[ad_1]

Gemma Hatvani has labored within the vitality business for 20 years however has not skilled something just like the previous couple of months as struggling households flock to her Fb-based service, Power Help and Recommendation UK.

“It’s horrendous . . . the demand from folks needing meals parcels, top-up vouchers . . . I do know we hear this phrase lots but it surely’s unprecedented,” mentioned Hatvani, a former enterprise analyst for vitality provider Eon.

Public and political anger in direction of electrical energy and fuel retailers in Britain — which as consumer-facing companies usually bear the brunt of fury in direction of the broader vitality business — is already heightened after revelations this month of forcible installations of costly prepayment meters within the houses of weak British Fuel prospects.

However executives are braced for the criticism to ramp up additional because the mum or dad corporations of among the nation’s largest suppliers put together to disclose bumper outcomes for 2022 within the coming weeks.

Centrica, proprietor of British Fuel, has already mentioned it expects a virtually eightfold enhance in adjusted earnings per share for 2022 when it studies on Thursday. Analysts are forecasting internet earnings of about £1.97bn, its finest leads to a decade, in keeping with Bloomberg information. In November it launched a £250mn share buyback, its first since 2014.

Others have revealed equally sturdy numbers in current quarters. Earnings at ScottishPower, owned by Spain’s Iberdrola, rose 12 per cent to almost £1.3bn within the first 9 months of final 12 months.

The majority of the massive suppliers’ earnings doesn’t come from promoting electrical energy and fuel to households however from different divisions similar to extracting fuel from beneath the North Sea, producing electrical energy from nuclear energy stations or wind farms and buying and selling vitality.

Britain’s retail vitality market is lossmaking on combination. Even lots of the bigger vitality corporations make losses on the sale of electrical energy and fuel to households.

However the place corporations generate their earnings doesn’t matter to hard-pressed households, gas poverty campaigners say. File outcomes from oil main Shell, which has a provide arm in Britain, have already triggered requires a rise in windfall taxes on vitality corporations.

“On the finish of the day the explanations the prices are excessive are due to these identical vitality companies,” mentioned Simon Francis, co-ordinator of the Finish Gasoline Poverty Coalition. “It may be a distinct division of that vitality agency however . . . they’re nonetheless owned by the identical firm.”

Analysts warn the problem for Centrica specifically will probably be acute, regardless of it apologising for the “deeply disturbing” behaviours unearthed by a Occasions investigation into pressured prepayment meter installations.

“The PR course that Centrica has to navigate has arguably bought tougher,” mentioned Martin Younger, analyst at Investec.

Centrica, which declined to remark, is anticipated to spell out on Thursday how a lot it would contribute to the exchequer in windfall taxes. The federal government has launched levies each on fossil gas producers and electrical energy mills to assist fund reductions in home vitality payments.

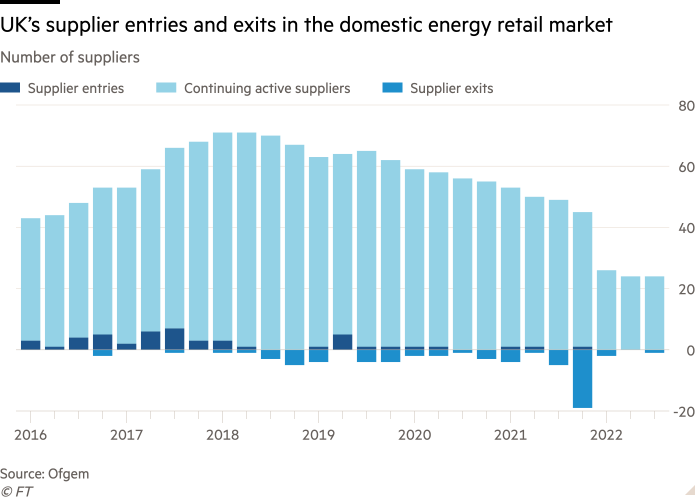

Power executives recognise that robust earnings for some vitality teams will probably be troublesome to elucidate within the context of the price of residing disaster. However they are saying the outcomes of a handful of enormous corporations masks deeper issues within the retail sector, whose ranks halved after the surge in wholesale fuel costs from 2021 led to the collapse of greater than 30 lossmaking suppliers.

Business insiders warn the state of the retail market has grow to be so dangerous that many corporations wish to give up. Shell has already mentioned it’s contemplating withdrawing from vitality provide within the UK and elsewhere in Europe.

“Many corporations are both regretting their transfer into [retail] or are attempting to get out of it,” mentioned one senior business govt.

Emma Pinchbeck, chief govt of commerce physique Power UK, says the business as an entire can’t serve prospects nicely and do different issues similar to put money into new applied sciences to assist the UK meet emissions targets until it’s “sustainable and viable”.

Power UK is looking on the federal government to launch a promised “root and department” evaluate of vitality retail to cease the business lurching from one disaster to a different.

“In the event that they [retailers] earn a living, they’ll put money into issues like customer support . . . and the entire issues that they already do however are actually needing to do at a mammoth scale due to the fuel worth disaster and the sheer quantity of people who find themselves fighting payments,” mentioned Pinchbeck, though she added there was no excuse for the behaviours unearthed by contractors for British Fuel.

Power UK can also be pushing the federal government for a “disaster plan” to assist households via the rest of 2023 and 2024. If households proceed to construct up dangerous debt on a big scale, Pinchbeck warns, it may result in extra provider failures.

This is able to contain extending the federal government’s present vitality costs assist so a “typical invoice” is proscribed to about £2,500 a 12 months as has been the case over winter, moderately than the federal government’s plan for it to rise to £3,000 a 12 months from April because it seeks to scale back subsidies.

Having labored each for a provider and on behalf of customers, Hatvani has seen either side of the business.

“I do converse to the vitality corporations and I do kick off quite a bit saying, ‘you may’t deal with folks like this’,” she mentioned.

However she added: “For each buyer they join, they’re dropping cash. As an alternative of the limelight [being] on the vitality suppliers . . . the limelight must be on the producers.”

[ad_2]