[ad_1]

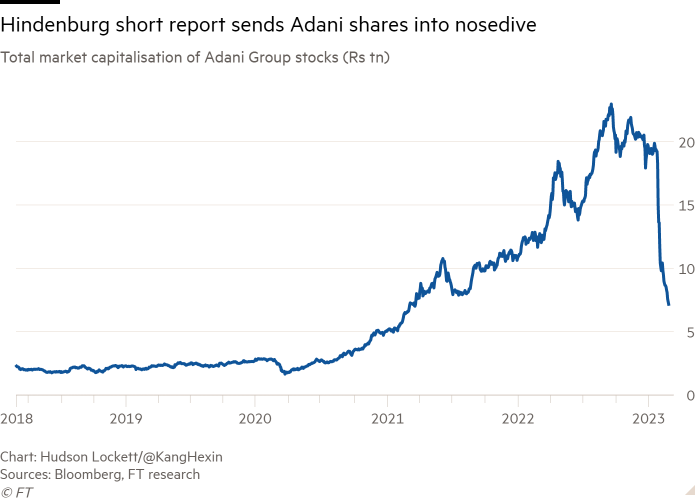

Gautam Adani’s enterprise empire has had greater than $145bn wiped from its worth within the month since a US brief vendor alleged fraud, laying naked the battle the Indian tycoon nonetheless faces in regaining the boldness of buyers.

The sell-off triggered by Hindenburg Analysis, which accused Adani of inventory manipulation and accounting fraud, has erased greater than 60 per cent from the worth of Adani’s publicly traded corporations and rocked an empire that spans ports to airports to power.

Adani has strenuously denied Hindenburg’s allegations, however shares have remained below stress. Falls on Friday left the general market capitalisation of the listed teams on the lowest degree since Hindenburg levelled its accusations.

The disaster that engulfed the sprawling set of companies has helped cut back the billionaire’s personal fortune by $79bn for the reason that begin of the 12 months, permitting rival Indian industrialist Mukesh Ambani to reclaim the title of wealthiest particular person in Asia.

“Among the corporations have been costly, overly costly, at greater than 100 occasions PE valuation,” mentioned Abhishek Jain, head of analysis at Arihant Capital in Mumbai. He added that the “hammering” by buyers meant among the shares have been now at extra enticing costs and “could be attention-grabbing to take a look [at]”.

Earlier than this 12 months’s turmoil, Adani had expanded his empire at breakneck velocity, taking up extra debt and pushing into areas that required substantial funding, together with hydrogen and photo voltaic companies.

However there at the moment are indicators of retrenchment. A number of Adani corporations have paused upcoming investments, together with an $847mn coal energy plant acquisition. Final week, an settlement by Adani Energy Maharashtra Restricted to determine a cement grinding unit with Orient Cements was referred to as off.

“We won’t make new commitments until we settle this volatility interval,” group chief monetary officer Jugeshinder “Robbie” Singh instructed analysts, following outcomes this month from Adani Enterprises, the group’s flagship firm.

A call to ditch a $2.4bn share sale by Adani Enterprises at the beginning of the month was one of the crucial placing blows inflicted by the disaster. Since then, score company Moody’s has lower its outlook on a number of Adani Group corporations.

Greenback bonds issued by Adani companies have bought off, with separate $750mn bonds from Adani Inexperienced Vitality and Adani Ports, maturing in 2024 and 2027 respectively, every buying and selling at round $0.80 on the greenback.

“Individuals don’t have any downside shopping for Indian credit score,” mentioned the pinnacle of Asia bond syndication for a western funding financial institution. “It’s Adani they gained’t contact.”

With the Adani empire nonetheless below intense scrutiny, analysts have mentioned that the group ought to deal with lowering leverage and reassuring buyers over the robustness of its underlying companies.

“He must deal with conserving the money, prepaying the debt,” mentioned Varun Fatehpuria, founder and chief govt of Kolkata-based digital wealth administration platform Daulat. “Individuals are searching for extra readability and transparency into the precise well being of the enterprise.”

The turmoil on the inventory market has additionally led to stresses over loans taken by Adani’s household backed by shares within the listed corporations. Earlier this month, Adani repaid a $1.1bn share-backed mortgage after going through a margin name of greater than $500mn.

In line with an individual conversant in the matter, executives on the Adani Group need to repay an additional $1bn value of excellent share-backed loans taken by the household or “promoters”.

In an effort to reassure bondholders, Adani corporations are paying some collectors forward of schedule. Adani Ports and Particular Financial Zone managing director Karan Adani mentioned the corporate would repay or pre-pay greater than $600mn of loans within the coming monetary 12 months, to convey down its debt to earnings ratio. The corporate repaid Rs5bn ($60.3mn) to an Indian mutual fund in opposition to maturing business papers final week.

“To spice up the sentiment of market individuals or bondholders, they’ve been paying off quite a lot of debt early,” mentioned Abhishek Jain, head of analysis at Mumbai-based Arihant Capital.

Regardless of the retrenchment in current weeks, there are indicators Adani retains his worldwide ambitions — it’s one month since Adani visited Israel to finish the group’s joint acquisition of Israel’s strategic Haifa Port. In the meantime, Adani Group mentioned it had bid for an under-construction metal plant within the central Indian state of Chhattisgarh, which the federal government is promoting.

In a video launched shortly after the Adani Enterprises share sale was ditched, Adani mentioned “we’ll proceed to deal with long-term worth creation and development”.

[ad_2]