[ad_1]

The U.S. inventory market, as measured by the S&P 500 Index

SPX,

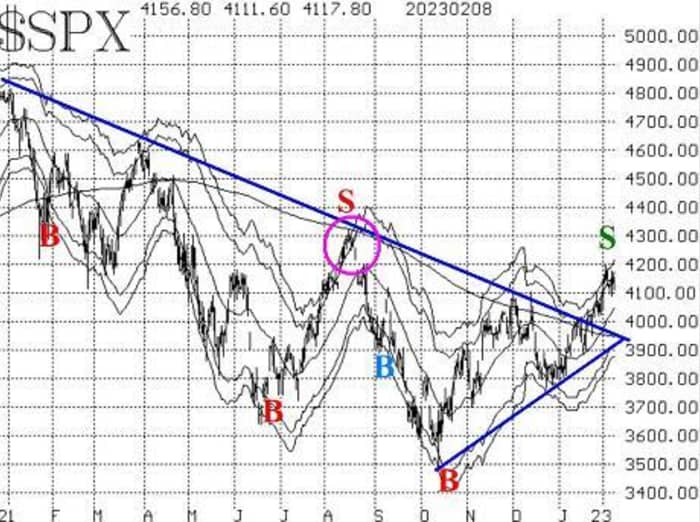

had lastly damaged out over triple resistance at 4100, on Feb. 1. However the S&P 500 has had bother including to that breakout. As an alternative, the market has pulled again and retested what’s now assist at 4100 quite a few instances this week. Thus far, that assist has held, however some overbought circumstances and even promote alerts have had time to manifest themselves whereas SPX stalls on this space.

If the assist at 4100 have been to provide means, that will be a psychologically disappointing occasion, and it could most likely propel SPX down in the direction of the decrease finish of its earlier commerce vary — close to 3800. On the upside, the preliminary breakout reached 4200, which was equal to the late August ranges. SPX has not closed the hole on its chart from that August time interval (circle on the accompanying SPX chart).

The rally did handle to exceed the +4σ “modified Bollinger Band (mBB).” Then, when SPX fell again beneath the +3σ Band, a “traditional” mBB promote sign was generated. Since SPX then fell additional the following day, a full-fledged McMillan Volatility Band (MVB) promote sign has been confirmed (inexperienced “S” on the chart). This may stay in impact till SPX both a) touches the -4σ Band, which is the “goal,” or b) closes again above the +4σ Band, which might cease out the commerce.

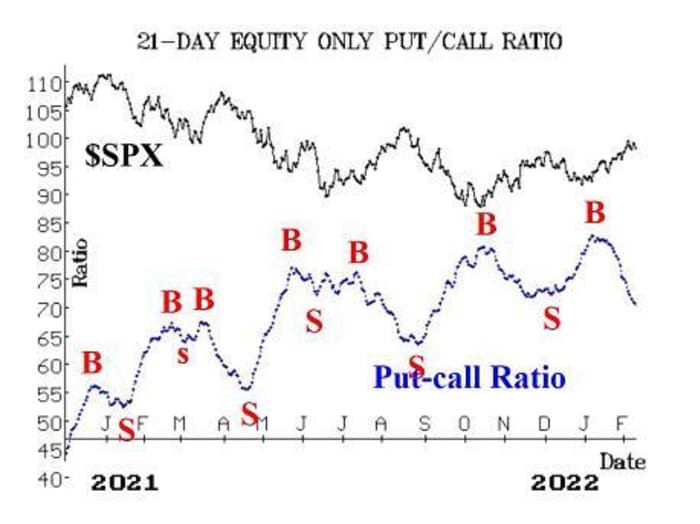

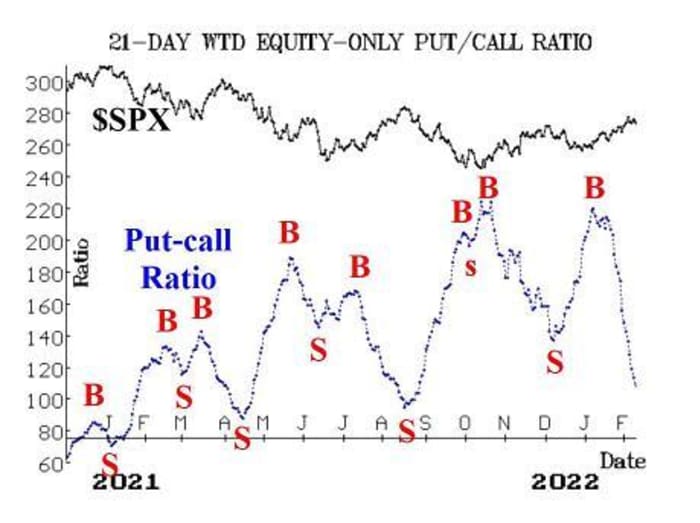

Fairness-only put-call ratios proceed to say no at a fast tempo. Thus, they’re nonetheless each on purchase alerts. They’ve now fallen to ranges close to the place promote alerts have been generated final 12 months. However we don’t use earlier ranges as indicators for these put-call ratios. Relatively, they’ll stay bullish for shares so long as they proceed to say no — irrespective of how low they get on their charts. They won’t generate promote alerts till they roll over and start to rise.

Breadth had been spectacular for over a month. However this newest back-and-forth motion by the market, with a number of sharp down days, has taken its toll. At present, each breadth oscillators are nonetheless on purchase alerts, however they’ve run out of “wiggle” room. That’s, any additional unfavorable accumulation of breadth from as we speak ahead will generate promote alerts from the breadth oscillators.

