[ad_1]

By Dhaval Joshi of BCA Analysis

The 4 deadliest phrases in life are ‘it’s completely different this time’. Anybody who utters these phrases often finally ends up being carried away, ft first. So, it’s particularly worrying that the ‘it’s completely different this time’ narrative is coming from none apart from the world’s most necessary central financial institution, the US Federal Reserve.

By way of the previous 75 years, the US unemployment charge has both not gone up meaningfully, or it has gone up by lots. The US unemployment charge has by no means gone up by ‘simply’ 1 %. But when requested ultimately week’s press convention if the price of killing inflation may very well be saved to the unemployment charge going up by ‘simply’ 1 %, Jay Powell answered:

“Yeah, completely it’s potential… this isn’t a regular enterprise cycle the place you possibly can have a look at the final ten occasions there was a worldwide pandemic… it’s distinctive”

The Sequence Of Occasions Main To Recession Is All the time The Similar

It’s not day-after-day that there’s a worldwide pandemic. Then once more, it’s not day-after-day that the Bretton Woods financial system collapses, as occurred previous to the Seventies recessions. It’s not day-after-day that the mom of all inventory market bubbles bursts, as occurred previous to the 2001 recession. And it’s not day-after-day that there’s a nationwide housing bust within the US, as occurred previous to the 2008 world monetary disaster.

The backdrop to each enterprise cycle is ‘completely different this time’. However the chain response that takes the economic system into recession is at all times the identical.

First, gross sales decline relative to wages.

Second, companies’ earnings plunge.

Third, companies lay off staff.

Fourth, at a tipping-point of a 0.5-0.6 % rise within the unemployment charge, shoppers take fright and improve their precautionary saving, and banks sluggish their lending.

Fifth, this additional slowdown in spending is the self-reinforcement which causes the unemployment charge to go up by a minimum of 2 %. That means, a recession.

This chain response explains why the US unemployment charge is non-linear: it both doesn’t go up meaningfully, or it goes up lots. If the chain response breaks down earlier than stage 4, then unemployment doesn’t rise meaningfully, but when the chain response will get to stage 4, then unemployment rises lots.

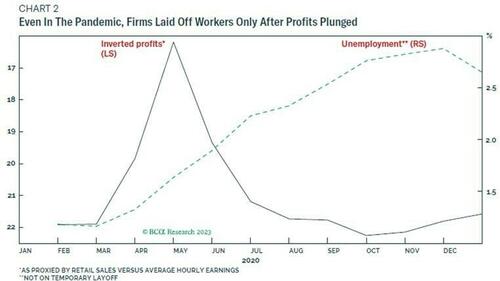

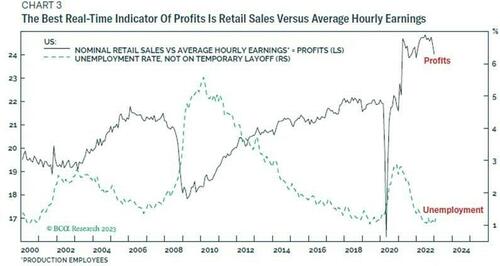

The most recent employment information exhibits that the US jobs market stays purple scorching, however this could come as no shock. To repeat, companies solely lay off staff after their earnings plunge. Not earlier than. Thus far, the chain response is simply at stage two. Gross sales are declining relative to wages, however economy-wide earnings haven’t declined sufficient to set off widespread layoffs.

Provided that we get to stage 4 within the chain response will we all know whether or not it’s completely different this time. However as I defined in The US Approaches Its Occasion Horizon, to get to stage 4, the perfect real-time indicator for earnings – retail gross sales versus common hourly earnings – should decline by 3-4 %. Thus far, this indicator has declined by 3 %, so it’s on the cusp of unleashing stage three and 4 of the chain response. Therefore, we await subsequent information launch on Feb fifteenth as a vital signpost.

So Far, It’s Not Totally different This Time

It not often is completely different this time. But we should always hold an open thoughts. There’s a first time for all the things. The Fed is betting that it’s completely different this time as a result of the self-reinforcement in stage 5 of the chain response might be a lot weaker this time. So, slightly than rising by effectively over 2 %, the unemployment charge will rise by simply 1 %. To repeat, this consequence is unprecedented. However given this outlook, says Powell, “I don’t see us reducing charges this yr.”

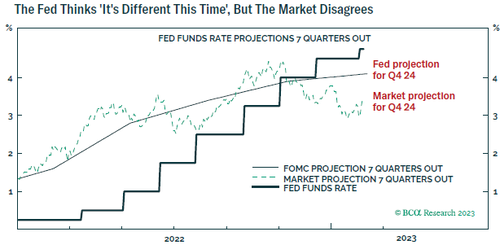

After the purple scorching jobs report for January, the market broadly agrees. Projections for the fourth quarter of 2023 present that each the Fed and the market count on one to 2 additional quarter-point hikes, after which a pause, however no charge cuts.

Projections for the fourth quarter of 2024 are extra attention-grabbing. Given the Fed’s outlook for the unemployment charge to rise by simply an unprecedented 1 % or so, it’s projecting the coverage charge to be solely modestly decrease than at this time. In the meantime, the market is projecting 125 bps decrease than at this time.

Due to this fact, if you happen to consider the Fed is correct, and it truly is completely different this time, the funding suggestion can be to promote the much less optimistically priced November 2024 Fed funds future (FFX24), or extra liquid shut equal FFZ24.

What if you happen to consider that the Fed is improper, and that it’s not completely different this time – does the much less optimistic market pricing for 2024 already low cost this? No, in each cycle, rates of interest climb up the steps, however fall down the elevator shaft. That means that after in a recession, the tempo of reducing charges is at all times aggressive. In 2001, charges collapsed at a tempo of 150 bps per quarter, in 2008 by 100 bps per quarter, and in 2020 – even ranging from a really low peak of two.5 % – by 80 bps per quarter.

Due to this fact, if this time will not be completely different, the unemployment charge will rise by effectively over 2 %, killing wage inflation, and unleashing the usually aggressive charge reducing that follows a recession. On this case, the pricing of the late 2024 Fed funds futures will not be pessimistic sufficient, and the funding suggestion can be to purchase them.

Thus far, there’s nothing to counsel that it’s completely different this time. To repeat, the US jobs market stays sturdy as a result of economy-wide earnings haven’t declined sufficient to set off widespread layoffs. We’ll solely uncover if it’s completely different this time after earnings plunge, and we received’t have to attend lengthy to seek out out.

We should watch the information and hold an open thoughts. However till the information proves that this time is completely different, it probably will not be. Due to this fact, the advice is to purchase the November 2024 Fed funds future (FFX24), or extra liquid shut equal FFZ24.

It additionally implies staying chubby bonds versus equities on a 6-12 month horizon.

Loading…

[ad_2]