[ad_1]

By Seth Carpenter, International Chief Economist at Morgan Stanley

As markets look to the longer term, the usual apply is to imagine that cycles are cycles, and taking historical past as a information, anybody shouting, “This time is completely different” is met with skepticism. However after all, we’ve got all lived via Covid now, and that truth alone units this cycle other than others. So, it’s value asking, “What’s completely different this time and what’s not?”

The Covid pandemic distinguishes this cycle from any post-WWII enterprise cycle. Demand collapsed in a extremely correlated means. Almost each financial information sequence now has a really clear statistical break, marking the primary distinction relative to different cycles.

The important thing attribute of this cycle is volatility in provide and demand, and the way shocks advanced throughout completely different sectors. The preliminary collapse in demand for each items and providers was adopted by a resurgence of demand for items in opposition to a sclerotic provide chain. The decoupling of demand for items from demand for providers had not been seen in earlier cycles. The preliminary collapse in demand led to disinflation, however the surge in demand for items particularly led items inflation to decouple from providers inflation.

Subsequently, providers demand recovered because the economic system reopened, however the reopening was rife with frictions, as a big swath of the labor market reinvented itself or was displaced for a time period. Whereas the collapse in demand was extremely correlated, the restoration was not. One consequence of this somewhat uncorrelated cycle is that inflation has been noisy. At this time, we see that inflation for items has retreated notably, however providers inflation stays sturdy, even after an aggressive tightening cycle.

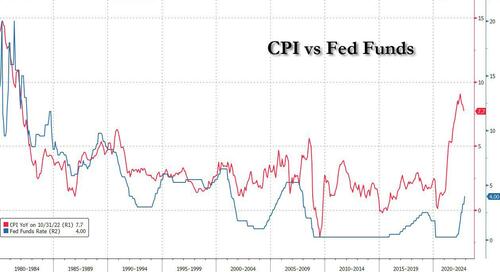

With inflation operating larger than at any level because the Seventies, we’ve got one other key distinction. The Federal Reserve (and different DM central banks) is mountain climbing charges to convey inflation down.

This mountain climbing cycle is the primary because the Seventies with that motivation. Put in a different way, in most earlier cycles, mountain climbing charges went together with robust development, and when development and earnings confirmed indicators of slowing, coverage retreated. This time, the Fed is deliberately elevating charges to gradual development considerably under the potential development fee of the economic system and plans to maintain them excessive whereas the economic system slumps. This central financial institution technique is clearly a key distinction relative to different cycles.

So, the place does this dialogue go away us? Why is it necessary to focus on the variations on this cycle? We now have had a “delicate touchdown” view for the US for a very long time. The pushback has constantly been that earlier cycles haven’t had delicate landings, so it isn’t affordable to forecast one now. We have been comfy that there have been sufficient variations within the cycle to provide a distinct consequence. The market narrative has shifted towards us, and now the query arises whether or not we are literally seeing sufficient slowing or perhaps a re-acceleration.

Thus far, we don’t suppose that there’s adequate proof to alter our basic view of a slowing economic system. And, going again to the Fed’s technique of deliberately slowing the economic system under potential to squeeze inflation out, a “no touchdown” state of affairs does not likely make sense to us.

However the information for January do replicate underlying energy. The seasonally adjusted non-farm payrolls have been robust, reflecting a lot much less of a contraction in jobs than is typical for a January. This labor hoarding dynamic is a key a part of why we’ve got been in favor of a delicate touchdown. In previous cycles, when there was a slowdown, there have been waves of layoffs.

This time, we see that sample in tech, however not throughout the remainder of the economic system. So, possibly this time is completely different.

Loading…

[ad_2]