[ad_1]

Authored by Nick Corbishley through NakedCapitalism.com,

Legions of European firms are succumbing to the ultimate straw of Europe’s largely self-inflicted vitality disaster.

Chapter proceedings within the Canary Islands, Spain’s closely tourism-dependent island chain, soared a whopping 276% yr over yr in 2022, in keeping with the newest information printed by the Normal Council of the Judiciary (CGPJ) in its report, “The Results of the Financial Disaster on Judicial Our bodies.” The archipelago additionally noticed the very best charge of dismissal claims in Spain, with round 400 of each 100,000 inhabitants shedding their jobs.

However this development shouldn’t be distinctive to the Canary Islands, nor certainly Spain. It’s taking place throughout giant swathes of Europe’s economies, as legions of companies succumb to the ultimate straw of Europe’s largely self-inflicted vitality disaster.

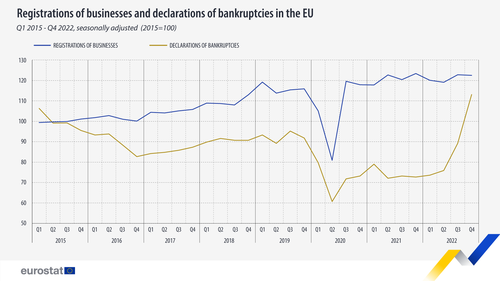

Within the EU as a complete the variety of chapter declarations initiated by companies elevated considerably (26.8%) quarter-on-quarter within the fourth quarter of 2022, reaching the very best ranges on file since Eurostat started amassing EU-wide chapter information in 2015. The variety of chapter declarations elevated throughout all 4 quarters of 2022. Because the Eurostat graph beneath exhibits, on the present charge of enterprise destruction it gained’t be lengthy earlier than companies are closing at a sooner charge than they’re opening.

This development, after all, was not onerous to foresee. In August 2022, I warned that the EU’s largely self-inflicted vitality disaster and ensuing inflation is tipping legions of small companies over the sting:

After reeling from one disaster to a different, Europe’s closely indebted and deeply debilitated small companies — the spine of the economic system — face the last word menace from vitality shortages and hovering costs.

With the specter of stagflation looming giant over Europe and the value of vitality rising at a blistering tempo, a whole bunch of hundreds, even perhaps thousands and thousands, of small companies face the grim prospect of closure this winter. Within the UK, a lot of the information cycle in latest weeks has been dominated by the plight of struggling households grappling with surging vitality payments. However many companies are, if something, in a good worse pickle, since they don’t have value caps on the vitality they pay. Some enterprise house owners are dealing with a rise in payments of greater than 350%.

Throughout Europe small and medium-sized companies (SMBs), significantly in sectors like journey and tourism, tradition and hospitality, have borne a lot of the brunt of the financial fallout of the pandemic. The stimulus packages — together with furlough packages, debt moratoriums and low-interest emergency loans — helped to tide over many (however not all) of the worst-hit companies however that assist has ended. In the meantime most of the financial issues spawned by the pandemic, together with provide chain bottlenecks and labor shortages, proceed to linger. Vitality shortages and surging costs are prone to be the ultimate straw.

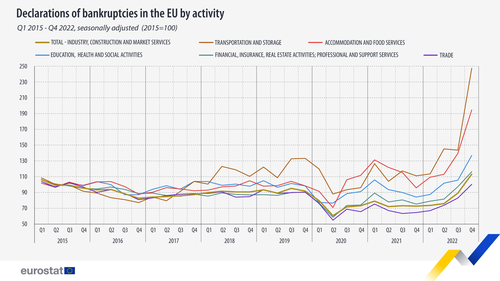

In 2022, inflation within the EU tripled to 9.2%, its highest studying ever. In keeping with Eurostat, all financial sectors witnessed an increase within the variety of bankruptcies within the fourth quarter of 2022 in contrast with the earlier one. However the hardest hit sectors have been transportation and storage (+72.2%), lodging and meals providers (+39.4%), training, well being and social actions (+29.5%), sectors that had already suffered considerably throughout the pandemic.

The distinction with the pre-pandemic chapter charge is especially hanging. In comparison with the fourth quarter of 2019 — the final quarter earlier than the Covid-19 lockdowns and different pandemic restrictions got here into impact — bankruptcies within the lodging and meals providers sector surged by 97.7%, whereas the transportation and storage business registered a equally noteworthy 85.7% enhance.

As I reported in February, firms in the UK, now a distinctly non-EU member, are hitting the wall on the quickest charge for the reason that World Monetary Disaster. A lot the identical is occurring throughout giant components of the European mainland.

The nation that witnessed the highest rise (64%) in bankruptcies final yr was Spain, whose economic system really grew by 4.7% in keeping with the OECD. This may be partly defined by a new restructuring regulation enacted in late October, which simplifies and accelerates the debt restructuring course of. But Spain additionally registered the second highest rise in bankruptcies in 2021, behind Romania. It’s hoped that the insolvency guidelines will assist scale back the nation’s excessive chapter charges, thereby attracting funding into the eurozone’s fourth-largest economic system. For the second it seems to be doing the alternative.

