[ad_1]

Rashad Ahmed brings my consideration to the next:

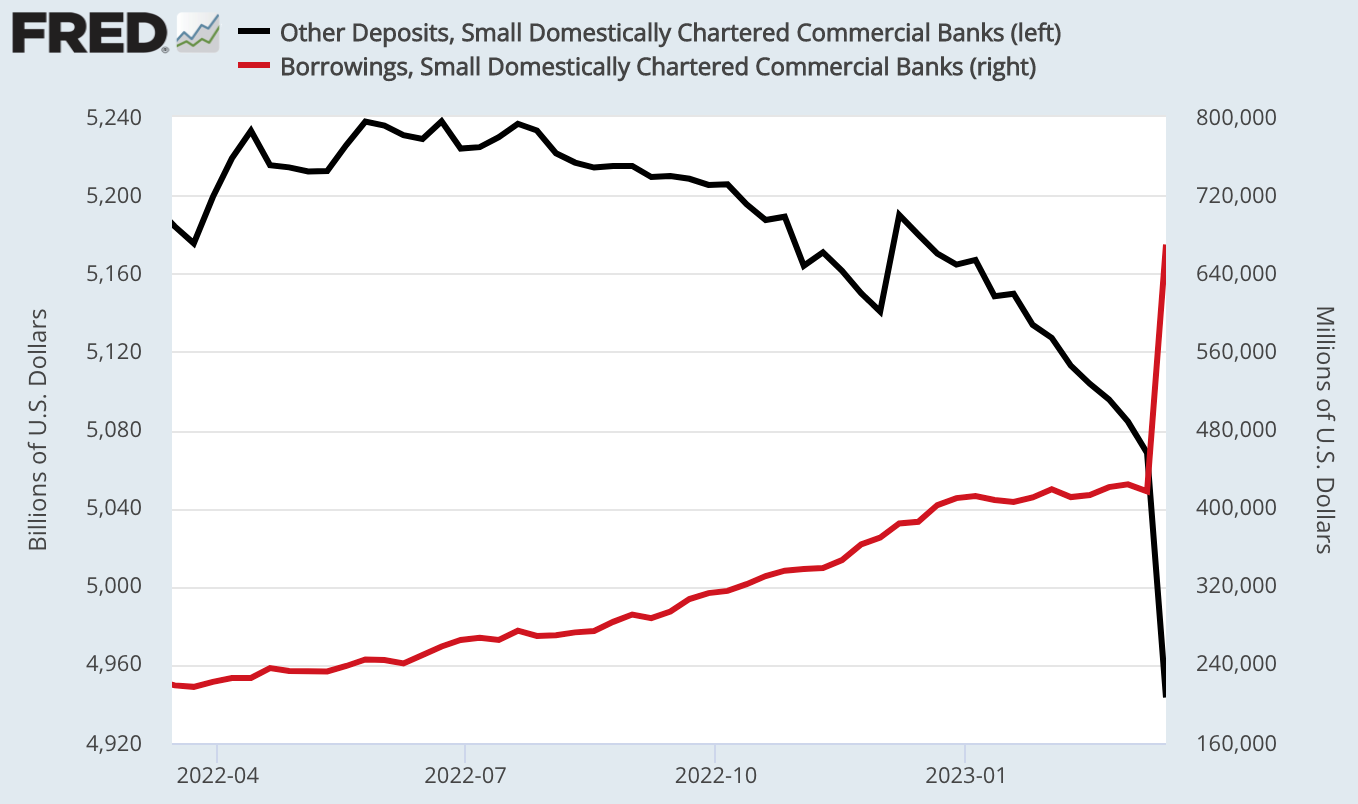

Supply: Ahmed by way of FRED.

“The H.8 information is up to date via March 15 and the info exhibits fairly starkly the “run” on small banks in black. “Different deposits” are principally proxying liquid demand deposits (complete deposits much less giant time-deposits). “Borrowings” proxies for banks drawing credit score from the likes of FHLB and Fed.”

