[ad_1]

By Simon White, Bloomberg Markets Reside reporter and strategist

Bull steepenings within the yield curve are typically seen as a precursor to a recession, however they’re typically preceded by bear steepenings. The 3m30y curve is presently bear steepening, indicating a recession might start as early because the summer time.

I mentioned the 3m30y’s nascent steepening on Tuesday. Yield-curve inversions point out a recession is on the best way sooner or later, however it’s the subsequent re-steepening that places the downturn below starter’s orders.

Not all yield curves are alike, and usually it’s the 3m30y curve that begins to steepen first, about 5 months earlier than the recession’s onset. That curve has been steepening since mid-January, its longest stint with out making a brand new low because it peaked final Might.

Just a few readers identified that as this steepening is a bear steepening, with 30-year charges rising greater than 3-month charges, it could be much less of a priority, and it’s bull steepenings which are a extra imminent signal of recession.

It’s true that bull steepenings are sometimes extra violent when the Fed does a volte-face because the economic system deteriorates shortly, however bear steepenings are as a lot part of the pre-recession image, and have typically preceded the bull steepening within the lead as much as a hunch.

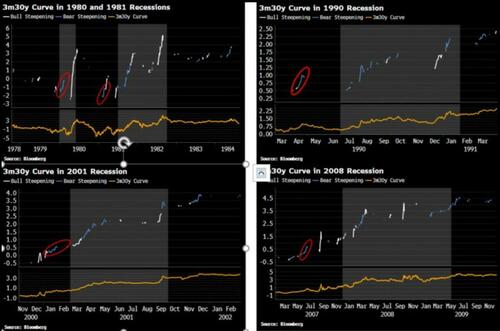

The charts beneath present the 3m30y curve across the final 5 (ex-2020) recessions. A bear steepening is outlined because the 30y fee being increased during the last month, and the one, two, three and four-week change within the 30y fee being greater than the one, two, three and four-week change within the 3m fee (and a bull steepening is outlined analogously). This ensures we solely seize significant steepenings.

As we will see, all of the recessions (aside from 1980’s) had been preceded by a major bout of bear steepening in 3m30y about 3-9 months earlier than the recession began. Bull steepenings have a tendency to come back later.

The recession itself is commonly a mixture of bull and bear steepenings (in addition to durations of flattening).

There are sufficient pockets of weak spot within the economic system that the recession signal from the 3m30y’s steepening – whether or not bear or bull – ought to nonetheless be paid consideration to.

Bull steepenings have a tendency to come back later. The recession itself is commonly a mixture of bull and bear steepenings (in addition to durations of flattening).

There are sufficient pockets of weak spot within the economic system that the recession signal from the 3m30y’s steepening – whether or not bear or bull – ought to nonetheless be paid consideration to.

Loading…

[ad_2]