[ad_1]

Authored by Lance Roberts by way of The Epoch Instances,

How does the minimal wage have an effect on the Fed’s greatest concern? I touched on this topic beforehand because the Fed started its rate-hiking marketing campaign. Nonetheless, whereas the difficulty of the “tens of millions of individuals” who aren’t paid a “residing wage” for work makes headlines, the precise numbers are fairly underwhelming.

As of the top of 2021, there are 2 million employees at, or beneath, minimal wage. Crucially, this quantity consists of these within the restaurant occupation which can be paid “wages” of $2/hour but in addition obtain ideas. Notably, the quantity and whole share of ALL employees at present who’re at or beneath minimal wage are on the lowest ranges since 1979.

(Supply: St. Louis Federal Reserve, Refinitiv; Chart: RealInvestmentAdvice.com)

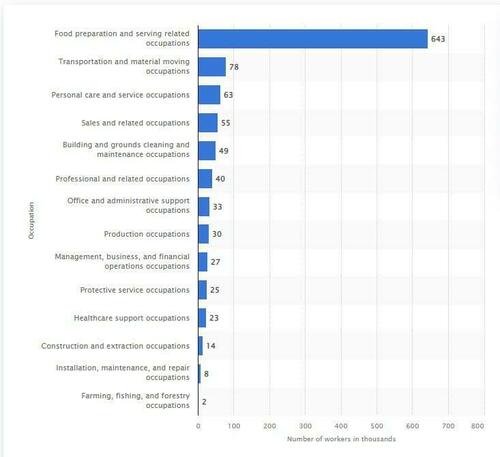

As famous, you can see most of these employees within the fast-food business.

(Supply: Bureau of Labor Statistics)

Because the Bureau of Labor Statistics notes: “Minimal-wage employees are usually younger. Though employees underneath age 25 represented practically one-fifth of hourly paid employees, they made up 44 % of these paid the federal minimal wage or much less.”

The Federal Minimal wage is a political “sizzling potato” that garners consideration however has little impression on the economic system’s total well being.

“So what? Folks working at eating places must make a ‘residing wage.’”

Whereas it’s an emotionally charged argument, the minimal wage just isn’t meant to be a residing customary.

Minimal wage jobs are starter positions to permit companies to coach, consider, and develop useful workers.

If the worker performs, wages enhance together with extra duties.

If not, they both stay the place they’re or get changed.

Critically, minimal wage jobs weren’t meant to be everlasting positions or a “residing wage.” If a person stays caught on the minimal wage, it might have extra to do with the employee than the employer.

Nonetheless, there’s a misplaced outcry for mountaineering the minimal wage to $15 an hour, or in California’s case, $22. The issue, in fact, is the financial impression on these receiving these pay will increase.

As is at all times the case, there’s “no free lunch.”

No Free Lunch

Okay, let’s hike the minimal wage to $15/hr. That doesn’t sound like that huge of a deal.

Nonetheless, assume the worker works full-time, incomes $15/hour.

$15/hr X 40 hours per week = $600/week

$600/week x 4.3 weeks in a month = $2,580/month

$2,580/month x 12 months = $30,960/12 months.

Given most are within the fast-food business, what occurs to the value of hamburgers when corporations should pay $30,000 per 12 months for “hamburger flippers?”

McDonald’s and Walmart can provide you a clue.

“KeKe Mendez recorded herself driving to a McDonald’s drive-thru. When she approached the window, there wasn’t an worker in sight. As an alternative, she was met with an automatic machine dealing with her order.

The machine positioned the bag down and pushed it on a conveyor belt to the window.”

After Walmart and Goal introduced larger minimal wages, layoffs occurred, and cashiers acquired changed with self-checkout counters. Eating places added surcharges to assist cowl the prices of upper wages, a “tax” on customers, and chains like Mcdonald’s and Panera Bread changed cashiers with apps and ordering kiosks.

Such shouldn’t be stunning as labor prices are the best expense to any enterprise. It’s not simply the precise wages but in addition payroll taxes, advantages, paid trip, healthcare, and so forth. Workers should not low cost, and that price should get coated by the products or providers bought. Subsequently, if the buyer refuses to pay extra, the prices should grow to be offset elsewhere.

Extra importantly, simply as we came upon with sending stimulus funds to households, as soon as companies understand there’s extra money accessible, the price of providers will enhance.

In different phrases, there’s “no free lunch,” as rising the minimal wage will result in a rise (inflation) in every thing else, primarily wiping out the advantage of the wage enhance.

Nonetheless, there’s extra to mountaineering the minimal wage than simply elevated prices. It has the potential to exacerbate the Fed’s greatest concern.

The Wage Spiral

How can mountaineering the minimal wage foster a wage spiral?

