[ad_1]

Possibly. Possibly not. Some causes to surprise.

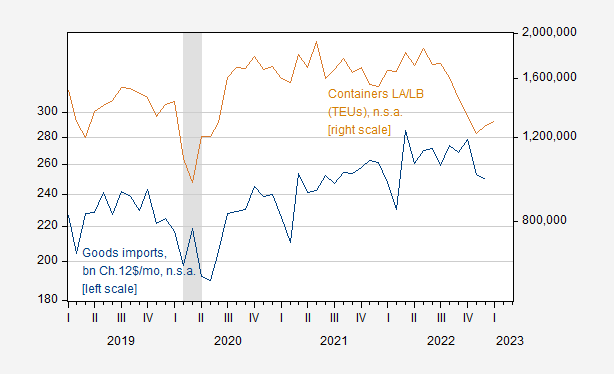

As Calculated Threat notes, LA port site visitors is down. A decline in port site visitors often indicators a downturn in imports. Determine 1 reveals the evolution of those two collection earlier than and throughout the pandemic.

Determine 1: Items imports in billions Ch.2012$/mo, n.s.a. (blue, left log scale), and containers (TEUs) at LA and Lengthy Seaside ports, n.s.a. (tan, log proper scale). Actual imports calculated deflating by import worth deflator obtained from seasonally adjusted collection. NBER outlined peak-to-trough recession dates shaded grey. Supply: Census, Port of LA, Port of Lengthy Seaside, NBER, and writer’s calculations.

A regression of 1 collection on the opposite yields an adj-R2 of 0.32, with a slope coefficient (log-log) of 0.32. Every 1% improve in container site visitors at LA and Lengthy Seaside ports is related to a 0.3% improve in actual items imports.

Imports are certainly declining so far as we will inform, for information going by means of December, and if port site visitors is any indicator, January (n.s.a.) imports will stay depressed relative to previous peak.

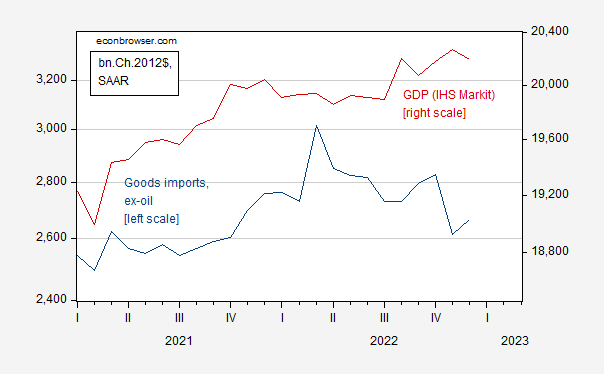

Determine 2: Items imports ex-oil (blue, left log scale), and month-to-month GDP (pink, proper log scale), each in billions Ch.2012$ SAAR. Supply: BEA/Census and IHS Markit/SP International.

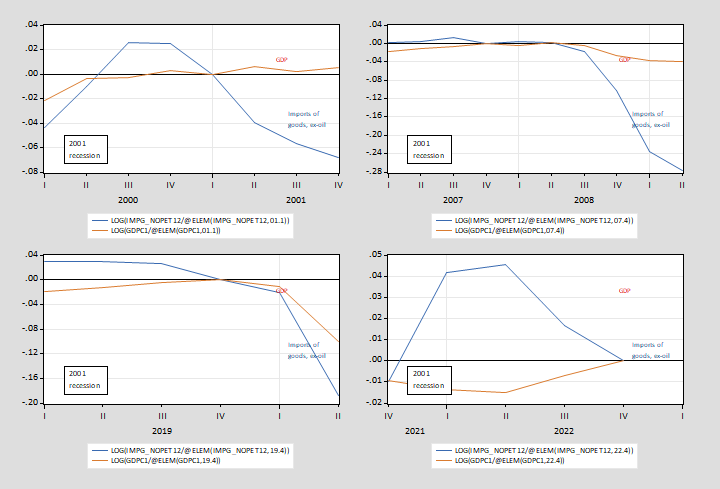

The truth is, imports have fallen extra drastically than GDP within the final 3 recessions (and actually, GDP didn’t fall within the 2001 recession). Within the 2007-09 recession, I famous that the collapse in imports advised a deep recession was doubtless (see high proper graph in Determine 3 under).

Determine 3: GDP (tan), and imports of products ex-oil (blue), each in logs, normalized to 0 at NBER peak (pink dashed line). Normalization for 2022 assumes peak at 2022Q4. Supply: BEA, NBER, and writer’s calculations.

Apparently, the present state of affairs differs from previous; non-oil imports have been falling as GDP has risen, prior to now two quarters (taking 2022Q4 as peak).

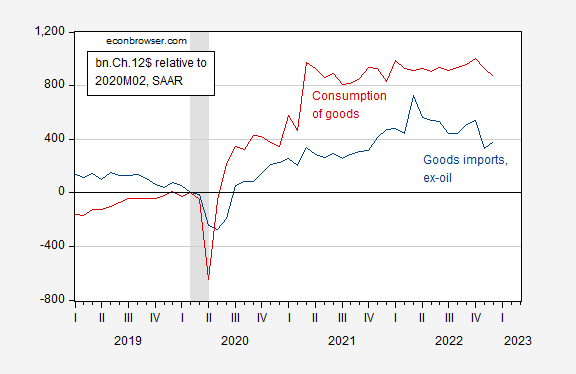

One cause to not suppose imports predict a recession this time round is the anomalous habits of products consumption throughout the pandemic. Determine 3 reveals the products consumption and imports consumption relative to ranges at 2020M02 (NBER outlined peak).

Determine 4: Items imports ex-oil (blue), and consumption of products (pink), each distinction from 2020M02, in billions Ch.2012$ SAAR. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, NBER, and writer’s calculations.

Imports of products have been excessive as a result of consumption of products was excessive. The deceleration of the latter is then in step with the depressed (comparatively) stage of products imports.

So it is perhaps the case that decrease items imports are signalling a slowdown. Certainly, that’s at the least a part of the story (as might be seen in decrease mixture — items and companies — consumption, which peaked in 2022M10). However the different a part of the story is the normalization of consumption patterns, and a reallocation of spending towards companies and away from items.

That being mentioned, consensus remains to be for recession, in Q1 (IHS Markit/SP International) or 2023H2 (for others), whereas GS has taken the chance to 35%.

[ad_2]