[ad_1]

This text is an on-site model of our Unhedged e-newsletter. Enroll right here to get the e-newsletter despatched straight to your inbox each weekday

Good morning. Fed chair Jay Powell spoke yesterday, and mainly stated the identical factor as he did on the press convention final week — that’s, if the robust financial knowledge retains coming, extra tightening will probably be so as. The market took this as dovish, which makes some sense. Powell had a possibility, within the face of robust markets, to strike a extra hawkish be aware. He declined to take action. Have one other interpretation? E-mail us: robert.armstrong@ft.com and ethan.wu@ft.com.

The Fed as menace to monetary stability

Lots of people don’t just like the Fed. Write an FT article about any imperfect characteristic of the monetary system, you’re more likely to get a remark saying “it’s the Fed’s fault”. The Fed, based on its detractors, has suppressed rates of interest, printed money, distorted asset costs, inspired malinvestment, worsened inequality, and elevated the chances of a market crash.

The supply of those arguments at occasions undermines their credibility. They’re ceaselessly (although not completely) made by underperforming worth buyers, bears who shorted the lengthy bull market, gold bugs, and diverse different malcontents.

This doesn’t make the arguments mistaken, although. It’s helpful, then, when the case in opposition to the Fed is framed intelligently by a really respected voice. Dennis Kelleher and Phillip Basil, of Higher Markets, did simply that in a report final month, “Federal Reserve Insurance policies and Systemic Instability.” I encourage everybody to learn it, if solely to crystallise views about Fed coverage works. A quick abstract of the arguments:

-

Since 2008, Fed charge and steadiness sheet coverage has decoupled asset costs from threat, and inspired each firms and households to make use of a harmful quantity of debt. Very low charges imply buyers have been “strongly incentivised if not compelled into riskier belongings, resulting in mispriced threat and a build-up of debt”

-

Evaluating the last decade after the good monetary disaster to the last decade earlier than, the expansion in US debt held by the general public was practically 500 per cent bigger, the expansion in nonfinancial company loans and debt securities was about 90 per cent bigger, and the expansion in shopper credit score — excluding mortgages — was roughly 30 per cent bigger.

-

Proof that the central financial institution had pushed an excessive amount of liquidity into the market with quantitative easing might be discovered within the Fed’s personal reverse repo operations. “The Fed was pumping trillions of {dollars} into monetary markets and limiting the provision of secure belongings on one aspect of the market and siphoning out trillions of {dollars} from monetary markets by means of its RRP facility on the opposite aspect.”

-

All this created a market excessively depending on simple cash, because the 2013 taper tantrum and the Fed being compelled to ease coverage in mid-2019 exhibit.

-

Reversing these dangerous insurance policies within the face of inflation dangers recession, company defaults, stress within the Treasury market, and a cracked housing market. The Fed might overreact to those stresses, too — perpetuating the cycle of error.

This cost sheet is just not loopy. However it attributes an excessive amount of energy to financial coverage. Central banks do have direct management over the very shortest rates of interest. Their affect on lengthy charges — those that actually matter — is actual, too, however is normally oblique, contingent, changeable, and depends upon mass psychology (the Financial institution of Japan’s experiment in direct management over lengthy yields is one thing of a particular case). It might be true that simple cash is a obligatory situation for an asset bubble, however it’s not a ample one.

There may be case to be made that the Fed follows lengthy charges, slightly than lengthy charges following the Fed. A really robust model of this argument was lately made by Aswath Damodaran of NYU. He writes:

If the query is why rates of interest rose so much in 2022, and in case your reply to that query is the Fed, you may have, for my part, misplaced the script. I do know that within the final decade, it has turn into trendy to attribute powers to the Fed that it doesn’t have and think about it as the last word arbiter of charges. That view has by no means made sense, as a result of central banking energy over charges is on the margin, and the important thing elementary drivers of charges are anticipated inflation and actual progress.

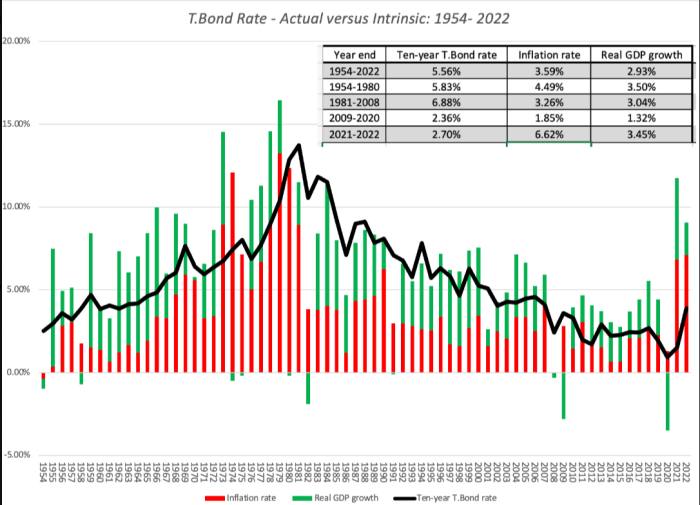

He affords this long-term chart of actual GDP progress, inflation, and 10-year yields:

