[ad_1]

Yves right here. Regardless of some technically-accurate effort to depict the rounding-error-level decline in CPI to six.4% in January from 6.5% in December as easing (as an illustration, the Wall Avenue Journal’s U.S. Inflation Eases, however Tempo of Moderation Slows), different venues have been within the Wolf Richter camp of not shopping for it. From Bloomberg:

Fed Officers Float Even Larger Charges After Brisk Inflation Information

The Inflation Boogeyman Now Hides in Companies

By Wolf Richter, editor of Wolf Avenue. Initially printed at Wolf Avenue

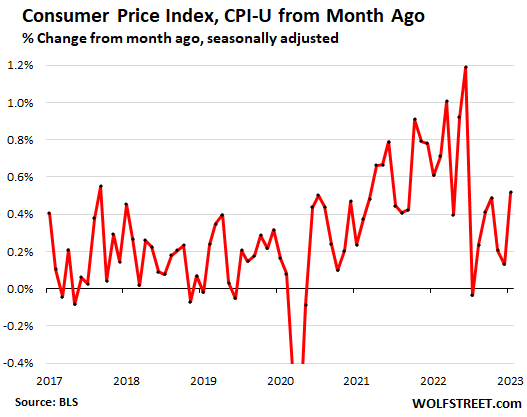

The Client Worth Index (CPI-U) for all gadgets jumped by 0.5% for the month, the largest month-to-month enhance since June, pushed up by relentless inflation in companies, in line with the CPI information launched as we speak by the Bureau of Labor Statistics.

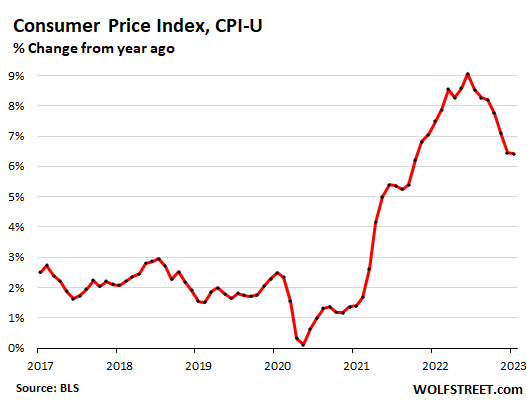

12 months-over-year, the Client Worth Index jumped by 6.4%, pushed by a four-decade excessive within the companies CPI. In December, the CPI had jumped by 6.5%. However the distinction was largely in rounding. Unrounded: January CPI = 6.410%, December CPI = 6.454%. Unrounded, the variations are too small to be significant:

Main classes of the CPI, month-over-month and year-over-year:

- Companies: +0.6%; +7.6%

- Sturdy items: -0.1%; -1.3%

- Meals at house: +0.4%; +11.3%

- Meals away from house: +0.6%; +8.2%

- Power: +2.0%; +8.7%

- Core CPI (with out meals and vitality): +0.4%; +5.6%

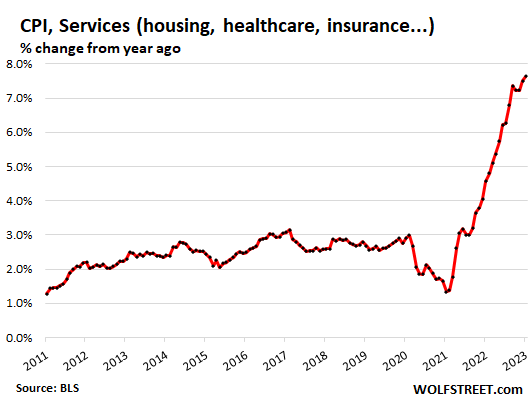

Companies Inflation Jumps to New 4-Decade Excessive

The Fed’s eyes are on companies. Powell has been speaking about it for months. I’ve been screaming about inflation transferring into companies since not less than the February 2022 CPI, earlier than the Fed even began mountain climbing charges. Almost two-thirds of client spending goes into companies: Hire, different housing components, insurance coverage of all types, healthcare, training, repairs, journey and resort bookings, subscriptions, streaming, telecommunication companies, haircuts, pet companies, and so forth. In companies is the place inflation will get sticky.

The CPI for companies inflation rose by 0.6% in January from December – on prime of the upwardly revised December bounce. It has been over 0.6% in seven of the previous 10 months, which reveals simply how sticky companies inflation is, as soon as it breaks unfastened.

On an annual foundation, companies inflation jumped by 7.6%, the worst year-over-year enhance since 1982 and the fifth month in a row above 7%. In companies is the place inflation is now raging, the place it’s entrenched.

