[ad_1]

Taichung, Taiwan – Earlier than he vanished in mid-February, Bao Fan, one in all China’s best-known funding bankers, had reportedly been in search of a secure place to park his wealth.

Bao, the founding father of China Renaissance, was within the course of of creating a non-public wealth administration firm in Singapore to switch cash out of China and Hong Kong, the Monetary Instances reported final month, citing 4 individuals acquainted with the plans.

Bao, who has joined an extended record of influential businessmen to instantly disappear in China, is only one of a rising variety of rich Chinese language businesspeople who’ve regarded to Singapore — dubbed the “Switzerland of Asia” — to flee Beijing’s crackdowns on non-public business and corruption.

“Wealth has flooded into Singapore from China and Hong Kong in recent times,” a wealth supervisor at a Singaporean financial institution with numerous Chinese language clientele, who spoke on situation of anonymity, advised Al Jazeera.

“In confidential conversations, lots of them have named the disappearances of Chinese language enterprise individuals together with unsure financial instances as major causes for transferring cash out of China,” the wealth supervisor stated.

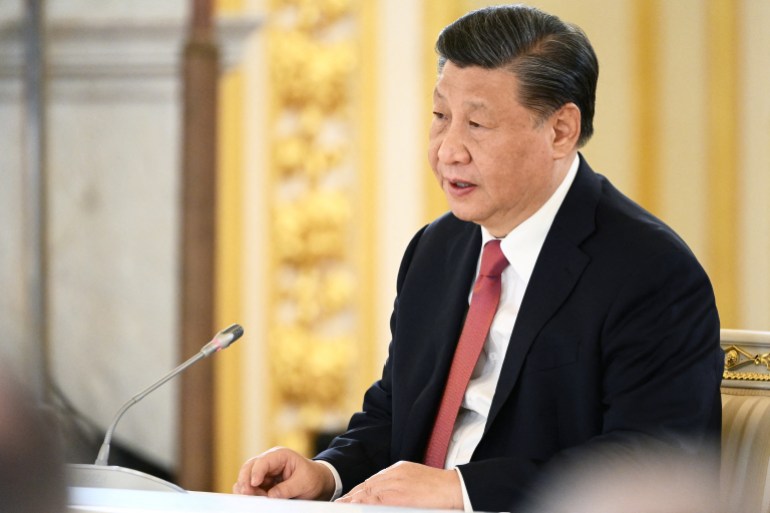

Singapore, named the world’s finest place to do enterprise by the Economist Intelligence Unit, has for years been constructing a popularity as a haven for high-worth Chinese language, significantly because the rise of Xi Jinping, China’s strongest chief in a long time, who has led his nation in an more and more authoritarian and nationalistic route.

In the course of the first 5 years of an anticorruption drive led by Xi, greater than 100 high-ranking officers throughout the Chinese language Communist Celebration and tens of hundreds of lower-level officers and enterprise individuals have been prosecuted for white-collar crimes.

Extra not too long ago, a regulatory crackdown on non-public business that has touched on sectors from tech to schooling and actual property has despatched cash fleeing out of China.

“My purchasers have advised me that within the present political local weather in China is much less tolerant in direction of prosperous individuals in comparison with earlier than, and due to this fact they needed to get their property out,” a supervisor at a big worldwide financial institution with branches in Singapore, who spoke on situation of anonymity, advised Al Jazeera.

“Beforehand, Chinese language traders would then have regarded to Hong Kong, however the metropolis will not be as engaging as an funding vacation spot in comparison with earlier than due to the years of instability and financial decline it has confronted.”

Put merely, China is turning into a “much less engaging nation to spend money on”, main Chinese language traders to hunt out “higher alternatives overseas,” Sara Hsu, an knowledgeable on Chinese language fintech and shadow banking on the College of Tennessee, advised Al Jazeera.

And whereas it’s difficult to maneuver giant quantities of cash out of China, many have discovered a means, Hsu stated.

The inflow of Chinese language cash into Singapore has been keenly felt within the city-state.

Mainland Chinese language consumers made up almost one-quarter of the consumers of the 425 luxurious houses offered within the metropolis in 2022, outnumbering US residents by greater than two to at least one.

Singapore’s residential actual property costs soared 14 % in 2022, in response to knowledge from actual property consultancy agency Knight Frank, whereas costs in different cities with historically in style actual property markets like Hong Kong and Sydney fell by single digits, though analysts have stated that home elements, not rich foreigners, have pushed the surging costs.

Chinese language nationals that don’t qualify to purchase actual property below Singaporean regulation have opted to lease as a substitute, contributing to greater than a tripling of the yearly rental prices of some high-end properties.