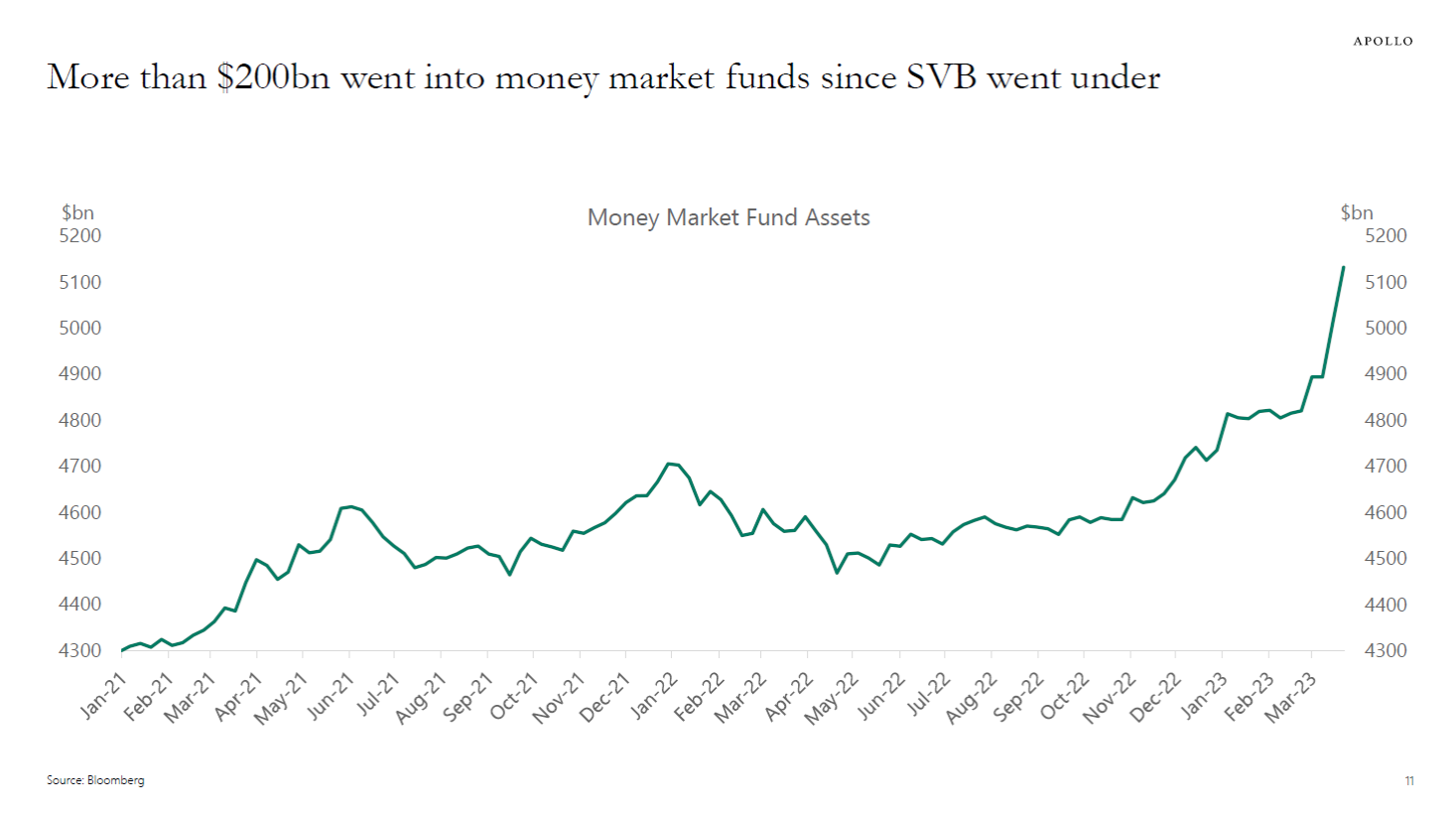

Not solely are funds shifting places, they’re shifting out of deposits, as identified by Torsten Slok at Apollo as we speak.

“The divergence between the Fed funds fee and rates of interest on checking accounts is the basic purpose why cash is being moved out of financial institution deposits and into higher-yielding investments, together with cash market accounts, see charts beneath. Greater charges as a supply of instability for deposits and Treasury holdings is extremely uncommon in comparison with earlier banking crises, the place the supply of instability has sometimes been credit score losses placing downward strain on the illiquid aspect of banks’ stability sheets.”

[ad_2]