Companies by Class

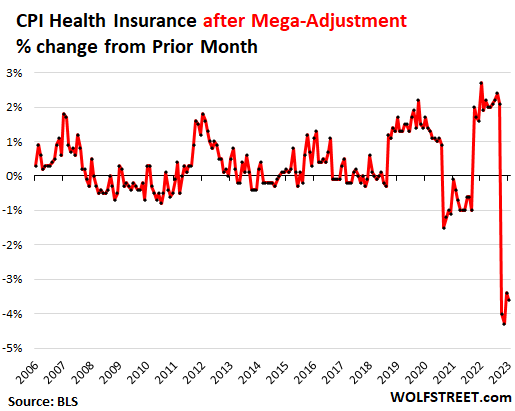

The medical health insurance downward adjustment. The BLS undertakes annual changes in the way it estimates the prices of medical health insurance after which spreads these changes over the next 12 months. The primary mega-adjustment hit in October. January was the fourth month of 12 (extra particulars right here). With out that adjustment, companies CPI would have been even worse for the previous 4 months.

On account of this downward adjustment, the CPI for medical health insurance plunged by 3.6% in January from December. These 4 months of mega-adjustments diminished the year-over-year fee of the CPI for medical health insurance from the pre-adjustment +28% in September to +1.2% in January.

However the Fed’s favourite inflation measure, the PCE worth index, tracks medical health insurance inflation otherwise, and there’s no such changes.

Listed below are the month-to-month modifications of the medical health insurance CPI after the changes:

Medical health insurance is a part of medical care companies, and in order that adjustment knocked down the CPI for medical care companies to -0.7% month-to-month. Each are included within the desk.

| Companies | MoM | YoY |

| General companies | 0.6% | 7.6% |

| Automotive and truck rental | 3.0% | 1.8% |

| Postage & supply companies | 1.5% | 6.8% |

| Resorts, motels, and so forth. | 1.5% | 8.5% |

| Motorcar insurance coverage | 1.4% | 14.7% |

| Motorcar upkeep & restore | 1.3% | 14.2% |

| Pet companies, together with veterinary | 1.0% | 9.4% |

| Water, sewer, trash assortment companies | 0.9% | 5.0% |

| Hire of main residence | 0.7% | 8.6% |

| Proprietor’s equal of lease | 0.7% | 7.8% |

| Video and audio companies, cable | 0.6% | 3.9% |

| Different private companies (dry-cleaning, haircuts, authorized companies…) | 0.5% | 5.3% |

| Recreation companies, admission to motion pictures, live shows, sports activities occasions | 0.3% | 5.7% |

| Phone companies | 0.2% | 2.0% |

| Tenants’ & Family insurance coverage | 0.1% | 0.9% |

| Medical care companies | -0.7% | 3.0% |

| Airline fares | -2.1% | 25.6% |

| Consists of: Medical health insurance | -3.6% | 1.2% |

The CPI for Housing as a Service

The CPI for “lease of shelter,” which in January accounted for 34.4% of complete CPI, tracks housing prices as a service, not as an funding, and relies on lease components, primarily:

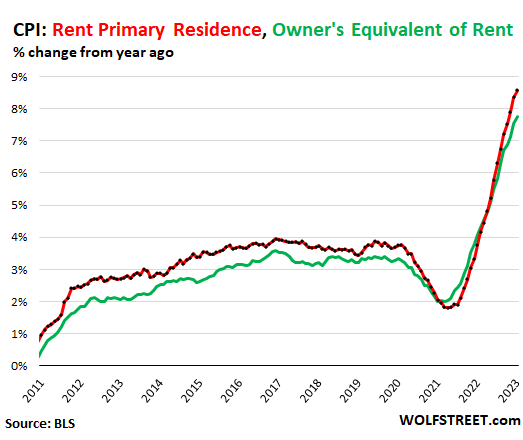

“Hire of main residence” (accounted for 7.5% of complete CPI) spiked by 0.7% for the month and by 8.6% year-over-year, the very best since 1982. It tracks how precise rents paid by tenants modified at a big group of rental homes and flats, together with in rent-controlled models (crimson within the chart under).

This contrasts with different lease indices that monitor “asking rents,” the marketed rents of nonetheless vacant models on the rental market. When asking rents are too excessive to fill the models, landlords could decrease the asking lease. There was a growth in asking rents in the course of the pandemic. However leases don’t flip over that a lot, and proportionately not many individuals truly ended up paying these asking rents.

