[ad_1]

Yves right here. Hubert Horan once more painstakingly goes via Uber’s intentionally distorted monetary outcomes to current one thing a lot nearer to an actual image. To offer an concept of the extent of the fabrications: Uber depends on a pet metric, Adjusted EBITDA Profitability, which excludes all types of price of doing enterprise expense, like authorized bills and regulatory settlements.

By Hubert Horan, who has 40 years of expertise within the administration and regulation of transportation firms (primarily airways). Horan has no monetary hyperlinks with any city automotive service trade opponents, traders or regulators, or any corporations that work on behalf of trade members

Uber’s cumulative losses from its precise, ongoing operations high $33 billion

Uber’s printed outcomes, which have been launched February 8th, confirmed a GAAP lack of $9.1 billion for full yr 2022 (a unfavourable 29% internet margin) and optimistic internet earnings of $0.6 billion (+7% internet margin) within the fourth quarter. Free money circulation within the fourth quarter (internet money flows from working actions much less capital expenditures), was unfavourable $303 million. On the finish of 2002 Uber had $4.3 billion of money available.

What have been Uber’s precise professional 2022 outcomes and the way did they examine to previous durations?

As has been mentioned on a number of events on this collection, Uber intentionally makes it very troublesome for traders or different outsiders to reply these seemingly easy questions. Uber’s reported internet earnings is distorted by the inclusion of claimed valuation shifts in untradeable securities that don’t have anything to do with the efficiency of Uber’s precise, ongoing operations. As an alternative of specializing in GAAP internet earnings, Uber emphasizes a bogus “EBIDTA profitability” measure designed to make outcomes look higher by excluding billions in bills that may not be excluded from a professional EBIDTA metric.

After Uber went public, its printed earnings have been inflated by roughly $7 billion as a result of claimed appreciation of Didi fairness it obtained after the collapse of Uber China ($2 bn) Seize fairness obtained after Uber deserted Southeast Asia ($2.2 bn) and Aurora fairness obtained after Uber deserted its autonomous car improvement efforts ($1.7bn). These claimed “earnings” have been fictitious. None of these firms demonstrated any potential to earn sustainable earnings. Solely Didi achieved the size and market penetration to justify critical investor consideration, and its fairness worth subsequently collapsed. [1]

This compelled Uber to cut back GAAP earnings between 2020 and the third quarter of 2022, though the paper losses have been simply as irrelevant to Uber’s precise enterprise efficiency as the sooner $7 billion earnings. However earnings inflation returned within the fourth quarter as Uber claimed that its Didi inventory appreciated by $773 million. Uber made no effort to elucidate precisely how an organization that had been delisted from exchanges, been blocked from including new prospects and deserted by traders within the US may very well be confidently judged to generated this a lot company worth since September. [2] Extra importantly Uber made no effort to elucidate why speculative numbers of this magnitude needs to be included within the headline numbers supplied to traders about Uber’s present profitability.

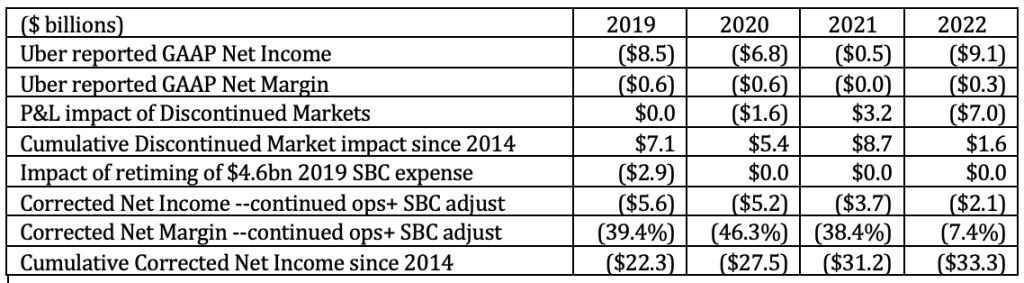

As proven within the desk Uber’s 2022 GAAP Web Revenue from ongoing operations was unfavourable $2.1 billion, producing a internet margin of unfavourable 7.4% and bringing a professional calculation of its cumulative GAAP losses to $33.3 billion. Any evaluation of Uber’s monetary efficiency over time must be primarily based on these restated numbers. The distortion of fourth quarter outcomes (not proven within the desk) was particularly problematic, because the claimed $773 million Didi appreciation allowed Uber to announce that it had turn out to be worthwhile. [3]

As this collection has mentioned, Uber’s public experiences to traders downplays GAAP profitability and emphasizes a bogus “Adjusted EBITDA Profitability” metric which doesn’t measure both profitability or EBITDA and does nothing to assist traders perceive adjustments in Uber’s monetary efficiency.