Let’s take a look at an instance parcel provider job that at the moment pays $15/hour and has the next work necessities.

Lifting bins as much as 150 lbs.

Loading and unloading vehicles in a warehouse that may be freezing or sweltering,

Driving a big truck wherever from 10-150 miles a day, Buyer interplay, Route planning.

What could be the results of elevating the minimal wage to $15/hour for this employee? There are two potential outcomes.

1. As an alternative of lifting parcels of as much as 150 lbs per day, they stop for a a lot simpler job for a similar pay; or

2. Calls for a pay elevate (which, in the event that they don’t get the elevate, they stop to take a a lot simpler job.)

The parcel provider service acquiesces and raises them to $20/hour. Nonetheless, now the managers making $20/hour need a elevate, and so forth. It’s the similar impact as throwing a rock right into a pond. Sure, the rock (on this case, the variety of minimum-wage employees) could also be small, however the “ripple impact” to the pond’s edges turns into substantial.

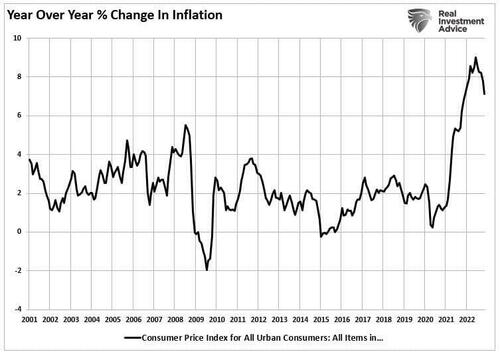

As wages enhance on the backside, there’s a trickle-up impact on all employees. Importantly, these accelerating wage prices in the end should go on to customers, in any other case often known as inflation. That cycle of rising wages and costs is the “wage-price spiral.” The Fed already acquired a style of the issue with the inflow of stimulus into the economic system, which led to surging demand when workers had been scarce.

(Supply: St. Louis Federal Reserve, Refinitiv; Chart: RealInvestmentAdvice.com)

Such can also be why the Federal Reserve stays dedicated to mountaineering rates of interest to sluggish financial demand (which, in flip, will decrease wages as unemployment will increase) to cut back inflationary pressures.

(Supply: St. Louis Federal Reserve, Refinitiv; Chart: RealInvestmentAdvice.com)

The Penalties

The results of mandated minimal wage will increase are problematic because of the impression such can have on total wages, prices, and company responses. The Manhattan Institute beforehand concluded: “By eliminating jobs and/or lowering employment development, economists have lengthy understood that adoption of a better minimal wage can hurt the very poor who’re supposed to be helped. Nonetheless, a political drumbeat of proposals—together with from the White Home—now requires a rise within the $7.25 minimal wage to ranges as excessive as $15 per hour.

However this groundbreaking paper by Douglas Holtz-Eakin, president of the American Motion Discussion board and former director of the Congressional Price range Workplace, and Ben Gitis, director of labor market coverage on the American Motion Discussion board, involves a strikingly totally different conclusion: not solely would total employment development be decrease on account of a better minimal wage, however a lot of the rise in revenue that may end result for these lucky sufficient to have jobs would go to comparatively higher-income households—to not these households in poverty in whose title the marketing campaign for a better minimal wage is being waged.”

Such is simply widespread sense logic, however it additionally finds help from the CBO report.

Reductions in employment would initially be concentrated at corporations the place larger costs rapidly scale back gross sales. Over an extended interval, nonetheless, extra corporations would substitute low-wage employees with higher-wage employees, machines, and different substitutes.

A better minimal wage shifts revenue from higher-wage customers and enterprise house owners to low-wage employees. As a result of low-wage employees are likely to spend a bigger fraction of their earnings, some corporations see elevated demand for his or her items and providers, which boosts the employment of low-wage employees and higher-wage employees alike.

A lower in low-wage employees reduces the productiveness of machines, buildings, and different capital items.

Though some companies use extra capital items if labor is dearer, that decreased productiveness discourages different companies from setting up new buildings and shopping for new machines. That discount in capital reduces low-wage employees’ productiveness, which ends up in additional reductions of their employment.

The important level right here is that the unintended penalties of a minimal wage hike in a weak financial atmosphere should not inconsequential. Given that companies will battle to keep up profitability, mountaineering the minimal wage, given the following “trickle-up” impact, will result in additional automation and the “off-shoring” of jobs to cut back rising employment prices.

The Federal Reserve is keenly conscious of the wage-price spiral and understands that rising borrowing prices will finally pressure wages to come back down because the economic system and inflation decline.

Sadly, those who simply acquired the minimal wage enhance may even see their jobs quickly changed by a cheaper technique.

Loading…

[ad_2]