“Proprietor’s equal lease of residences” (accounted for 25.4% of complete CPI) jumped by 0.7% for the month and by 7.8% year-over-year, the worst within the information. It tracks the prices of homeownership as a service, based mostly on what a big panel of house owners report their house would lease for (inexperienced line).

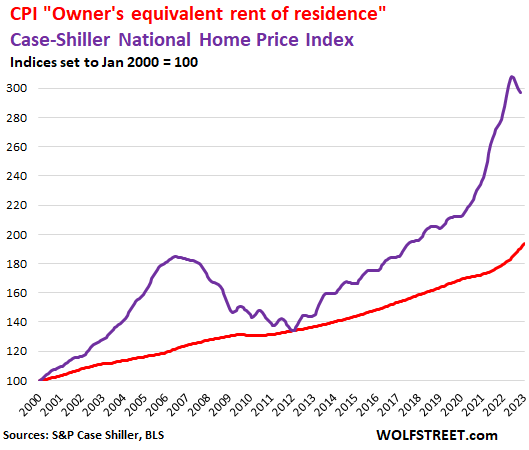

House costs, based mostly on the Case-Shiller House Worth Index, peaked with the “June” report after which began to say no [I track this by city in The Most Splendid Housing Bubbles in America]. The latest information level is the three-month transferring common of September, October, and November (purple line within the chart under).

The crimson line represents “proprietor’s equal lease of residence.” Each traces are index values, not percent-changes of index values:

Meals Inflation

The CPI for “Meals away from house”– eating places, merchandising machines, cafeterias, sandwich outlets, and so forth. – jumped by 0.6% for the month and by 8.2% year-over-year, the sixth month in a row of 8.0% or extra.

The CPI for “meals at house” – meals purchased at shops and markets – re-accelerated to a rise of 0.4% in January from December. On an annual foundation, the CPI for meals at house rose by 11.3%, the eleventh month in a row with double-digit year-over-year will increase.

As some costs began to retreat, different costs rose. The CPI for eggs spiked as a consequence of points triggered by the avian flu:

| Meals at house by class | MoM | YoY |

| General Meals at house | 0.4% | 11.3% |

| Cereals and cereal merchandise | 1.3% | 15.9% |

| Beef and veal | 1.1% | -1.2% |

| Pork | 0.0% | 1.5% |

| Poultry | -0.1% | 11.2% |

| Fish and seafood | -0.1% | 4.0% |

| Eggs | 8.5% | 70.1% |

| Dairy and associated merchandise | 0.0% | 14.0% |

| Contemporary fruits | 0.8% | 3.0% |

| Contemporary greens | -2.3% | 7.4% |

| Juices and nonalcoholic drinks | -0.1% | 13.3% |

| Espresso | 0.9% | 12.8% |

| Fat and oils | 0.0% | 20.9% |

| Child meals & system | -0.5% | 10.0% |

| Alcoholic drinks at house | 0.4% | 5.3% |

Power Costs

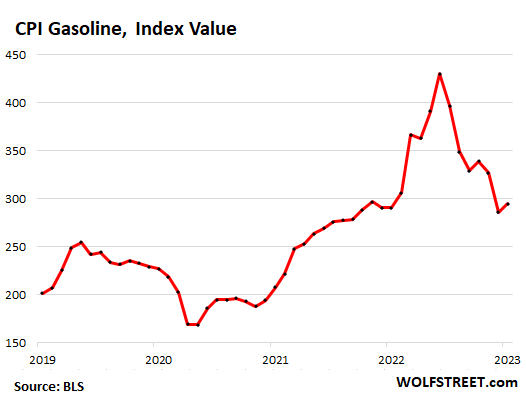

Gasoline costs rose by 2.4% in January from, December, after having plunged since June 2022. The explosion, so to talk, of gasoline costs within the first half of 2022 has now been unwound.