Throughout the city-state, rental costs elevated by 33.2 % from January 2022 to January 2023, in response to the Straits Instances newspaper.

A lawyer in Singapore’s wealth administration sector final month estimated that the variety of wealth administration places of work greater than doubled in 2022 from 700 places of work to 1500, with about half of them originating from China.

On touristed Sentosa island off the south coast of Singapore’s important landmass, the inflow of overseas cash has resulted in a membership on the Sentosa Golf Membership rising to 880,000 Singaporean {dollars} ($660,000) for foreigners, double the value in 2019.

“You additionally discover that there are much more Chinese language within the cityscape in comparison with just some years in the past,” stated the supervisor on the giant worldwide financial institution who spoke on situation of anonymity.

“All over the place you go you hear individuals with mainland China and Hong Kong accents.”

Gross sales supervisor Emma Chiu has additionally seen the presence of extra mainland Chinese language individuals in Singapore in recent times.

“My associates and I usually speak about how we see all these Chinese language mainlanders driving round in large, costly vehicles, carrying all the latest designer manufacturers and eating in any respect the flamboyant eating places,” Chiu advised Al Jazeera.

“A number of the money-flashing by the Chinese language will get a bit ostentatious for my style, however I suppose that’s a part of what makes them enjoyable to watch as nicely.”

The arrival of extra Chinese language mainlanders in Singapore demonstrates that rich Chinese language usually are not solely trying to safeguard their property but additionally their households, in response to the wealth supervisor who spoke on situation of anonymity.

Singapore runs a worldwide investor program by which people can achieve everlasting residency for themselves and their households in the event that they make investments a minimal quantity within the nation.

“So by parking their property right here, they will shield their fortunes in addition to their lives from a doubtlessly precarious political state of affairs in China or Hong Kong,” the wealth supervisor stated.

For moneyed foreigners looking for safety for themselves and their property, Singapore has vital attracts.

The town-state is a secure tax haven that, for many years, has supplied banking and funding administration companies to rich people from all around the world.

Since attaining independence in 1965, Singapore has been a poster little one for stability. The ruling Individuals’s Motion Celebration has had one of many longest uninterrupted governing streaks on the planet — albeit in a polity that successfully outlaws most protest and has one of many lowest rankings for media freedom.

Charges of crime and corruption are low, and the gross home product (GDP) per capita, at greater than $72,000, stands among the many highest on the planet.

For Chinese language mainlanders particularly, Singapore can be each geographically and culturally near house. The nation lies throughout the identical time zone as China, and Mandarin is extensively spoken among the many 70 % of Singapore’s inhabitants that’s ethnically Chinese language.

However the stream of property and folks from China to Singapore won’t final.

Yang Jiang is a senior researcher on the Danish Institute for Worldwide Research the place she conducts analysis on the up to date political financial system of China. She stated that Chinese language authorities may search to additional tighten their already in depth capital controls if the capital flight continues.

“If a whole lot of businessmen transfer out of China it may begin to seem like a Chinese language mind drain,” Jiang stated.

“And that may be a improvement the federal government would need to stifle since China wants these non-public people to keep up its market dynamism.”

The influx of overseas wealth can be not welcomed by everybody in Singapore.

Whereas a big portion of Singapore’s housing is by regulation reserved for Singaporeans, insulating a lot of the market from overseas shopping for, the inflow of cash has been felt in different areas.

“I’ve heard tales of loopy spending sprees by newly arrived mainlanders,” Chiu stated.

“And I additionally personally discover that after I need to buy groceries today issues are both way more costly or just offered out in comparison with earlier than, which I feel has to do with all of the overseas cash working by the town.”

College instructor Sean Feng stated sharp will increase in meals costs have made it robust to make ends meet for him and his household.

Singapore imports greater than 90 % of its meals, leaving the nation weak to exterior headwinds. Meals inflation exceeded 8 % in January and February, considerably greater than the general inflation price, in response to Singapore’s Division of Statistics.

Singapore’s core inflation price of 5.5 % in February ranked among the many highest in Southeast Asia and greater than double the charges skilled by different developed Asian economies like Hong Kong, Japan and Taiwan. In December, the Economist Intelligence Unit named Singapore the costliest metropolis to stay in together with New York Metropolis.

“A whole lot of every day objects are much more costly now,” Feng advised Al Jazeera. “I do know inflation has been dangerous in all places the previous few years, however when so many individuals with a lot cash settle right here, it’s sure to make it even worse for us.”

“I simply hope that Singapore is usually a place for all people who name the town house,” Chiu stated, “and never only a place for the super-rich.”

[ad_2]