[ad_1]

It is a corrected title of a mendacious (and sometimes statistically incompetent) article by Craig Eyermann in an Unbiased Institute blogpost (beforehand highlighted as Ironman of PoliticalCalculations). He writes:

After two years in energy, President Joe Biden doesn’t have many optimistic accomplishments to brag about.

…

However whereas his financial legacy just isn’t shaping as much as be one, he has given Individuals one enduring legacy. He’s grown the U.S. nationwide debt by 11% within the two years he has occupied the Oval Workplace. That’s actually saying one thing as a result of the nationwide debt was already $27.76 Trillion on the day he was sworn in.

Mr. Eyermann’s title is, so far as I can inform, incorrect. In line with the Treasury Division’s Bureau of the Debt (accessed on 3/8/2023), on January 20, 2023, gross federal debt was $31454980005742.4, and on January 20, 2021, it was $27751896236414.7. Utilizing excel (in order to make sure no mistyping errors), I discover the change within the two years to be $3703083769327.70, and never $3,695,343,467,324.62 (as indicated within the PoliticalCalculations blogpost he references). For the reason that January 20, 2023 quantity matches my determine, and the determine within the Treasury web site, I can solely conclude that he made a subtraction mistake. He additionally made a mistake in calculating the share development fee. I get hold of 13.3% (and never 11%) change. My recommendation – don’t belief the mathematics in Unbiased Institute items.

However there’s really an even bigger drawback with Mr. Eyermann’s calculations. First, there’s no context when it comes to what others have accomplished of their first two years. Within the two years going from January 20, 2017 to January 20, 2019*, gross federal debt rose by 11.7% – throughout a time of buoyant development (January 2019 predates the pandemic by greater than a yr– take the 2 final years of Trump and it’s a blowout at 34.4%).

Second, we might most likely wish to take into consideration the debt burden normalizing by one thing. A technique to do this is to have a look at the debt to potential GDP ratio. Then, we have now the next comparability (the place I’m utilizing end-of-month debt figures now).

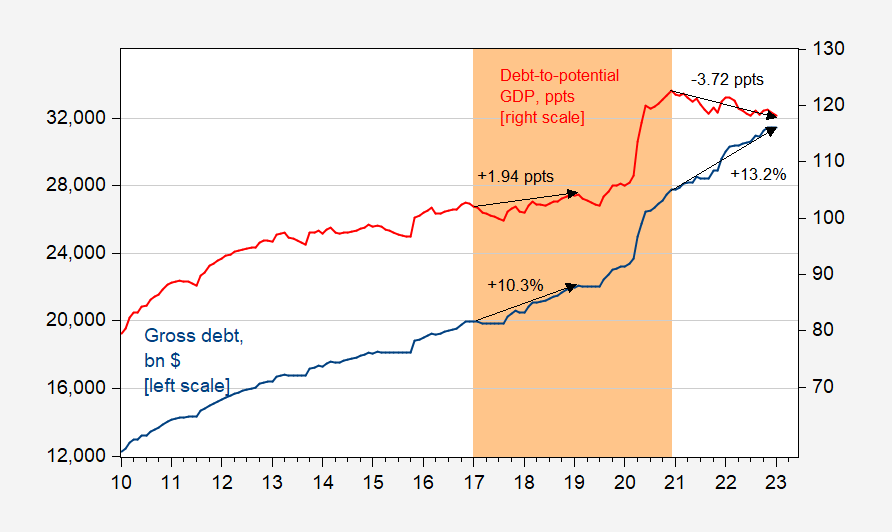

Determine 1: Gross federal debt in billions of $, finish of month (blue, left scale), and gross federal debt in share factors of potential GDP (crimson, proper scale). Numbers hooked up to black arrows denote modifications over 2 years. Quarterly estimates of potential GDP transformed to month-to-month utilizing quadratic interpolation process in EViews. Orange shading denotes Trump administration. Supply: Dallas Fed, CBO, and writer’s calculations.

Whereas gross federal debt rose by 13.2% by January 2023 (utilizing end-of-month information), as a share of potential GDP, it fell by 3.7 share factors.

Gross federal debt contains intra-government holdings (so debt that Social Safety belief fund holds, as an example). A extra applicable sequence to have a look at is debt held by the general public (FRED sequence FYGFDPUN). I don’t have this sequence on a month-to-month foundation, however I’ve marketable federal debt, which over the previous twenty years strikes very intently with FYGFDPUN on the quarterly frequency (see Determine 4). Right here’s the analogous graph utilizing marketable debt.

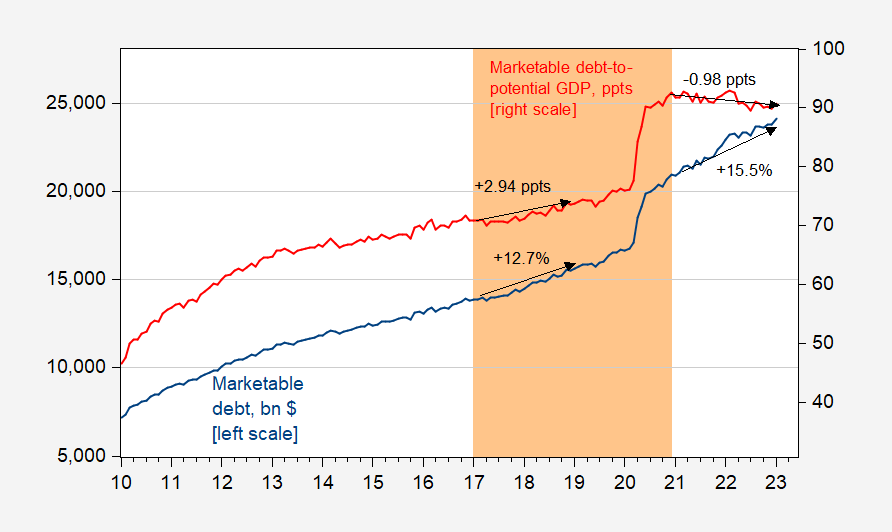

Determine 2: Marketable federal debt in billions of $, finish of month (blue, left scale), and marketable federal debt in share factors of potential GDP (crimson, proper scale). Numbers hooked up to black arrows denote modifications over 2 years. Quarterly estimates of potential GDP transformed to month-to-month utilizing quadratic interpolation process in EViews. Orange shading denotes Trump administration. Supply: Dallas Fed, CBO, and writer’s calculations.

