[ad_1]

American retail buyers and merchants are again after a brutal 2022, and appear to be embracing the Fed-pivot-soft-landing narrative. From JPMorgan in a single day:

— Each the older and the youthful cohorts of retail buyers added threat YTD.

— The youthful cohorts’ impulse into equities rose in latest weeks to the very best degree since final August.

— The older cohorts have been shopping for each fairness and bond funds at a robust tempo YTD, reviving recollections of the asset reflation flows of 2017.

— This abrupt change in behaviour originally of 2023 is probably pushed by elevated confidence amongst retail buyers that inflation has entered a downward trajectory and that the Fed coverage price is approaching its peak. Due to this fact, until inflation reaccelerates inducing a considerably greater peak within the Fed funds price than presently anticipated, it’s seemingly that the YTD stream patterns by the older cohorts of retail buyers shall be sustained supporting each equities and bonds throughout 2023

JPMorgan’s Nikolaos Panigirtzoglou types retail buyers into younger and outdated cohorts. The olds primarily make investments by means of mutual funds and ETFs. The youngs are extra inclined to purchase particular person shares, use margin and dabble with choices.

Panigirtzoglou estimates that the olds have lumped $81bn into bond funds and $44bn into fairness funds up to now this yr, after avoiding the previous altogether in 2022 and yanking out an enormous $340bn out of bond funds.

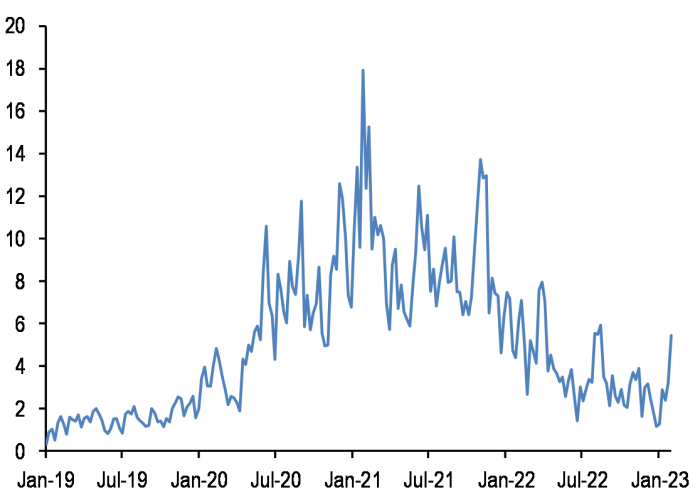

And what in regards to the leverage-loving, risk-seeking younglings? Effectively, the height of the choices frenzy of 2021 is a way away, however purchases of retail-sized bundles of name choices on particular person shares has rebounded strongly from the lows of final yr, and are as soon as once more far above pre-2020 ranges.

We don’t have but the month-to-month information from NYSE margin accounts for the month of January. Nonetheless our greater frequency (i.e. weekly) proxy primarily based on small merchants’ fairness name choice flows, i.e. choice clients with lower than 10 contracts, present a pointy rebound YTD. These information come from OCC, the world’s largest fairness derivatives clearing group. They’re weekly, with the week ending February third because the final out there commentary. Determine 3 depicts these small merchants’ name choice flows for exchange-traded particular person fairness choices within the US. This name choice stream has elevated markedly in latest weeks to its highest degree since final August.

You may also see the return of retail merchants within the rally of know-how shares and small-caps, plus a basket of shares standard on large US retail buying and selling platforms.

Proxies of the US retail impulse into tech-related particular person shares are sending an analogous message of re-emergence of shopping for by the youthful cohorts of retail buyers. These youthful cohorts of retail buyers tended to favour massive tech shares in addition to small caps and consequently their inventory choice will be regarded as a barbell commerce. From a efficiency perspective, this barbell commerce will be proxied by the efficiency of Russell 2000 and Nasdaq indices vs. that of the S&P500. This relative efficiency proxy . . . rebounded in latest weeks pointing to re-risking by the youthful cohorts. Fairness baskets containing shares standard with US retail buying and selling platforms . . . are conveying an analogous message.

Additional studying:

— The timeless choices growth

— Meme-stock teams have raised $5bn in 2 years since buying and selling frenzy

— Is a brand new period of retail buying and selling rising after GameStop saga?

— Rise of the retail military: the newbie merchants reworking markets

[ad_2]