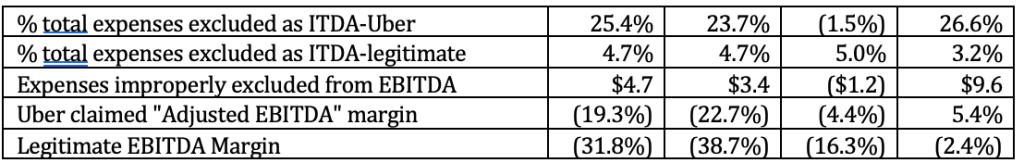

The curiosity, tax, depreciation and amortization bills excluded in a professional EBITDA calculation have sometimes accounted for lower than 5% of Uber’s whole expense. To be able to produce numbers that make Uber’s outcomes look significantly better than they are surely, Uber’s bogus “Adjusted EBITDA Profitability” often excludes 1 / 4 of Uber’s whole bills. This improved the “profitability” Uber touts by $9.6 billion in 2022 and by $16.5 billion during the last 4 years. Along with distortions brought on by bills unrelated to present, ongoing operations, Uber excludes inventory primarily based compensation ($1.8 billion in 2022) and the price of authorized and regulatory settlements ($732 million in 2022). The bogus metric allowed Uber to current an “adjusted” 2022 revenue margin of 5.4% when precise, professional EBITDA was unfavourable 2.4%.

Along with “Adjusted EBITDA Profitability” Uber’s public experiences attempt to distract traders’ consideration from precise revenue efficiency by closely emphasizing top-line income progress.

In 2022 Uber’s income information turned severely distorted by a $3.4 billion UK-only accounting change required when drivers have been reclassified from ‘unbiased contractors” to workers. [4] Uber failed to offer the knowledge that may enable traders to grasp how these accounting adjustments have an effect on total profitability. It doesn’t say how large the UK market is in comparison with its total income base, though primarily based on the dimensions of its “Europe, Center East and Africa” area (15-18% traditionally) it seems to be roughly 3-5%. Uber doesn’t clarify why this $3.4 billion improve in 2022 UK income is suitable on condition that it’s greater than 100% of Uber’s prior revenues in your complete “Europe, Center East and Africa” area. Since Uber had been combating these adjustments tooth and nail one might fairly assume that the web P&L influence is unfavourable, however Uber did not doc any of the offsetting “Price of Income” bills. Maybe a full and clear accounting of those impacts might resolve these points however Uber apparently doesn’t need traders to know what the web P&L influence of driver reclassification is and wished to have the ability to spotlight artificially inflated 2022 income progress numbers.

Uber’s intentionally opaque and deceptive monetary experiences have at all times been designed to stop mainstream enterprise media reporters from understanding Uber’s precise efficiency, in order that their tales are restricted to Uber’s most popular PR narratives. Tales about Uber’s February 8th bulletins emphasised Uber’s top-line income progress and endorsed Uber claims that this “strongest quarter ever” and that it had carried out a significantly better job than different tech firms in “staving off the downturn” whereas ignoring the multi-billion greenback accounting changes behind the income progress numbers. Tales highlighted that Uber had been “worthwhile” within the fourth quarter, with out explaining the large distortions in all “Adjusted EBITDA Profitability” numbers or that the alleged fourth quarter quantity had been completely pushed by the claimed appreciation in untradable Didi inventory. Not one of the tales in main enterprise publications talked about Uber’s reported 2022 lack of $9.1 billion or every other GAAP numbers. [5] There is no such thing as a approach to say whether or not the issue is that Wall Avenue Journal and New York Instances reporters and editors are financially illiterate, or whether or not they’re intentionally making an attempt to mislead their readers.

