[ad_1]

Nominal consumption above consensus (1.8% m/m vs. 1.3%). Private revenue was 0.6% m/m, vs. consensus 1%. The NBER BCDC seems to be at actual consumption and actual revenue ex-current transers for conjunctural evaluation. These are plotted beneath, together with with actual manufacturing and commerce trade gross sales.

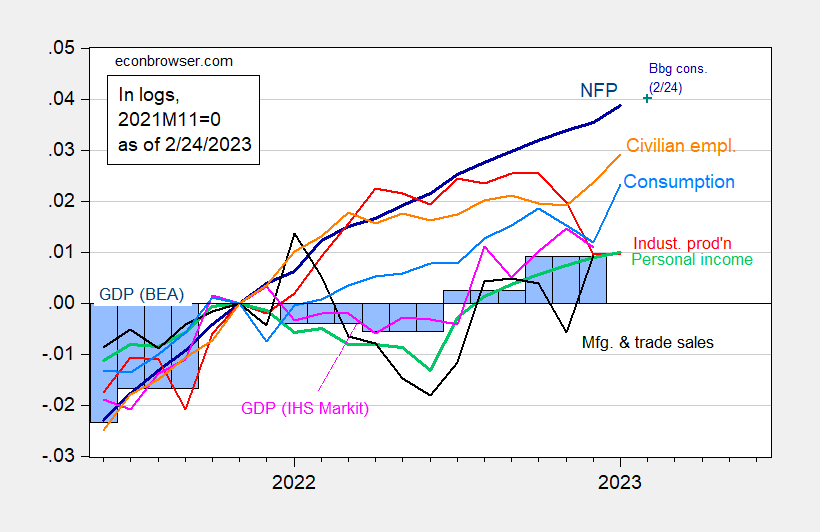

Determine 1: Nonfarm payroll employment, NFP (darkish blue), Bloomberg consensus of two/24 (blue +), civilian employment (orange), industrial manufacturing (crimson), private revenue excluding transfers in Ch.2012$ (inexperienced), manufacturing and commerce gross sales in Ch.2012$ (black), consumption in Ch.2012$ (mild blue), and month-to-month GDP in Ch.2012$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Q3 Supply: BLS, Federal Reserve, BEA 2022Q4 2nd launch by way of FRED, IHS Markit (nee Macroeconomic Advisers) (2/1/2023 launch), and writer’s calculations.

Sturdy labor market, spending and revenue numbers all recommend no recession in place but. GDPNow is at 2.7% q/q SAAR for Q1; however IHS Markit/SP World has upgraded its monitoring estimate to -0.3%.

[ad_2]