Whereas nominal marketable debt rose by 15.5%, as a share of potential GDP it fell by virtually a share level.

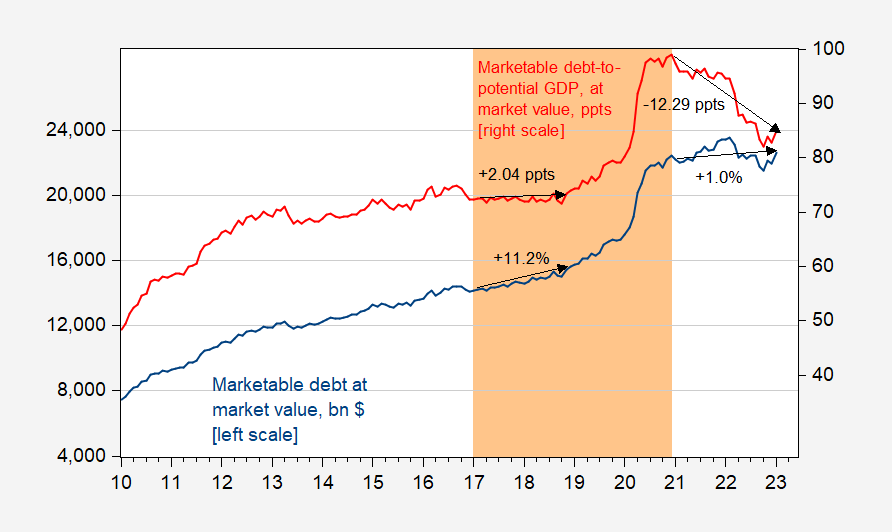

By way of assessing debt burden, one would possibly wish to use the market — reasonably than par — worth of debt. The par worth represents the rate of interest at situation, whereas market worth represents the rate of interest prevailing on the time of commentary. Utilizing the market values of marketable debt (roughly, debt held by the general public), we have now the next image.

Determine 3: Marketable federal debt at market worth in billions of $, finish of month (blue, left scale), and marketable federal debt at market worth in share factors of potential GDP (crimson, proper scale). Numbers hooked up to black arrows denote modifications over 2 years. Quarterly estimates of potential GDP transformed to month-to-month utilizing quadratic interpolation process in EViews. Orange shading denotes Trump administration. Supply: Dallas Fed, CBO, and writer’s calculations.

In different phrases, the Trump administration ramped up debt to potential GDP in a interval of financial increase, and was a real fiscal profligate even earlier than the Covid response.

Different analyses by Mr. Eyermann, relating to the definition of externalities, what metrics are most helpful for monitoring state stage financial exercise, time sequence econometrics, including/subtracting chain-weighted volumes I, including/subtracting chain-weighted volumes II, and reporting nominal vs. actual magnitudes.

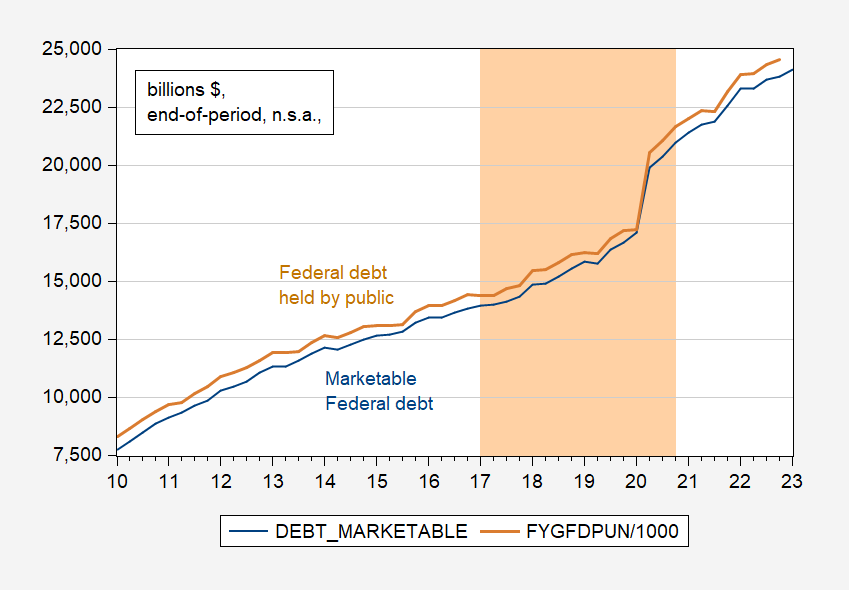

Appendix: Comparability of Marketable Federal debt and Federal debt held by public.

Determine 4: Marketable federal debt (blue), federal debt held by public, FRED sequence FYGFDPUN (tan),in billions of $, finish of quarter. Orange shading denotes Trump administration. Supply: Dallas Fed, CBO, and writer’s calculations.

* Really refers to common of January 18 and January 22, 2019, since no information reported for January 20.

.

[ad_2]