Uber diminished losses by capturing billions that had beforehand gone to drivers

Because the adjusted numbers present, Uber has considerably diminished its losses. Its GAAP internet earnings from ongoing operations, which had been unfavourable $5.6 billion in 2019 are actually solely unfavourable $2.1 billion. Web margins have improved from unfavourable 39% to unfavourable 7%.

Traders would need to perceive what has pushed these enhancements and whether or not these enhancements would possibly proceed and permit the corporate to attain sustainable earnings within the close to future. However Uber’s reporting is designed to stop traders from answering these questions, and Uber’s doesn’t present traders with any rationalization of latest adjustments or how these adjustments would possibly future P&L prospects. To what extent have been latest adjustments the results of one time occasions or accounting adjustments versus productiveness or advertising enhancements that may be ongoing? Uber doesn’t even enable traders to grasp how demand volumes and costs in its completely different companies and areas have modified, or how pricing adjustments have affected demand progress.

The 2 greatest latest adjustments in Uber’s economics are main value will increase because the onset of the pandemic, and Uber’s potential to seize a a lot bigger portion of buyer funds since early 2022. Within the years previous to the pandemic Uber’s technique was primarily based on extraordinarily aggressive costs and capability progress designed to gasoline the extraordinarily sturdy top-line site visitors and income progress it believed that traders have been centered on. As this collection had mentioned intimately, this produced large losses and there was no proof that Uber had any concept how one can produce sustainable earnings underneath this technique. When the ridesharing enterprise was devastated by the pandemic, Uber was compelled to place larger emphasis on the a lot decrease margin supply enterprise, and to refocus on decreasing ridesharing companies and elevating fares.

The information Uber supplies is restricted to mixture income and journey volumes (rides plus supply mixed). This clearly masks margin and aggressive variations between the 2 companies and accounting points similar to UK driver reclassification, however that is all an out of doors observer has to work with.

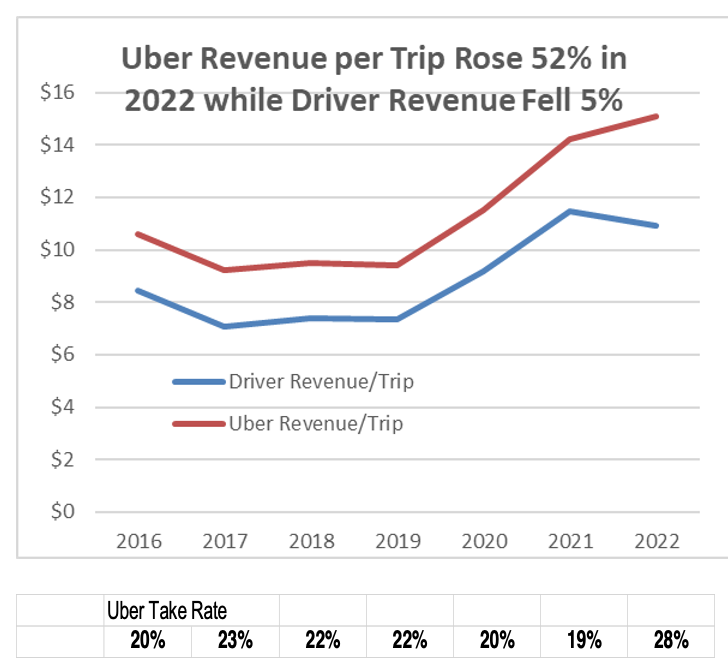

Pre pandemic whole buyer funds per journey had averaged roughly $9.50, with Uber getting somewhat over $2 (22%) and drivers getting a bit greater than $7 (78%). 2021 buyer funds per journey have been 51% increased than 2019 ranges, however Uber income/journey elevated solely 34% because the portion of low margin supply journeys elevated and since Uber wanted to offer a better share to drivers (81%) with a purpose to maintain service ranges from collapsing.

