[ad_1]

Hey everybody! That is Lauly writing from Taipei. I’ve been reconnecting with sources within the provide chain and attending earnings calls over the previous a number of weeks. I’m sorry to say, the temper amongst suppliers concerning client electronics — the pillar of the tech business — is basically bleak.

Yesterday I went to the earnings convention of an influence administration provider whose clients embody Meta, AWS and Google in addition to all the main PC manufacturers. The CEO informed me that demand dropped off so out of the blue within the final quarter of 2022 that nobody had anticipated it. “Virtually all of our PC purchasers requested us to cease transport merchandise to them in October and by December, our knowledge centre purchasers additionally out of the blue halted shipments from us,” the CEO mentioned. “And now, we don’t even know whether it is on the backside but.”

The supervisor of a thermal module maker informed me that his firm, its suppliers and others working close by in the identical industrial zone in Dongguan, China, have all been operating at lower than 50 per cent of their manufacturing utilisation charges for the reason that remaining quarter of 2022.

The state of affairs within the tech business is totally totally different from what it was two or three years in the past, when corporations have been racing to satisfy unprecedented demand spurred by the increase in working and studying remotely. Now suppliers are hoping that the electrical automobile business and a restoration in client demand within the second half of the yr will assist them get again on observe.

Augmented technique

Apple has tapped Luxshare to assist develop its augmented actuality units, with the Chinese language contract electronics producer set to be the first producer of the primary technology of the gadget, Nikkei Asia’s Cheng Ting-Fang and Lauly Li write.

Luxshare took over AR improvement from Pegatron, the Taiwanese iPhone assembler that had been engaged on the undertaking with Apple for 4 years.

Foxconn, Apple’s largest manufacturing accomplice, has been tasked with the parallel improvement of the second technology of the the iPhone maker’s AR units. Apple has additionally requested Taiwan Semiconductor Manufacturing Co. and Sony to develop the essential micro OLED show applied sciences for the units.

Luxshare’s participation within the AR undertaking marks a milestone for Chinese language tech suppliers. Previously, Apple relied on Taiwanese suppliers like Foxconn to develop the primary generations of recent product strains, whereas Chinese language suppliers have been allotted orders afterward. Luxshare’s rising significance to Apple additionally comes amid heightened tech tensions between Washington and Beijing and scrutiny of Apple’s personal reliance on its Chinese language provide chain.

Staying house

China’s latest crop of know-how corporations is extra prone to checklist at house moderately than within the US, write the Monetary Instances’ Ryan McMorrow, Solar Yu and Demetri Sevastopulo.

Worldwide funding for Chinese language start-ups dried up in 2022, pushing many fledgling know-how corporations to lift capital and checklist at house as a substitute of on Wall Road.

Greenback investments within the nation’s new corporations fell by almost three-quarters final yr, declining to 19 per cent of the full capital put into start-ups, from 39 per cent in 2021, in line with new knowledge from analysis group ITJuzi.

Chinese language buyers and founders say geopolitical tensions with the US, in addition to Beijing’s tech crackdown and harsh zero-Covid coverage, spooked overseas buyers. On the similar time, rising assist from the Chinese language authorities and Washington’s sanctions additionally made elevating renminbi extra interesting.

The choice to lift {dollars} or renminbi typically places Chinese language entrepreneurs on two very totally different paths. One results in profitable corporations going public in New York or in Hong Kong, whereas the opposite normally ends in an inventory in Shanghai, Shenzhen or Beijing.

The drop in greenback funding for start-ups comes as giant worldwide buyers pull again from pouring cash into China-focused non-public fairness and enterprise funds. China funds raised solely $14bn final yr, down from $95bn in 2021, in line with Preqin knowledge.

