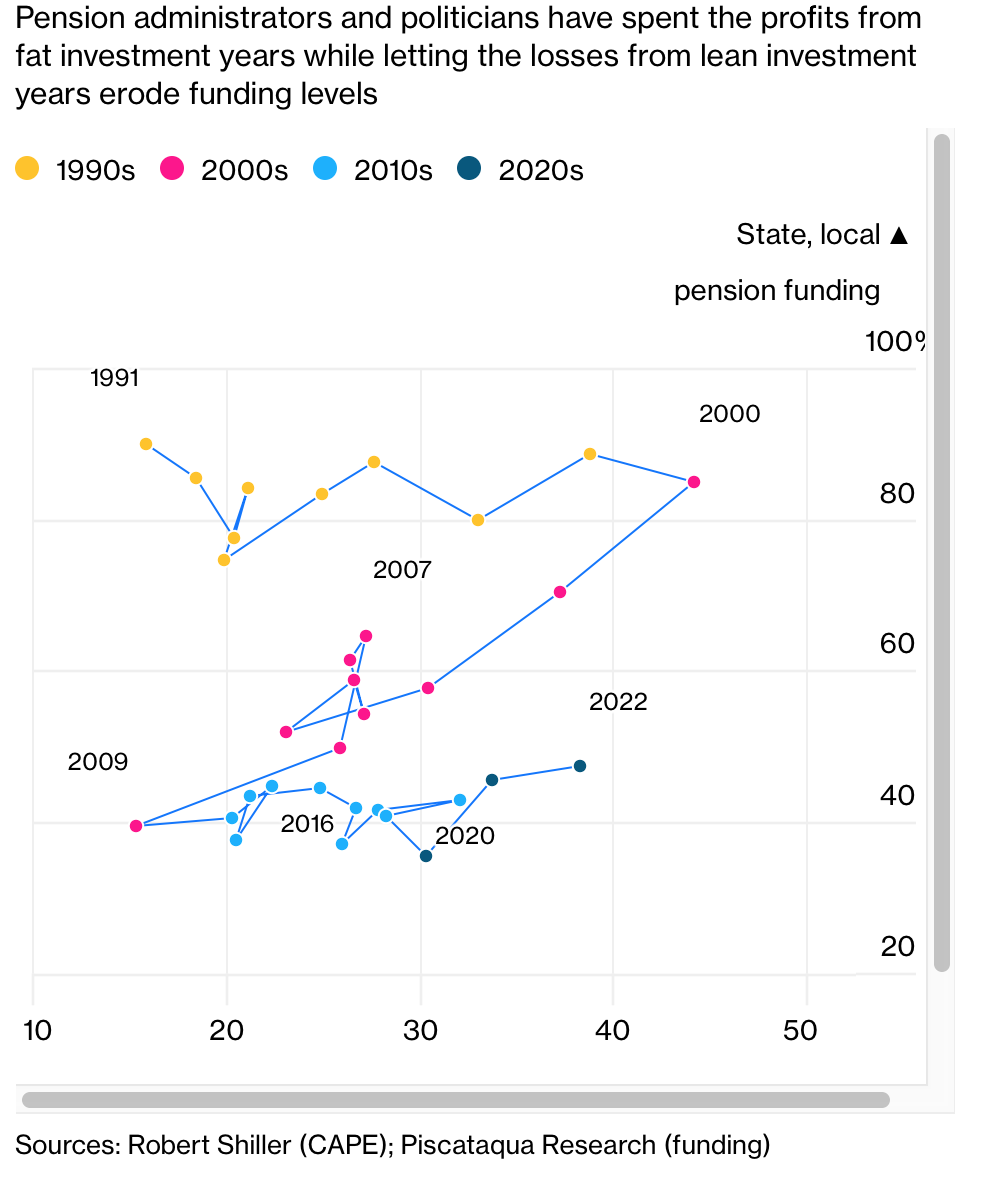

I believe we are able to get extra perception by what engineers name a “section area.” As an alternative of graphing the funding ranges over time, let’s have a look at them in contrast with cyclically adjusted price-earnings ratios (CAPE). It is a measure developed by Yale professor Robert Shiller that divides present inventory costs by common inflation-adjusted earnings over the previous 10 years. I think about it the perfect customary model of price-earnings ratio….

Admittedly, phase-space diagrams take a bit extra work to grasp than time collection charts, however I believe this one rewards the trouble. You may see from 1991 to 2000, inventory valuations almost tripled, whereas pension funding ranges didn’t change a lot. One is reminded of the bumper sticker seen in Silicon Valley in 2000, “Lord, give me one other web increase, I promise to not waste it” (recycled from the Eighties-era oil increase sticker). State and native pension directors and politicians wasted the web increase by utilizing rising inventory costs and low rates of interest to chop pension funding and improve promised advantages. They didn’t improve reserves as CAPEs soared to 44.20, far above the 1929 peak worth of 32.56, robust motive to anticipate both a inventory crash or a decade of mediocre actual returns.

Over the subsequent decade, as CAPEs fell again to 1991 ranges, pension funding fell with inventory markets. There was a quick reversal in the course of the 2003-06 housing bubble — fund directors didn’t waste that one — however the subsequent housing crash and financial disaster worn out these positive factors and continued the downward trajectory.

Subsequent got here the longest bull market in historical past from 2009 to 2022 and, just like the Nineties bubble, it was wasted. Regardless of widespread reforms to chop advantages and improve contributions by newly employed employees, a rise in authorities contributions and adoption of more and more aggressive funding methods, February 2023 mixture funding ranges are most likely just like 2009 lows.

That is three many years of historical past to argue that state and native pension directors and politicians will spend the income from fats funding years whereas letting the losses from lean funding years erode funding ranges. When valuations rise, they’re handled as everlasting financial positive factors. After they drop, they’re handled as momentary mark-to-market losses that don’t have an effect on long-term financial fundamentals. If that continues, catastrophe is definite whether or not future funding returns total are higher or worse than historic averages.

Notice that Brown has not included out pet hobbyhorse, that public pension funds rising their allocations to supposedly higher-returning “alts,” as in different investments like personal fairness, has worsened returns in comparison with easier and cheaper methods for nearly all public pension funds and endowments. And CalPERS is likely one of the greatest sinners, as in greatest turbines of “unfavourable alpha”.

This sorry story reinforces the concept that pension ought to primarily be a Federal duty. The US creates its personal forex and might all the time afford the spending. And if we had extra rational management, stronger pension rights ought to provide extra growth-oriented spending insurance policies. None different that arch neoliberal Larry Summers has identified that infrastructure spending could be anticipated to generate $3 in GDP for each greenback of expenditure. How about having an financial assume tank rank order spending when it comes to progress payoff. Humorous we don’t see analyses like that as a matter after all.

Equally, if we had higher leaders, we would additionally see extra in the best way of packages to ship providers to retirees extra effectively. One reader described how social employees go to the houses of aged folks twice per week, bringing even transportable bathtubs, to wash them in addition to store and carry out different duties to assist hold them dwelling independently. However now that nursing houses are huge enterprise in America, we might by no means get there from right here.

Sadly, as with our international coverage, it appears like on the general public pension entrance that we’ll need to see actual breakdown earlier than we get actual change.

[ad_2]