However as ridesharing demand was recovering in 2022, Uber managed to extend its income per journey by 52% ($4.17 vs $2.74 in 2021) whereas forcing drivers to just accept much less income per journey (down 5% from $11.46 in 2021 to $10.93). Throughout 2022 Uber carried out “upfront” pricing schemes that uncoupled driver funds from buyer fares. Drivers now not had any manner of realizing what prospects have been paying or what share of the steadily growing buyer fares they have been getting. This allowed Uber to enhance its margins by charging the very best fares it thought passengers would pay, whereas paying drivers the bottom charges it thought it will take to get them to just accept journeys.

Drivers have been solely getting 72% of every buyer greenback in 2022 whereas Uber’s share had elevated to twenty-eight%. Drivers would have obtained $6.5 billion extra in 2022 if fares have been nonetheless being cut up on the pre-pandemic 78%/22% foundation, whereas the extra $6.5 billion in income was pure revenue for Uber and was essential to offsetting increased prices in different areas. This wealth switch doesn’t mirror the full decline in driver take-home pay per journey, since they’ve been going through big will increase in gasoline and car prices.

It’s troublesome to see how Uber might obtain the equally massive margin enhancements within the subsequent few years that may be wanted to supply significant, sustainable earnings. This might require each getting prospects to pay increased and better fares and getting drivers to just accept smaller shares of buyer funds. Marginal features are at all times potential however it’s troublesome to see 2022 magnitude features (bettering Uber take charges by greater than 6 factors) occurring once more. Continued market progress would do little or no for Uber’s P&L if the share of buyer funds stays fixed. There is no such thing as a proof that Uber has any manner to enhance operational effectivity sufficient to spice up its P&L by billions.

The chaos of the pandemic (and pandemic restoration) masks the questions of when buyer resistance to increased fares and driver resistance to low funds attain the important factors often seen in aggressive markets. In comparison with the normal taxis they changed Uber has lower driver compensation and is now providing riders a lot much less service at increased fares. A number of tales report the magnitude of fare hikes in chosen cities and rising driver discontent [6] however (by design) Uber’s refusal to publish fundamental pricing and demand information limits the notice that its diminished losses relied on diminished buyer and driver welfare.

The collapse of “tech” fairness has had little influence on the demand for Uber inventory

The central concern affecting Uber’s future well being and viability is whether or not it could keep a strong demand for its fairness. Quarterly P&L outcomes are related to inventory costs, however the hyperlink is oblique. It’s extra vital to grasp the components which have pushed the most important latest collapse within the valuation of a variety of “tech” firms just like Uber.

Following Uber’s lead with taxicabs, tons of of enterprise capital funded US startups within the final decade constructed narratives about how their revolutionary applied sciences would enable them to “disrupt” established industries similar to automotive promoting, actual property, logistics, style, and investing. These narratives highlighted how they have been following the mannequin established by the profitable unicorns of the earlier decade (Google, Amazon, Fb) together with a strict preliminary give attention to hyper-aggressive top-line income progress (within the expectation that earnings would observe later), richly valued IPOs and robust ongoing fairness appreciation.

Over the previous 18 months all the narrative claims these submit 2010 startups made have fallen aside. None of those vaunted disruptive new applied sciences have created highly effective aggressive benefits within the industries they have been making an attempt to “disrupt”. The overwhelming majority of those firms have by no means earned a greenback of professional earnings and none have produced wholesome, sustainable earnings. None had the highly effective scale or community economies that may have justified their extreme give attention to top-line income progress.

The bubble sustaining the demand for the fairness of those narrative-driven startups burst in late 2021. By the top of 2022, the worth of 23 of those firms had fallen greater than 85% and one other 14 firms experiences inventory value declines of 75-84%. [7] The Ark Innovation ETF, which explicitly tracks a majority of these startups was down 80%. Softbank, the biggest investor in a majority of these startups (together with Uber) misplaced $5.9 billion within the fourth quarter of 2022. [8]

