[ad_1]

Every week we determine names that look bearish and should current attention-grabbing investing alternatives on the quick facet.

Utilizing technical evaluation of the charts of these shares, and, when acceptable, current actions and grades from TheStreet’s Quant Rankings, we zero in on three names.

Whereas we won’t be weighing in with elementary evaluation, we hope this piece will give traders excited by shares on the best way down a great place to begin to do additional homework on the names.

The Sysco Child

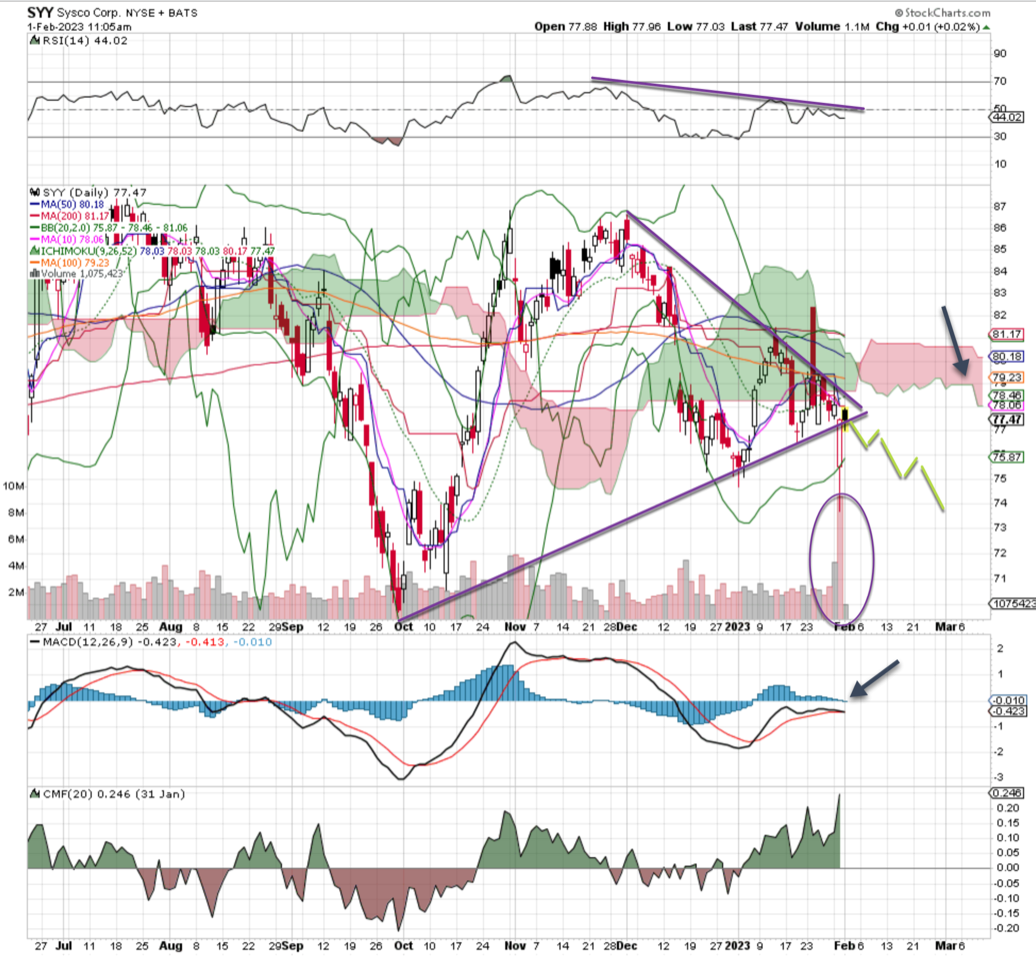

Sysco Corp. (SYY) is rated is rated a Maintain with a C+ score by TheStreet’s Quant Rankings.

SYY exhibits us a chart of a inventory prepared to interrupt decrease. The current transfer into the apex of this triangle was fairly bearish, with heavy quantity on that large candle day.

That was a down session, and is being adopted up with one other one. We see cash move is bullish, and that’s most likely the perfect and solely constructive indicator.

The Relative Energy Index (RSI) is bending decrease whereas we now have the Shifting Common Convergence Divergence (MACD) is able to roll over to a promote sign.

We might see a run in the direction of the low $70’s and probably $69, because the cloud is pink too. Put in a cease at $81 simply in case.

A Bear Flag Is Flying Right here

Calix Corp. (CALX) is rated is rated a Maintain with a C+ score by TheStreet’s Quant Rankings.

Calix has shaped a bear flag right here, and with heavy quantity on the current down transfer there’s monumental strain on the inventory.

Discover the bearish cash move and the on-going MACD promote sign. That’s telling, and the hole that’s open from again in July begs to be stuffed. That is available in at $45, a pleasant 14% down transfer from present ranges.

Let’s goal that space, put in a cease at $56.50, simply above the 200-day shifting common in case consumers come again in. I extremely doubt that can occur.

It is Robust to Get a Downtrend Again within the Tube

Colgate-Palmolive is rated is rated Maintain with a C+ score by TheStreet’s Quant Rankings.

Colgate exhibits us a steep downtrend channel, with decrease highs and decrease lows. Additional, the inventory plunged by way of the 50-day and 100-day shifting common just lately, and the 200-day on sturdy turnover.

That heavy promoting is just not being re-considered, and costs proceed to drop. The current pull-up appears to be like like a bear flag forming, and wonderful spot for low threat entry level on a brief play.

Goal the $70.90 space; put in a cease at $77 simply in case.

Get an electronic mail alert every time I write an article for Actual Cash. Click on the “+Comply with” subsequent to my byline to this text.

[ad_2]