[ad_1]

Lambert right here: He’s b-a-a-a-c-k!!!! And I’m guessing no. Learn all the way in which to the top, the place you will note a wonderful instance of lack of company in a coverage advice. Readers?

By Alex Domash, Analysis Fellow, Mossavar-Rahmani Heart for Enterprise & Authorities Harvard Kennedy College of Authorities, and Lawrence H. Summers, Charles W. Eliot College Professor and President Emeritus Harvard College. Initially revealed at VoxEU.

In latest months, wage development has confirmed indicators of slowing regardless of a very tight labour market, which has introduced a puzzle for normal fashions of labour market slack. This column exhibits that opposite to what many have claimed, wage development within the fourth quarter of 2022 was truly consistent with what a typical Phillips curve mannequin predicts. The authors argue that labour market tightness right now implies wage development that’s roughly 1 to 1.5 proportion factors increased than in 2019, and that with none further softening within the labour market, this stage of wage inflation is prone to proceed in 2023.

The US labour market continues to be terribly tight by practically each measure of labour market slack. The unemployment fee – probably the most conventional indicator for labour market slack –is at a 50-year low at 3.4%. Different demand-side labour market measures such because the job emptiness fee and the quits fee, which latest analysis has proven to be higher indicators of slack (Saez and Michaillat 2022, Furman and Powell 2021), counsel a fair tighter labour market: there are practically two job openings per unemployed, and employees are quitting at a sooner fee than at any time earlier than the Covid pandemic.

Regardless of historic ranges of tightness, nevertheless, high-quality measures of wage development have proven some indicators of disinflation in latest months. Particularly, the Employment Value Index (ECI) for personal salaried employees confirmed three-month wage development slowing to 4.2% (annualised) in December 2022, in comparison with 5.1% over the earlier 12 months. Given the latest slowdown in ECI wage development, many have questioned whether or not views primarily based on a standard Phillips curve mannequin are overly pessimistic as predictors of the seemingly course of inflation transferring ahead.

To guage this argument, we revisit the Phillips curve mannequin utilized in our February 2022 paper (Domash and Summers 2022) and examine the mannequin predictions for wage inflation in 2022 to realised wage inflation. Conditional on realised labour market tightness, our mannequin predicted annual wage inflation in 2022 of 4.1% utilizing the ECI for personal salaried employees (versus 5.1% precise) and 4.9% utilizing the common hourly earnings of manufacturing and nonsupervisory employees (versus 5.3% precise). Whereas these predictions underestimate true wage inflation in 2022, they’re according to wage development over the past three months. These estimates are additionally nearer to realized inflation in 2022 than the consensus Federal Open Market Committee’s (FOMC) abstract of financial projections in December 2021 or the consensus forecast from the Federal Reserve Financial institution of Philadelphia’s Survey of Skilled Forecasters (FRBP 2021), each of which projected core PCE inflation beneath 3%.

Opposite to what many have claimed, these findings counsel that wage disinflation in latest months can readily be reconciled with a typical Phillips curve mannequin: wage inflation has begun to revert to development after accelerating properly past what would have been predicted by labour market slack in 2021 and early 2022. Particularly, labour market tightness right now implies wage inflation that’s roughly 1 to 1.5 proportion factors increased than 2019 ranges, which is what has been noticed over the past three months. By the top of 2023, with no further slack within the labour market, our mannequin predicts annual wage development to stay above 4% utilizing any wage measure.

Wage Progress over the Final Yr Has Been Unusually Excessive

In Domash and Summers (2022), we in contrast different labour market indicators as predictors of wage inflation and located that vacancies and quits had been higher predictors than the unemployment fee. We then estimated a ‘firm-side’ unemployment fee from the unemployment fee that will have traditionally been according to noticed ranges of vacancies and quits, and located that this variable carried out noticeably higher than the precise unemployment fee in explaining wage development from 2001 to 2019.