12 months-over-year the CPI for gasoline is up by 1.5%. It’s potential that the CPI for gasoline could have bottomed out in December. This chart reveals the CPI for gasoline of every type:

And word the surge in pure fuel piped to the house. Electrical energy continues to rise sharply:

| Power | MoM | YoY |

| General Power CPI | 2.0% | 8.7% |

| Gasoline | 2.4% | 1.5% |

| Utility pure fuel to house | 6.7% | 26.7% |

| Electrical energy service | 0.5% | 11.9% |

| Heating oil, propane, kerosene, firewood | -3.9% | 18.0% |

Sturdy Items Costs: Drop Seems to Stall

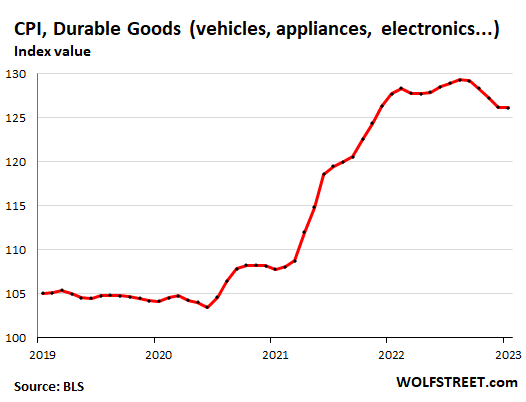

The CPI for sturdy items fell for the fifth month in a row, by 0.1% from December, a a lot slower decline than within the prior months, slowing the method of working off the ridiculous spike that began in late 2020.

On an annual foundation, the sturdy items CPI fell by 1.3%.

Right here is the CPI for sturdy items, expressed as index worth, not as percent-change of the index worth. It reveals the ridiculous spike beginning in late 2020 by mid-2022, and the value drops since then.

The long-term development of the sturdy items CPI because the mid-Nineties, when “hedonic high quality changes” have been integrated, was downward – that means deflationary. And that is the way it ought to be naturally as a result of manufacturing and transportation efficiencies, pushed by competitors, ought to trigger costs of the identical product to return down.

Nonetheless, these aren’t the identical merchandise. For instance, even the fundamental mannequin of the Ford F-150 pickup now has a 10-speed automated transmission, up from a four-speed automated within the mid-Nineties. Motor automobiles have gotten quite a bit higher over time and aren’t the identical merchandise anymore. The cellphones of the mid-Nineties have became smartphones. They’re not the identical merchandise anymore. And so the price of these enhancements are faraway from the index through “hedonic high quality changes.” The spike in costs that began in 2020 outran by a large margin the hedonic high quality changes.

| Sturdy items by class | MoM | YoY |

| Sturdy items general | -0.1% | -1.3% |

| Data expertise (computer systems, smartphones, and so forth.) | 0.0% | -11.7% |

| Used automobiles | -1.9% | -11.6% |

| Sporting items (bicycles, gear, and so forth.) | 0.5% | 1.5% |

| New automobiles | 0.2% | 5.8% |

| Family furnishings (furnishings, home equipment, flooring coverings, instruments) | 0.5% | 6.4% |

“Core CPI.”

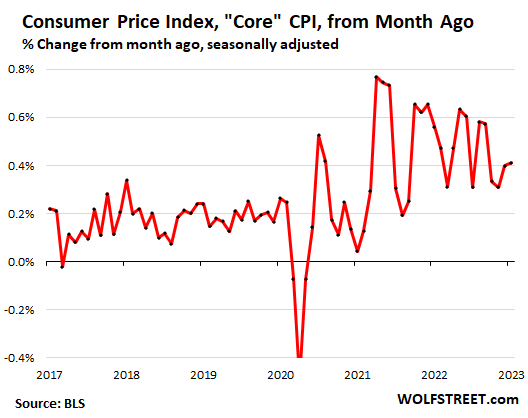

The core CPI, which excludes the risky meals and vitality merchandise, rose 0.4% in January from December, only a hair (unrounded) above the rise in December. This additionally reveals simply how sticky inflation has change into, regardless of the drop in sturdy items costs:

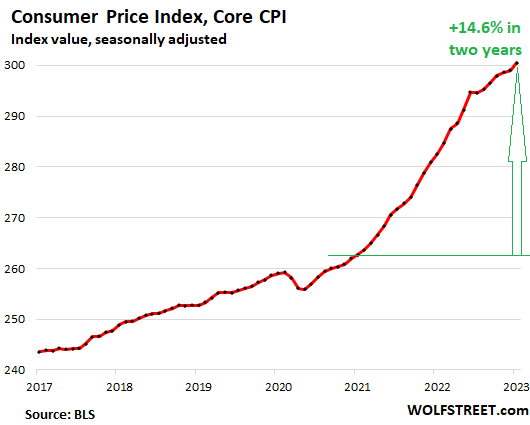

12 months-over-year, core CPI jumped 5.6%, in comparison with 5.7% in December. This chart reveals the index of Core CPI, quite than the year-over-year p.c change, for a dose of the place that is going: Over the previous 24 months, the Core CPI has soared by 14.6%:

[ad_2]