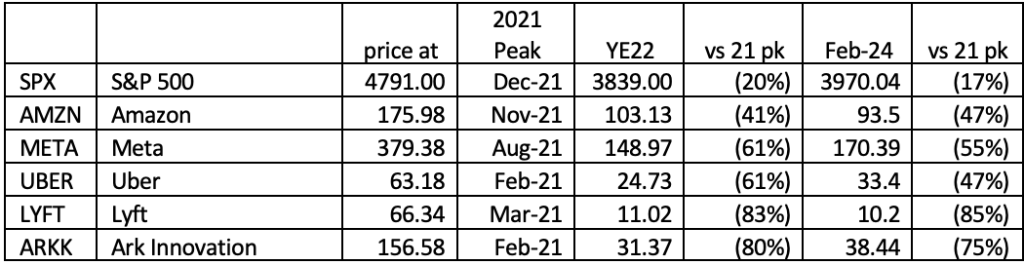

The general inventory market was declining throughout this era as traders acknowledged that the Federal Reserve’s shift away from near-zero-interest price insurance policies would improve the chance of equities. On the finish of December the S&P 500 was down 20% from its 2021 peak; due to a latest uptick on account of hypothesis that the Fed would decelerate rate of interest will increase it was down 17% as of February 24th.

The a lot bigger collapse of those narrative-driven “tech” firms demonstrates the market’s rising consciousness that it might now not shrug off the a lot larger threat of firms that had by no means demonstrated compelling aggressive benefits or any near-term prospect of incomes sustainable earnings. This additionally led the market to start rejecting different dangers that had not been correctly priced, together with SPACs and crypo-related firms, and even severely started marking down the inflated values of strongly worthwhile pre-2010 unicorns similar to Meta, Fb and Google. [9]

However the rising consciousness that pre-2022 fairness values of ‘tech’ startups have been pushed by a “consensual hallucination” created by artificially manufactured narratives and the phantasm that Federal Reserve insurance policies had eradicated regular startup dangers has not but affected the marketplace for Uber inventory. As of the top of 2022 Uber was down 61% however is up 35% since then so it is just down 47% as of February 24th. This was a considerably smaller decline than seen on the bulk of the opposite narrative-driven “disrupters”. Ark Innovation remains to be down 75% whereas Uber’s declines are according to firms with lengthy histories of sturdy profitability like Amazon (down 47% as of February 24th), Alphabet (down 40%) and Meta (down 55%).

Though Uber remains to be structurally unprofitable, and nobody has laid out a public argument as to the way it would possibly obtain sustainable earnings, Uber remains to be valued as a $67 billion firm. All of the Wall Avenue analysts following Uber are predicting this worth will materially improve; none suppose Uber’s economics are in anyway akin to the numerous different narrative-driven “tech” disrupters (e.g. Carvana, OpenDoor, Snap, Zoom, DoorDash, Rocket) whose company worth has fully collapsed.

The inventory market’s analysis of Uber vs Lyft has dramatically diverged

On February 9th Lyft introduced a full yr 2022 internet earnings of unfavourable $1.6 billion (versus unfavourable $1.1 billion in 2021) and fourth quarter 2022 internet earnings of unfavourable $588.1 million (versus $283.2 million in 4Q21). Lyft reported $1.8 billion money available on the finish of 2022.

The inventory market’s valuations of Uber and Lyft had adopted parallel paths till mid 2022 and it’s not clear why such a radical divergence occurred. Lyft’s inventory value was down 83% from its 2021 peak on the finish of December. There was no 2023 bump; it was nonetheless down 85% on February 24th. There is no such thing as a significant distinction between the underlying economics of the 2 firm’s ridesharing operations. However the market clearly started valuing Lyft according to the numerous collapsed “tech” disrupters, whereas believing that Uber’s future prospects have been considerably higher, and far more akin to the fluctuate massive scale worthwhile tech firms.

Enterprise press experiences on Lyft’s earnings report famous that Lyft issued unexpectedly pessimistic income steering for the primary quarter of 2023, though it had overwhelmed Wall Avenue income and revenue estimates for the fourth quarter. None of those experiences tried to elucidate why the market’s far more unfavourable view of Lyft had developed six months in the past, or tried to elucidate the more and more divergent valuations when it comes to something Uber was doing higher, or when it comes to seemingly near-term P&L efficiency variations. If one fastidiously restates earnings to regulate for accounting anomalies and irrelevant gadgets, one would see that Uber margin features have been stronger than Lyft’s however not one of the trade observers have carried out that and none have provided any public explanations as to what has been driving Uber’s higher efficiency. [10]

There was some hypothesis that Uber is now in place to drive Lyft out of the market and profit from vastly much less competitors. Lyft CEO Logan Inexperienced famous a weak present pricing surroundings given Lyft’s must “stay aggressive inside the trade.” This implies that Uber might have been conserving fares down, not solely to spice up its top-line site visitors numbers however to extend strain on Lyft.