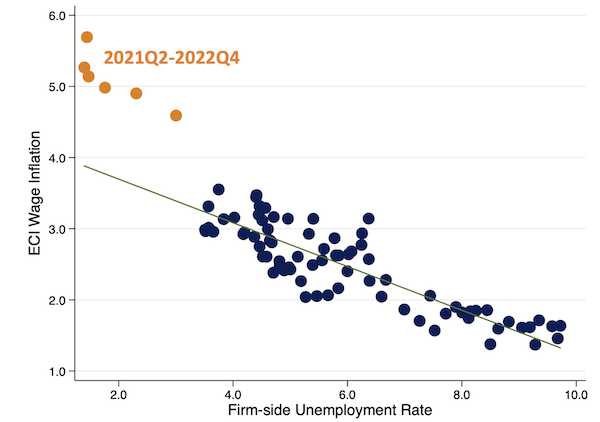

Determine 1 exhibits a standard Phillips curve mannequin with firm-side unemployment because the slack variable and wage inflation as the expected variable (controlling for inflation expectations). Wage inflation is the 12-month p.c change in ECI wages and salaries for personal employees, and firm-side unemployment is the common firm-side unemployment fee over the earlier 4 quarters. The blue dots denote observations earlier than the second quarter of 2021, and the orange dots denote observations from the second quarter of 2021 to the fourth quarter of 2022.

Determine 1 Wage Phillips curve utilizing firm-side unemployment as slack measure, 2001Q1–2022Q4

Observe: The inexperienced strong line is the regression line for 2001–2019. Wage inflation is the four-quarter p.c change within the ECI for personal wages and salaries. Agency-side unemployment is the four-quarter (backward-looking) transferring common of the unemployment fee according to the job emptiness and quits charges.

Sources: Bureau of Labor Statistics; authors’ calculations.

The scatterplot exhibits that between 2001 and 2019, a standard Phillips curve mannequin with firm-side unemployment because the slack indicator does a reasonably good job of explaining annual wage inflation. Nevertheless, over the past six quarters, year-over-year wage development has been a lot increased than would have been implied by the historic relationship between labour market tightness and wage development.

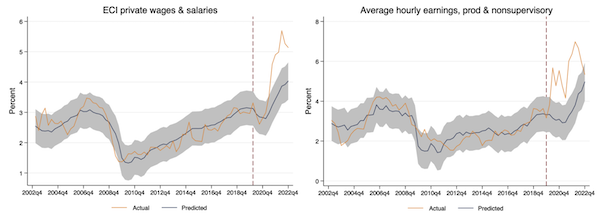

In Determine 2, we replicate the mannequin utilized in Domash and Summers (2022) and present mannequin predictions of 12-month wage inflation versus precise wage inflation for every quarter by 2022. The mannequin used within the paper is a typical formulation of the Phillips curve, the place wage inflation is pushed by shifts in expectations, supply-side shocks, and demand-side elements. We use a four-quarter (backward-looking) transferring common of the firm-side unemployment fee for our demand indicator, and a three-year weighted lag of CPI inflation to proxy for inflation expectations. The mannequin is educated on pre-Covid knowledge between 2001 and 2019 to keep away from adjustments induced by the pandemic, after which predicts out-of-sample estimates for wage inflation post-2020 utilizing the estimated coefficients on firm-side unemployment and inflation expectations.

Determine 2 Precise versus predicted year-over-year wage inflation, 2002Q1–2022Q4

Observe: The mannequin regresses the four-quarter p.c change within the wage measure on the four-quarter (backward-looking) transferring common of the firm-side unemployment fee, and a 3-year weighted lag of CPI inflation (which applies a weight of three to inflation one yr in the past, a weight of two to inflation two years in the past, and a weight of 1 to inflation three years in the past) to proxy for inflation expectations. The mannequin is educated on quarterly knowledge between 2001Q1 to 2019Q4 to keep away from adjustments within the relationships brought on by the pandemic, after which used to foretell out-of-sample estimates from 2020Q1 onwards. The 95% confidence interval across the predicted values is proven in gray. The mannequin predictions are sturdy to a wide range of completely different specs for the lag size of the slack indicator and for the proxy used for inflation expectations.