Rubbish in, items out

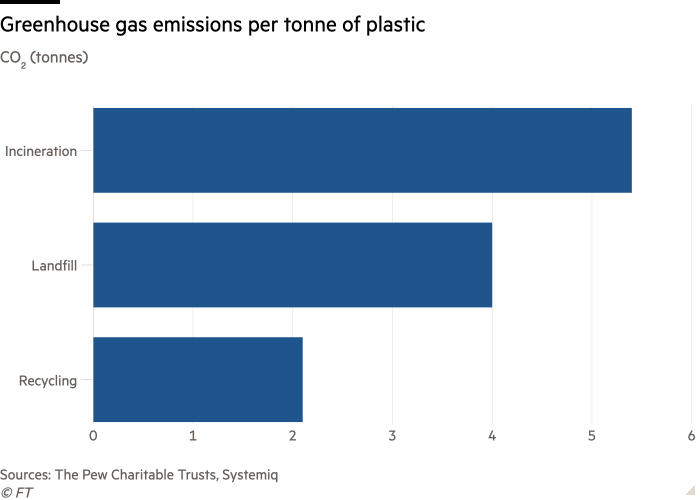

South-east Asia has reaped the financial advantages of worldwide provide chains shifting away from China, however the area can also be dealing with a disaster within the type of plastic waste. Native start-ups are tackling the issue in inventive methods, together with by turning this waste into client items, writes Nikkei Asia’s Dylan Loh.

“In comparison with the remainder of the world, South and south-east Asia use extra single-use plastic on account of its affordability and comfort,” mentioned Prak Kodali, CEO and co-founder of pFibre, which is taking one other strategy. The Singapore-based firm makes use of biodegradable plant-based components to make versatile packaging movie that mimics the properties of plastic.

Eco-friendly companies of this kind are looking for to advertise a “round financial system” that reduces or eliminates human-generated waste. However elevating cash is a problem at a time when world macroeconomic uncertainties, rising rates of interest and inflationary pressures are retaining buyers on the sidelines. Deal exercise involving sustainable corporations fell 24 per cent in 2022 to $159.3bn, a two-year low, in line with a report in January by monetary knowledge supplier Refinitiv.

New drive wanted

From chip and part makers to remaining product assemblers, tech suppliers are banking on the rising electrical automobile business to offset the extreme slowdown in client electronics demand, Nikkei Asia’s Lauly Li writes.

Foxconn, the world’s largest contract electronics producer, is optimistic concerning the EV business, whereas Taiwan Semiconductor Manufacturing, the highest contract chipmaker, says demand for auto-related chips stays excessive and provide constraints will proceed this yr.

“I spent 4 months on a enterprise journey to our factories in Dongguan, Suzhou, China, not too long ago,” mentioned a procurement supervisor at a maker of thermal modules for PCs, smartphones and servers that additionally provides EV maker BYD. “The one factor that our firm, our suppliers and our compatriots discuss and really feel hopeful about this yr is EVs.”

Nonetheless, there’s a danger in anticipating an excessive amount of from the automotive sector, analysts warn, as the worldwide financial system battles inflation whereas value of dwelling crises in main nations eat into client shopping for energy.

Advised reads

-

China tells large tech corporations to not supply ChatGPT providers (Nikkei Asia)

-

Disappearance of dealmaker Bao Fan casts chill throughout China’s tech sector (FT)

-

Sumitomo to bypass China in EV rare-earth provide chains (Nikkei Asia)

-

China performs catch-up to ChatGPT as hype builds round AI (FT)

-

Shein offers buyers lofty income projections because it prepares for IPO (FT)

-

Chinese language EV matches luxurious with cost-cutting guts, teardown reveals (Nikkei Asia)

-

Banker’s disappearance undermines Beijing’s messaging to buyers (Nikkei Asia)

-

Saudi Arabia-backed group to take a position $265mn in Chinese language esports firm VSPO (FT)

-

Justin Solar to maneuver crypto change Huobi’s Asia HQ to Hong Kong (Nikkei Asia)

-

Lex: Temu/Pinduoduo: purchasing like a billionaire comes with strings hooked up (FT)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with help from the FT tech desk in London.

Join right here at Nikkei Asia to obtain #techAsia every week. The editorial workforce might be reached at techasia@nex.nikkei.co.jp

[ad_2]