Whereas it is a matter that has not even been hinted at within the enterprise press, few issues excite the inventory market greater than the elimination of competitors, and this would possibly clarify among the present divergence in Uber/Lyft valuations. However Uber can’t understand these form of features (e.g. large will increase in market energy over customers and drivers) until Lyft approaches the verge of liquidation, and there’s no proof that’s a near-term risk. On the contrary, Lyft will presumably do the whole lot potential to struggle for survival, producing market share battles which might damage each firm’s dismal margins.

Lyft has at all times been a distant quantity 2 to Uber, however there’s by no means been proof that passengers have any willingness to pay increased costs simply to journey with the larger firm. It’s potential that Uber has found out methods to get wealthier prospects to pay increased fares, or to get drivers to just accept decrease compensation whereas conserving them from realizing that they’re getting an more and more awful deal, however these wouldn’t appear to be issues that Uber might more and more exploit to maximise strain in opposition to Lyft.

Any investor expectations that Uber might purchase Lyft and merge them out of the market would seem unrealistic at this level. Until Lyft thought the chance of liquidation was imminent, they might demand an especially excessive acquisition value. Not like the state of affairs when firms like Google and Fb purchased out opponents, Uber just isn’t able the place it’s flush with earnings and pays for acquisitions with extraordinarily priceless and quickly appreciating inventory. And antitrust authorities would totally acknowledge the purely anti-competitive nature of any Uber-Lyft merger and would acknowledge that Uber has not one of the in style assist that firms like Google and Fb loved once they pursued anti-competitive mergers.

_____________

[1] The problems with Didi’s profitability–regardless of large market benefits it had versus Uber (95%+ market share, a lot decrease automotive possession charges, cities that have been a lot bigger and denser), have been mentioned in Can Uber Ever Ship? Half Twenty-5: Didi’s IPO Illustrates Why Uber’s Enterprise Mannequin Was At all times Hopeless, August 2, 2021

[2] Some speculative uptick in demand for unlisted Didi fairness is feasible however Beijing didn’t carry the ban on including new customers till January and the potential relisting in Hong Kong stays hypothetical. Silva, Marco, DiDi International: Get Out Whereas You Nonetheless Can, In search of Alpha, Nov 15, 2022; Huang, Raffaele, Didi Wins Approval to Restart New Person Registration for Trip-Hailing Service, Wall Avenue Journal, Jan 16, 2023. Uber had introduced its intention to get rid of its Didi inventory, however it’s unclear how this may very well be carried out with out crashing the values, particularly within the absence of a wholesome exchange-based buying and selling. Briançon, Pierre, Uber Contemplating Shedding Its Stake in China’s DiDi International, Barrons, 15 December 2021;

[3] Uber Half Twenty 9 (February 11, 2022) offered a extra detailed model of this desk displaying monetary outcomes from 2014 via the top of 2021. That desk, and the 2019 column of this desk, additionally alter printed outcomes to unfold inventory primarily based compensation (SBC) expense realized instantly after Uber’s 2019 IPO throughout an extended time interval. On this case Uber was following correct accounting practices; it couldn’t report these as present bills till the day they really vested, however this produced third quarter 2019 Uber P&L numbers wildly out of line with all different time durations.

[4] If drivers are workers, the whole lot passengers pay needs to be included as “Uber income” and all common and incentive funds to drivers needs to be included as bills underneath “Price of Income”. If Uber, because it has lengthy claimed is merely a passive middleman offering software program that helps unbiased drivers discover prospects, then solely Uber’s lower of passenger fares (what drivers are paying for Uber’s software program and model assist) needs to be included as “Uber income” and all different driver bills (autos, gasoline, hourly pay) are irrelevant to Uber’s company P&L. Uber stated the influence of the UK accounting change on its reported income by quarter was $200 million, $893 million, $1.1 billion and $1.2 billion. Driver reclassification additionally signifies that Uber is liable to gather worth added tax (VAT) on passenger fares that small-scale unbiased drivers wouldn’t be required to gather. The UK fined Uber $732 million in 2022 for its previous failure to gather VAT. As with the modified income accounting, Uber’s SEC experiences are designed in order that it’s unattainable for traders to determine what the web P&L influence of driver reclassification might be going ahead