Sources: Bureau of Labor Statistics; authors’ calculations.

The outcomes above present that the mannequin predicts wage inflation moderately properly earlier than the pandemic, however has underpredicted wage development over the past two years. Between the fourth quarter of 2019 and the fourth quarter of 2022, firm-side unemployment fell from 3.6% to 1.5%, whereas our proxy for inflation expectations elevated from 2.0% to 4.4%. Collectively, these variables predicted a rise in wage development from 3.0% to 4.1% utilizing ECI personal wages and salaries, and from 3.3% to 4.9% utilizing common hourly earnings of manufacturing and nonsupervisory employees. The discrepancy between the mannequin predictions and noticed inflation means that a number of the wage development in late 2021 and 2022 was seemingly attributable to one-time results like provide chain points and reallocation shocks, which resulted in short-term wage inflation above what could be predicted by labour market slack and shifts in expectations alone.

In latest months, wage development has confirmed indicators of slowing in comparison with late 2021 and early 2022, which has led some to counsel that it’s attainable to get additional disinflation with much less labour market slack than conventional fashions would point out. We see two issues with this argument, nevertheless. First, our out-of-sample mannequin predictions counsel that the slowdown in wage development noticed within the fourth quarter of 2022 is actually simply wage development reverting to the tempo that a typical Phillips curve mannequin would predict. For instance, ECI personal wages and salaries grew by 4.2% (annualised fee) over the past quarter, which is roughly what our mannequin predicted for ECI wage development in 2022. Second, wage ranges right now stay roughly 2.5% increased (utilizing the ECI) than what would have been predicted in 2019 given cumulative labour market slack. This implies that some extent of imply reversion is to be anticipated beneath a typical Phillips curve mannequin.

Outlook for Wage and Value Inflation Shifting Ahead

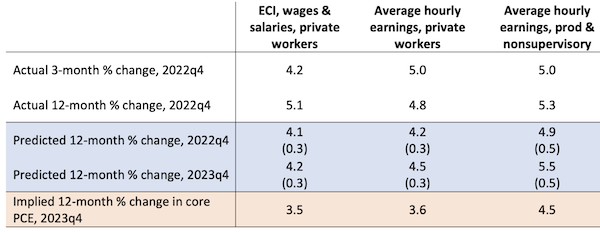

Desk 1 presents a abstract of precise versus predicted wage inflation in 2022, together with mannequin predictions for wage inflation in 2023. Assuming no further softening within the labour market, we predict annual wage development to stay above 4% by the top of 2023 for each wage measure. Our predictions for wage development in 2023 intently resemble noticed wage development over the past three months, and counsel {that a} additional slowdown in wage development is unlikely with out further slack within the labour market.

The desk additionally presents the implied core PCE inflation fee that’s according to our predicted wage inflation in 2023. Assuming underlying productiveness and revenue tendencies stay the identical as they had been within the twenty years earlier than the pandemic, our prediction for ECI wage development would suggest a core PCE inflation fee of about 3.5% in 2023.

Desk 1 Abstract of precise and predicted wage development for 2022 and 2023

Observe: The expected 12-month p.c change in wage development in 2023q4 assumes that labour market tightness stays on the similar stage the place it was in 2022q4 for the following 4 quarters. Implied inflation is calculated utilizing the common historic distinction between 12-month wage inflation and 12-month value inflation from 2001 to 2019.

Sources: Bureau of Labor Statistics; authors’ calculations.

General, our outcomes have proven that a typical Phillips curve mannequin of labour market tightness has carried out comparatively properly in predicting wage inflation in 2022. Over the subsequent yr, our mannequin predicts ECI wage inflation above 4%, and manufacturing and nonsupervisory wage development above 5%. With out will increase in productiveness or margin compression, such excessive ranges of wage development are unlikely to be appropriate with a 2% inflation goal, which suggests to us that further softening of the labour market is probably going wanted within the coming yr.

[ad_2]