[ad_1]

The case for elevating fairness allocations when rates of interest have been near zero was straightforward. After a yr of rate of interest hikes by the Federal Reserve, the calculus is extra difficult.

By some accounts, a positive tailwind is now blowing for bonds, significantly for a buy-and-hold technique with Treasuries. Jim Bianco of Bianco Analysis highlighted the concept this week by noting that purchasing Treasuries of late, and tapping into sharply larger present yields, affords a possibility unseen lately till now.

“You’re going to get two-thirds of the long-term appreciation of the inventory market with no danger in any respect,” says Jim Bianco of Bianco Analysis.

Truthful level, however deciding how or if to boost weights in bonds – Treasuries particularly – requires considerate evaluation. Granted, a 10-year Treasury yield at 3.88% (as of Feb. 23) is near the very best degree in additional than a decade and a world above the 2020 low of roughly 0.5%. What’s to not like?

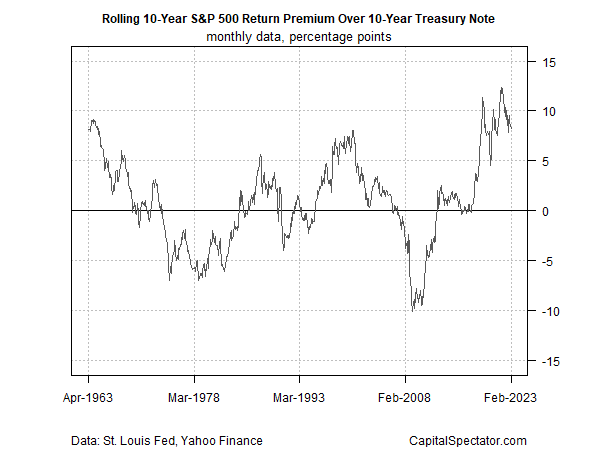

However deciding how a lot to carry in Treasuries requires occupied with greater than yields. It’s additionally a activity of factoring in your time horizon, danger tolerance and different variables which might be particular to you. It’s essential to additionally make some assumptions about how fairness returns will unfold over a related time horizon vs. the bond maturity you prefer. A very good place to begin is contemplating how the US inventory market (S&P 500 Index) compares on a rolling 10-year foundation vs. shopping for and holding a 10-year Treasury Word, which is summarized within the chart under for outcomes for the reason that early Sixties.

As an approximation of what you’d have earned in a 10-year word I’m utilizing the present yield for a 10-year Treasury as a return estimate. For instance, assume to procure a 10-year Word a decade in the past, when the present yield was slightly below 2%. Shopping for and holding that Word implies a 2% return over the following decade, as proven by the final level within the pink line within the chart above. By comparability, the S&P 500 earned an annualized 10.2% over the trailing decade (black line). The blue line marks the present 10-year Treasury yield: 3.88% (Feb. 23), which serves as a dependable forecast of anticipated return for a 10-year Word for the last decade forward.

The important thing takeaway: the S&P’s 10-year return varies broadly relative to the implied return for getting and holding a 10-year Word. No shock, but it surely’s a reminder that once you purchase a Treasury, and the way lengthy you maintain it, will forged a protracted shadow on how the funding fares.

For a clearer comparability of how the S&P’s efficiency stacks up in opposition to a buy-and-hold 10-year Word place, the subsequent chart tracks the inventory market’s premium over this Treasury safety. Clearly, latest historical past has been unusually variety to a heavy allocation in equities.

Is it well timed to change to a heavy bond (Treasury) allocation? Perhaps, however the reply requires greater than merely evaluating present yields within the bond market, though that’s place to begin the evaluation.

Be taught To Use R For Portfolio Evaluation

Quantitative Funding Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Danger and Return

By James Picerno

[ad_2]