[5] Browning, Kellen, Uber Reviews Document Income as It Defies the Financial Downturn, The New York Instances, Feb 8, 2023; Needleman, Susan, Uber Shares Rise After Trip-Hailing Firm Reviews Income, Revenue Development, Wall Avenue Journal, Feb 8, 2023

[6] Jeanette Settembre, Uber ‘taking benefit’ of unsafe NYC with astronomical fares, New York Submit April 15, 2022; Henry Grabar, The Decade of Low-cost Rides Is Over, Slate, Might 18, 2022; Asher Schechter, “Uber Has Larger Costs and Worse Service Than the Taxi Business Had Ten Years In the past”, ProMarket, July 28, 2022; Lee, Timothy B. What Shocked Me Most After I Turned a Lyft Driver for a Week, Slate Dec 22, 2022 (“How a lot passengers have been charged, how a lot I took residence, and that someway this firm remains to be in enterprise”); Salam, Erum, Uber drivers strike in New York after firm blocks raises and fare hikes: Metropolis company accepted raises for drivers by 7.42% per minute and 23.93% per mile however firm filed lawsuit, The Guardian Jan 5 2023; Sherman, Len, Uber’s New Math: Enhance Costs And Squeeze Driver Pay, Forbes, Jan 6, 2023; Hu, Winnie and Ley, Ana, Uber Drivers Say They Are Struggling: ‘This Is Not Sustainable’, New York Instances, Jan 12, 2023; Rodgers, Sophie, Uber and Lyft was less expensive than taxis. Now cabs are leveling the taking part in area, Crains’s Chicago Enterprise, Jan 27, 2023; Wehner, Greg, New York Taxi union to strike in opposition to Uber and Lyft at LaGuardia airport, Fox Enterprise, Feb 23, 2023

[7] Firms whose December 2022 fairness values have been 95% or extra under their 2021 peaks embrace Carvana, Vroom, Fubo TV, Opendoor, Upstart, RealReal, Redfin and Blue Apron; 94-90% down: Affirm, Lending Tree, Past Meat, Virgin Galactic, Pelaton, Teledoc Well being, Good RX, and Roku; 85-89% down: WeWork, AMC,Twilio, Snap, Robinhood, Zoom, Rivan Automotive; 84-80% down Draft Kings, Lyft, Rocket, Palantir, Zillow, SoFi Applied sciences, Cloudflare and Door Sprint; 70-79% down :Spotify, Seize, Warby Parker, Automotive Gurus and Pintarest. Wolf Richter’s Wolf Avenue weblog has been monitoring these “Imploded Shares” that had been inflated on account of market-wide “consensual hallucination”

[8] Fujikawa, Megumi, SoftBank Loses $5.9 Billion in Quarter as Investments Endure, Wall Avenue Journal, Feb 7, 2023

[9] Thompson, Derek, Why Every thing in Tech Appears to Be Collapsing at As soon as, Atlantic, Nov 17, 2022; Goswami, Rohan, Tech’s actuality examine: How the trade misplaced $7.4 trillion in a single yr, CNBC, Nov 25, 2022; Richter, Wolf, 2022, Yr of Face-Ripping Bear-Market Rallies that Obtained Crushed, Wolf Avenue, Dec 30, 2022; Richter, Wolf, The Most Astounding IPO Hype-and-Hoopla Present Ever Ends 2022 in Tears, Wolf Avenue, Dec 26, 2022; Waters, Richard, Traders search for backside of tech sector downturn, Monetary Instances, Jan 19, 2023

[10] Sumagaysay, Levi, Lyft inventory closes decrease than $10 for the primary time; three-quarters of its valuation has been wiped away this yr, Marketwatch, Dec 28, 2022; Bellan, Rebecca, Lyft shares get crushed on weak steering for first quarter, Techcrunch Feb 9, 2023; Feiner, Lauren, Lyft shares tank 30% after firm points weak steering, CNBC, Feb 10th 2023

[ad_2]