[ad_1]

Credit score Suisse has appealed to the Swiss Nationwide Financial institution for a public present of help after its shares cratered as a lot as 30 per cent, sparking a broader sell-off in European and US financial institution shares.

The request for a reassuring assertion about Credit score Suisse’s monetary well being got here after its shares sank as little as SFr1.56, having earlier been halted amid a heavy sell-off, in keeping with three folks with data of the talks.

Credit score Suisse additionally requested for the same response from Finma, the Swiss regulator, two of the folks mentioned, however neither establishment has but determined to intervene publicly.

The steep share worth declines got here within the wake of the collapse of Silicon Valley Financial institution within the US and after the chair of the Saudi Nationwide Financial institution (SNB), which purchased a ten per cent stake in Credit score Suisse final 12 months, dominated out offering the Swiss lender with any extra monetary help.

Credit score Suisse’s market cap slipped beneath SFr7bn ($7.6bn), with the financial institution having raised SFr4bn of capital just some months in the past. By Wednesday mid-afternoon the shares have been 17 per cent down.

“It’s wanting inevitable that the Swiss Nationwide Financial institution must intervene and supply a lifeline,” mentioned Octavio Marenzi, analyst at Opimas. “The [Swiss National Bank] and the Swiss authorities are totally conscious that the failure of Credit score Suisse and even any losses by deposit holders would destroy Switzerland’s popularity as a monetary centre.”

Finma didn’t instantly reply to a request for remark; the Swiss Nationwide Financial institution and Credit score Suisse declined to remark.

Individually, the European Central Financial institution has requested EU lenders to reveal their exposures to the Swiss lender, an individual aware of the matter advised the Monetary Occasions.

The ECB debated the professionals and cons of creating a public assertion to try to calm the waters, however as of Wednesday afternoon it had determined in opposition to doing so for concern of solely including to market panic, the particular person added.

The most recent woes on the troubled Swiss lender reignited a broader sell-off in financial institution shares in Europe and the US, which have been already reeling this week from the fallout following the collapse of Silicon Valley Financial institution.

BNP Paribas shares dropped 9 per cent and Société Générale fell 11 per cent. Deutsche Financial institution and Barclays misplaced 7 per cent, whereas ING fell 8 per cent. Wider fairness markets have been dragged decrease, with the Europe-wide Stoxx 600 dropping 2.4 per cent. The promoting unfold to Wall Road as US markets opened, with the S&P 500 down 1.8 per cent in early commerce led by banks.

Citigroup shares dropped 5 per cent and JPMorgan misplaced 4.6 per cent. US regional lenders on the centre of a sell-off earlier this week fell extra sharply. First Republic Financial institution dropped 13 per cent, whereas PacWest was 14 per cent decrease.

Banks on the Stoxx 600 have now misplaced 16 per cent over the previous week in a rout sparked by SVB’s failure after the Californian lender was compelled to take enormous losses on its bond portfolio. Buyers mentioned Credit score Suisse’s issues have been a reminder that Europe’s banks additionally had massive holdings of bonds that had been hammered by rising rates of interest.

“Credit score Suisse is an remoted case,” mentioned Charles-Henry Monchau, chief funding officer at Syz Financial institution. “However banks in Europe, due to regulatory strain, needed to load up on negative-yielding bonds on the worst time and now they’re going through main unrealised losses on the steadiness sheet and the market is questioning whether or not Europe might see the identical subject because the US.”

Bond markets rallied as buyers ramped up bets on rate of interest cuts from the Federal Reserve later this 12 months. Markets now count on, at most, one quarter-point rate of interest rise from the US central financial institution by Could, adopted by as much as 1.25 share factors of cuts by December. Earlier than SVB’s collapse, buyers anticipated a half-point improve later this month, and for charges to remain excessive for the rest of 2023.

Credit score Suisse on Tuesday revealed that its auditor, PwC, had recognized “materials weaknesses” in its monetary reporting controls, which had led to the delay of the publication of its annual report final week after the US Securities and Change Fee wished additional readability on flaws.

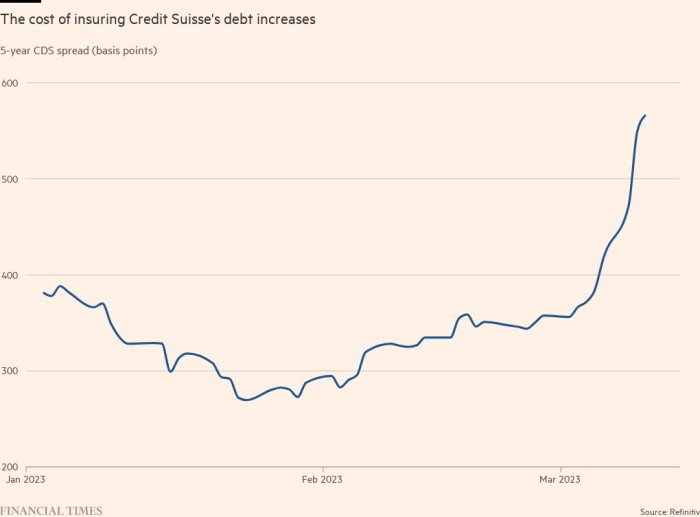

The spreads on the financial institution’s five-year credit score default swaps, which point out investor bearishness, widened to 565 foundation factors on Wednesday, from 350bp initially of the month.

Requested on Bloomberg TV whether or not Saudi Nationwide Financial institution can be open to offering capital to Credit score Suisse if there was a name for added funding, SNB chair Ammar Alkhudairy mentioned: “The reply is completely not, for a lot of causes exterior the best cause which is regulatory and statutory.”

He mentioned proudly owning greater than 10 per cent of Credit score Suisse would deliver further regulatory necessities. In feedback to journalists on the occasion, he added that he was proud of the financial institution’s restructuring plan and didn’t really feel it wanted additional capital.

In a separate interview at a finance convention in Saudi Arabia, Credit score Suisse chair Axel Lehmann mentioned on Wednesday that monetary help from the Swiss authorities “isn’t a subject” for the lender.

“We now have sturdy capital ratios, a robust steadiness sheet,” he mentioned, including that the financial institution was within the means of executing a radical restructuring geared toward arresting years of scandals and losses. “We already took the drugs.”

A day earlier, chief govt Ulrich Körner mentioned prospects have been persevering with to tug cash from the financial institution, however at a a lot decrease degree than late final 12 months, when Credit score Suisse suffered SFr111bn of outflows.

Credit score Suisse shares are down 35 per cent this 12 months and 84 per cent over the previous two years.

Extra reporting by Katie Martin, Martin Arnold and Sam Jones

[ad_2]