One more reason for the latest sharp rise in bankruptcies in Spain is that the duty to file for chapter was suspended throughout the COVID-19 pandemic to forestall an avalanche of enterprise failures. This meant that many firms that might have hit the wall, together with some longstanding zombie corporations, got a keep of execution. That suspension was lifted in July 2022. The outcome, as feared, has been an avalanche of enterprise failures.

Different EU international locations which have seen a notable enhance in bankruptcies in 2022 embrace Austria (57%), France (51%), Belgium (42%), the Netherlands (18%) and Finland (8.5%). It’s small and medium-size firms which might be on the sharpest finish of this development. As Euractiv reported in January, insolvencies in France and throughout Europe have damage small companies, significantly one-person outfits, probably the most:

But [a report from data analytics consultancy] Altares… exhibits the scenario is turning into more and more worrying [for] bigger SMEs with 10-99 staff.

“3,214 SME insolvencies have been recorded in 2022 in comparison with 1,804 in 2021, a surge of +78% over one yr,” the report reads. A 3rd of those insolvencies occurred within the final three months of 2022, representing a 93% enhance.

“When SMEs fall, it’s the entire native financial community that’s impacted,” Thierry Millon, who directed the examine, informed EURACTIV France.

“They’ll not pay their suppliers, and the job loss is far higher throughout the worth chain,” he mentioned. What’s of specific concern to him is that a few of these SMEs have been economically sound to start out with earlier than they have been compelled to unwind.

Hovering vitality payments, low financial progress and the quite a few monetary constraints imposed by the reimbursement of state-guaranteed loans all contribute to this development.

The “no matter it takes” period coined by President Emmanuel Macron to assist firms by any means doable throughout the pandemic can also be over.

This can be a frequent theme in lots of international locations: the monetary, fiscal and furlough-based security nets that have been erected for companies throughout the pandemic have lengthy disappeared. Quite a lot of the small in-person companies that remained standing throughout the pandemic took on large quantities of debt to climate the lockdowns and different restrictions, typically for the primary time. As soon as economies started reopening, not solely did they’ve to start out repaying these loans; they’d to take action towards a backdrop of surging enter costs and, in some sectors, lacklustre demand.

It’s straightforward to neglect that lengthy earlier than Russian and Ukrainian troopers started exchanging fireplace in February 2022, inflation was already rising quick in most Western economies, because of a cocktail of things together with, most notably, ongoing provide chain shocks and dislocations. Different components embrace post-lockdown pent-up demand, employee shortages and the unprecedented fiscal and financial stimulus unleashed throughout the pandemic.

Central banks have since begun mountaineering charges in a largely useless try and include inflation. Within the course of they’re making it even more durable for closely indebted shoppers and companies to service their money owed.

For a lot of companies, the battle in Ukraine and the spiralling rise in vitality costs triggered by the US and EU’s backfiring sanctions on Russia have been the ultimate straw. In Belgium three-quarters of unbiased retailers concern bankruptcies over the approaching months, in keeping with market evaluation agency GraydonCreditsafe. Shopkeepers blame their monetary difficulties on a number of components, together with hovering vitality payments, government-mandated wage indexations, and broader inflation.

However curiously, not all international locations are struggling a pointy rise in bankruptcies. Some, corresponding to Italy, Portugal, Poland, Rumania and Slovakia, really registered fewer bankruptcies in 2022 than 2021, for causes that aren’t fully clear to this humble blogger however presumably must do with every nation’s specific chapter guidelines laws, the monetary assist packages provided to firms and ongoing debt moratoriums. Maybe NC readers residing in these international locations may also help make clear the scenario.

The total-year information for Germany shouldn’t be but obtainable, however the information to November (as proven within the Buying and selling Economics graphic beneath) counsel that the long-term downward development in bankrupcties is starting to reverse, albeit slowly.

The Nationwide Affiliation of German Cooperative Banks (BVR) expects considerably extra firm bankruptcies in 2023, stories the German enterprise weekly Wirtschaftswoche. In comparison with 2022, BVR has forecast a rise of round 12% to roughly 16,300 insolvencies.

That will nonetheless be decrease than the degrees pre-Covid. Beneficiant state-aid packages all through the pandemic and the vitality disaster have performed an necessary position in defending German firms from chapter, the WW article notes. This can be a luxurious that different, extra indebted EU governments can in poor health afford to supply. One other key think about staving off (for now!) a dramatic surge in bankruptcies is the excessive ranges of fairness held by many German firms.

Nevertheless, whereas German companies could also be hitting the wall in fewer numbers, many bigger firms are voting with their ft and relocating a big a part of their operations elsewhere. They embrace the automotive giants BMW and Volkswagen. Just some days in the past BASF, the world’s largest chemical firm, unveiled plans to downsize its manufacturing in Europe, closing a number of of its German manufacturing services and shedding round 2,600 staff. The German chemical substances large cited elevated vitality costs as the primary cause for its resolution.

Loading…

[ad_2]