“It was the mix of low inflation and anaemic progress that was on the coronary heart of low charges,” he writes, “although the Fed did affect charges on the margin, maybe pushing them down beneath their intrinsic ranges with its machinations.” You’ll be able to quibble with Damodaran’s personal account of charges (particularly the hyperlink between charges and actual progress), however the level is that you would be able to’t simply assert that Fed coverage decided the final decade of very low charges.

We’ve got argued — and nonetheless imagine — that the quantitative easing, by growing liquidity in markets, drives asset costs up, by means of the portfolio steadiness channel. However, similar to charges, market liquidity is set by quite a lot of elements. International central banks play a task, as do demographics and wealth inequality.

Nonetheless, the essential level stays: the Fed was too free, and now now we have a heavy debt burden, costly belongings, and inflation. However bear in mind the rationale that the Fed went for free coverage all these years: demand was weak. And there’s a very robust, maybe unanswerable, case that the Fed was a yr late to elevating charges and tapering asset purchases. However do Kelleher and Basil suppose that the Fed was too accommodative in, say, 2011-14? Why?

One closing level. Thus far — considerably to Unhedged’s shock — the return to a impartial coverage stance goes fairly nicely. Asset costs are down and residential gross sales are falling, however after the run they’ve had, that appears wholesome. Unemployment is decrease than ever. The Kelleher/Basil argument will look so much stronger if we get a correct market crash or a deep recession.

What the Fed would possibly take into consideration monetary circumstances

The Fed desires to tighten monetary circumstances to root out inflation. Markets simply need an excuse to rally. However markets have an enormous function in figuring out monetary circumstances. This leaves the Fed with less-than-ideal choices: tighten financial coverage nonetheless additional, to whip markets into line, or settle for watered-down financial coverage transmission for some time.

Requested about this Fed/markets hole final week, Powell appeared remarkably chill about all of it. He’s “not notably involved” about “short-term strikes” in monetary circumstances as a result of they merely replicate markets’ dovish opinion of inflation falling rapidly. His is just not a daft view. Nonetheless, one wonders if there’s extra to what Powell, and the Fed, is pondering.

A brand new analysis be aware from the San Francisco Fed would possibly maintain a clue. The authors, Simon Kwan and Louis Liu, take a look at a measure of coverage tightness referred to as the “actual funds charge hole”. That is the distinction between the fed funds charge and the Fed’s estimate of the impartial charge (ie, the theoretical rate of interest that neither stokes nor suppresses inflation) after each are adjusted for inflation. The larger the hole, the tighter coverage is; the smaller, the extra accommodative. Estimates for this cycle’s charge hole (January 2022 to Could 2023 beneath) come partly from the Fed’s newest set of financial projections.

The train reveals simply how far more dramatic current financial tightening seems to be in comparison with tightening cycles prior to now:

On this cycle, actual charges moved method up (rightmost inexperienced bar) from a really low baseline (rightmost blue bar) as inflation ran sizzling. If the Fed’s projections roughly bear out, will probably be essentially the most drastic actual funds charge hole change — that’s, essentially the most screeching tightening cycle — within the postwar period.

This may matter to monetary circumstances. Previously, Kwan and Liu discover {that a} extremely destructive charge hole (ie, extremely accommodative coverage) in the beginning of a tightening cycle is adopted by widening yield spreads and falling inventory costs. However primarily based on how vastly destructive this cycle’s preliminary charge hole was, shares haven’t fallen and spreads haven’t expanded practically as a lot as historical past would counsel they need to. A lot tighter monetary circumstances might lie forward:

Once we use this historic relationship to guage inventory costs on the giant destructive funds charge hole, inventory costs are projected to say no additional. The historic relationship between the funds charge hole and bond spreads additionally requires extra tightening within the bond market . . . previous experiences point out that extra tightening of monetary circumstances may comply with.

Should you’re on the helm of the Fed, that is cause sufficient for forbearance. Financial tightening is barely half method by means of; monetary markets may catch up quick, and violently. Latest “short-term strikes” in markets simply won’t be value sweating. (Ethan Wu)

One good learn

RIP to this Australian Shepherd. Good canine!

Really helpful newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the worldwide cryptocurrency trade. Enroll right here

Swamp Notes — Professional perception on the intersection of cash and energy in US politics. Enroll right here

[ad_2]