New 52-week highs on the NYSE proceed to be robust (they reached greater than 200 on one latest day), whereas new 52-week lows stay in single digits. So, this indicator stays constructive for shares. It is going to proceed to do be bullish until new lows outnumber new highs for 2 consecutive days, on the NYSE.

The volatility complicated typically stays bullish for the inventory market as nicely. VIX

VIX,

has stayed at low ranges, regardless of some comparatively heavy promoting occasionally by SPX. Thus, the pattern of VIX purchase sign stays in impact (it started on the crossover contained in the inexperienced circle on the accompanying VIX chart). The primary indicators of fear can be if VIX have been to re-enter “spiking” mode — that’s, if it have been to shut a minimum of 3.00 factors greater over any 1-, 2-, or 3-day interval. At present, VIX must shut above 21.48 as we speak or Friday in an effort to re-enter “spiking” mode. It has not proven any latest indicators of such an upward transfer, although.

The assemble of volatility derivatives can also be bullish for shares – for essentially the most half. The one “fear” within the assemble is that the CBOE short-term 9-day Volatility Index (VIX9D) is greater than VIX. That’s as a result of the CPI figures are because of be launched this month on February 14th, and that’s inside the 9-day “window” for VIX9D. Merchants predict the CPI determine to introduce some (extra) volatility into inventory costs.

We’re not carrying a “core” bearish place since SPX has risen above its bear market downtrend line. We’ll commerce from each the lengthy and brief sides, although, as confirmed alerts from our indicators dictate.

New Suggestion: MVB promote sign

Since a brand new MVB promote sign has been generated, we’re going to add a place in step with that indicator:

Purchase 1 SPY Mar (seventeenth) at-the-money put

And Promote 1 SPY Mar (seventeenth) put with a putting value 25 factors decrease.

This commerce can be stopped out if SPX have been to shut again above the +4σ Band. We’ll hold you up to date concerning the place of the Bands every week.

New Suggestion: Catalent Inc. (CTLT)

Choice quantity in Catalent

CTLT,

has remained at an elevated degree for a number of days, after if first gapped greater on information of attainable takeover by Danaher

DHR,

That rumor has slowed only a bit, however the inventory is holding at ranges above 70. Inventory quantity patterns are constructive, and there are additionally put-call ratio purchase alerts on this inventory. Due to value gaps, there is no such thing as a seen assist degree till you get all the way in which again all the way down to 58.

Purchase 2 CTLT Mar (17th) 70 calls

At a value of 6 or much less.

CTLT: 71.60 Mar (17th) 70 name: 5.50 bid, provided at 6.20

Comply with-Up Motion:

All stops are psychological closing stops until in any other case famous.

We’re utilizing a “commonplace” rolling process for our SPY spreads: in any vertical bull or bear unfold, if the underlying hits the brief strike, then roll your entire unfold. That will be roll up within the case of a name bull unfold, or roll down within the case of a bear put unfold. Keep in the identical expiration, and hold the space between the strikes the identical until in any other case instructed.

Lengthy 2 PCAR1 Feb (17th) 64.80 places: Paccar

PCAR,

break up 3-for-2 on Feb. 8. Thus, the “shares per possibility” have been elevated from $100 per share to $150 per share, and the putting value was diminished by two-thirds. Put-call ratio has rolled over after a powerful earnings report from PCAR. The choices are primarily nugatory, so we are going to maintain them to see if the inventory can pull again some.

Lengthy 2 OSH Feb (seventeenth) 30 calls: Oak Avenue Well being

OSH,

obtained a $39 takeover bid from CVS Well being.

CVS,

The inventory is buying and selling nicely beneath that degree, apparently because of antitrust considerations, so we’re going to exit and take the revenue. Don’t promote your calls beneath parity.

Lengthy 1 SPY Feb (24th) 412 name and Quick 1 SPY Feb (24th) 426 name: This unfold was purchased when the breakout over 3940 by SPX was confirmed, on the shut on January 12th. It was rolled up on Feb. 1, when SPY

SPY,

traded at 412.

Lengthy 1 SPY Feb (17th) 404 name and Quick 1 SPY Feb (17th) 419 name: This unfold was purchased in step with the “New Highs vs. New Lows” purchase alerts. It was rolled up on Jan. 26, when SPY traded at 404. Cease your self out of this place if New Lows on the NYSE exceed New Highs for 2 consecutive days.

Lengthy 4 NATI Feb (17th) 55 calls: Maintain Nationwide Devices

NATI,

with out a cease initially, to see if a bidding conflict develops.

Lengthy 1 SPY Mar (17th) 415 name and Quick 1 SPY Mar (17th) 431 name: This commerce was established as a “breakout commerce” when SPX closed above 4100. Cease your self out on an in depth beneath 4020 by SPX.

Lengthy 3 XM Mar (17th) 15 calls: Proceed to carry Qualtrics Worldwide

XM,

whereas the takeover rumors play out.

Ship inquiries to: lmcmillan@optionstrategist.com.

Lawrence G. McMillan is president of McMillan Evaluation, a registered funding and commodity buying and selling advisor. McMillan might maintain positions in securities really useful on this report, each personally and in consumer accounts. He’s an skilled dealer and cash supervisor and is the writer of the best-selling e-book, Choices as a Strategic Funding. www.optionstrategist.com

©McMillan Evaluation Company is registered with the SEC as an funding advisor and with the CFTC as a commodity buying and selling advisor. The knowledge on this e-newsletter has been fastidiously compiled from sources believed to be dependable, however accuracy and completeness are usually not assured. The officers or administrators of McMillan Evaluation Company, or accounts managed by such individuals might have positions within the securities really useful within the advisory.

[ad_2]