[ad_1]

Productiveness progress underperforms (-2.7% vs. -1.8% Bloomberg consensus, q/q AR), whereas unit labor prices surprises on the upside (+6.3% vs. +5.5% consensus, 3.3% earlier).

Hours rose as output fell. Seemingly fairly unhealthy information, however I feel it’s helpful to place these current progress charges in context by trying on the ranges.

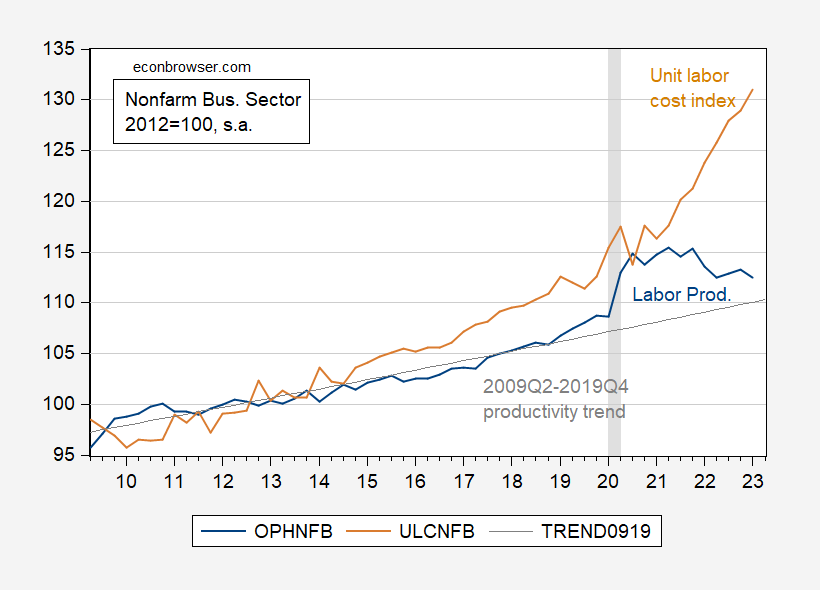

Determine 1: Nonfarm enterprise sector output per hour index (blue), 2009Q2-2019Q4 deterministic pattern (grey line), and unit labor prices index (tan), all 2012=100, all on log scale. NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS, NBER, and creator’s calculations.

One ought to view the lackluster productiveness progress towards the backdrop of an immense surge in measured productiveness related to the labor shedding in the course of the pandemic, and the shortfall in employment relative to pre-pandemic tendencies. The present degree is above the pre-pandemic pattern (not that that’s the place productiveness must be – that is dependent upon a number of different components). Proper now, we’re adjusting out of labor dis-hoarding into labor hoarding, explaining the decline in measured labor productiveness.

(Notice that these estimates will probably be revised over time; 80% of adjustments from advance to third launch to q/q AR productiveness vary from -1.0% to +1.4%.)

However, unit labor prices — the ratio of compensation to actual output per hour — continued to rise. One mind-set about this variable is that it represents a type of cost-push shock. Therefore, a shortly rising unit labor value (ULC) index confronts the Fed with a harder problem, as in comparison with a decelerating progress of ULCs.

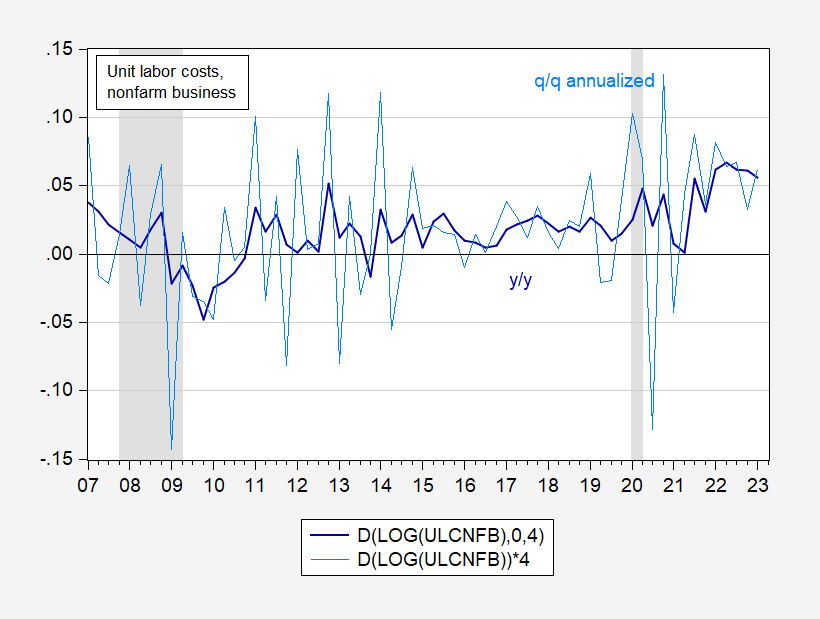

Determine 2: Progress charge of year-on-year unit labor prices (ULC) (darkish blue), and quarter-on-quarter annualized (gentle blue), each calculated utilizing log variations. NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS, NBER and creator’s calculations.

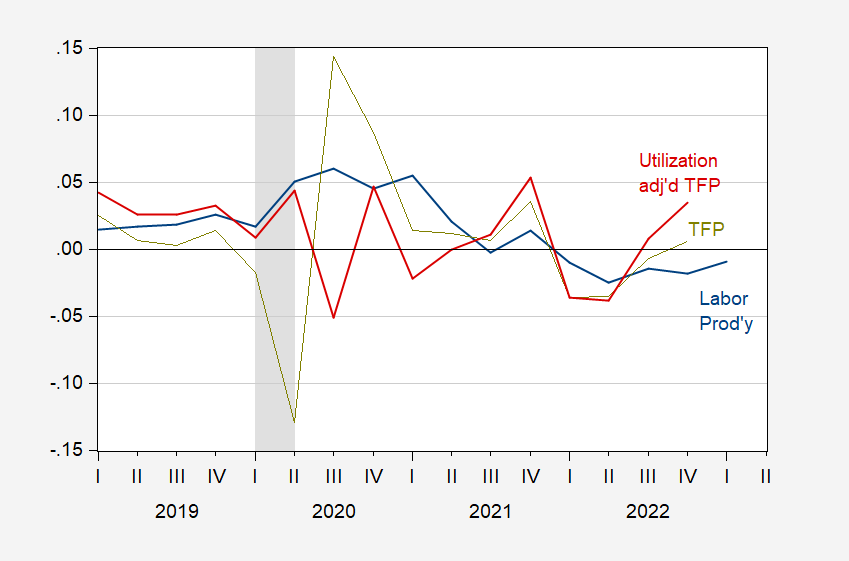

Last notice: We depend on labor productiveness as a result of we consider we estimate it with higher accuracy than complete issue productiveness. Actually, complete issue productiveness (TFP) calculations are additionally affected by adjustments in capability utilization (so capital “hoarding” in addition to labor hoarding). Under I current y/y progress in labor productiveness (from Determine 1) as in contrast towards y/y progress in TFP and utilization adjusted TFP, as estimated by John Fernald.

Determine 3: 12 months-on-year progress charge of output per hour (blue), of complete issue productiveness (chartreuse), and utilization adjusted complete issue productiveness (crimson), all calculated utilizing log variations. NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS by way of FRED, Fernald/SF Fed, NBER, and creator’s calculations.

Replace, 9PM Pacific:

Home, Orazem, Furman and I mentioned the numbers on MarketPlace in the present day.

[ad_2]