[ad_1]

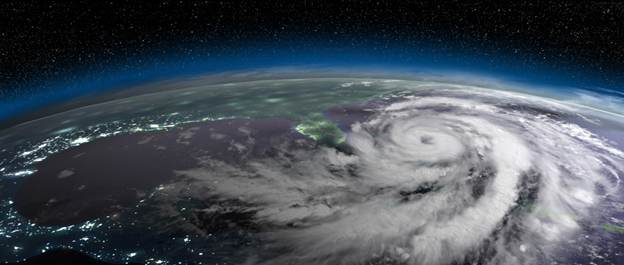

BERLIN, Mar 02 (IPS) – When tectonic plates shift, the earth shakes. Tsunamis race across the globe within the type of shock waves. The worldwide financial system has skilled three such earthquakes in recent times. The Covid-19 pandemic has made us conscious of the vulnerability of a globally built-in financial system.

When essential parts are caught in quarantine in China, manufacturing strains in Germany come to a halt. Thus, within the group of worldwide provide chains – which for many years have been trimmed down for effectivity (‘simply in time’) – resilience (‘simply in case’) will play a extra essential position sooner or later.

After the top of the unipolar second, bigger and smaller powers are vying for the most effective positions within the new world order. Within the hegemonic battle between China and america, the federal government beneath Joe Biden has verbally disarmed, however its export controls within the high-tech sector have all of the extra chunk.

This politicizes the framework situations for funding selections. Market entry, infrastructure tasks, commerce agreements, power provides and expertise transfers are an increasing number of being evaluated from a geopolitical standpoint.

Corporations are more and more confronted with the choice of selecting one IT infrastructure, one market and one foreign money system over the opposite. The most important economies might not decouple from one another throughout the board, however diversification (‘not all eggs in a single basket’) is gaining momentum, particularly within the high-tech sector. As this develops, we can not rule out the likelihood that financial blocs will type.

The expertise with the ‘human uncertainty issue’ within the pandemic can be ensuing within the acceleration of digital automation. Robots and algorithms make it simpler to guard towards geopolitical dangers.

With a purpose to convey these vulnerabilities beneath management, the previous industrialized nations are reorganizing their provide chains. It stays to be seen whether or not that is purely for financial or logistical causes (re-shoring or near-shoring), or whether or not geopolitical motives additionally play a job (friend-shoring).

Bloc formations

China should reply to those challenges. The destiny of the Folks’s Republic will rely on whether or not it succeeds in charging to the pinnacle of the pack in worldwide expertise, even with out overseas expertise and know-how. Anybody who believes that Beijing has no countermeasures up its sleeve will quickly be confirmed unsuitable.

With a purpose to compensate for the closure of the developed export markets, the Silk Street Initiative has been opening up new gross sales markets and uncooked materials suppliers for years. On the final get together congress, the Chinese language Communist Occasion formally permitted a reversal of its improvement technique.

Any longer, the large dwelling market would be the engine of the ‘twin round financial system’. Export earnings are nonetheless desired, however strategically they’re being relegated to a supportive position.

One impetus behind China’s large build-up of gold reserves serves is the aim of getting its personal (digital) foreign money take the place of the US greenback because the world’s reserve foreign money. As a result of China advantages greater than anybody else from open world markets, it’s persevering with to depend on a globally networked world financial system in the interim. Alternatively, Beijing is also tempted to create its personal financial bloc.

The foundations for this have already been put into place, with the Regional Complete Financial Partnership (RCEP), the BRICS Improvement Financial institution (NDB), the Asian Infrastructure Funding Financial institution (AIIB), the Silk Street Initiative (BRI) and bilateral cooperation in Africa, Latin America and the Center East.

The difficulties that Western firms face within the Chinese language market ought to present only a pattern of what’s looming if China makes market entry into such a bloc contingent on good political will.

However it’s not simply China. Usually, for all of Asia as the brand new heart of the world financial system, these geoeconomic disruptions are tantamount to a tsunami. And the disruptions may hit growing nations notably laborious.

Whether or not they’re being minimize from world provide chains for the sake of resilience or because of geopolitical elements, this brings equally devastating outcomes. After all, some economies are hoping to learn from the diversification methods of developed nations (i.e. the ‘China plus one’ technique).

However digital automation neutralizes what is commonly their solely comparative benefit – low cost labor prices. Why ought to a European medium-sized firm need to take care of corruption and energy cuts, high quality issues and sea routes lasting weeks, when the robots at dwelling produce higher and cheaper?

Algorithms and synthetic intelligence are additionally prone to exchange thousands and thousands of service suppliers in outsourced again workplaces and name facilities. How are growing nations speculated to feed their (generally explosively) rising populations if, sooner or later, easy jobs are to be carried out by machines in industrialized nations? And what do these geoeconomic disruptions imply for the social and political stability of those nations?

As with Europe, most Asian states rely on China’s dynamism for his or her financial improvement – and on the ensures of the US for his or her safety. Subsequently, to various levels, they resist strain to decide on sides.

Whether or not it is going to be potential to flee the pull of geoeconomic bi-polarization over the long run, nonetheless, continues to be an open query. If the splitting of IT infrastructures continues, it might be too pricey to play in each technological worlds.

American laws forestall merchandise with sure Chinese language parts from coming into the market; however those that need to play on the Chinese language market will be unable to keep away from a steadily rising share of Chinese language parts.

Lowering financial vulnerabilities by way of diversification

The sort of world financial system would additionally pose an existential problem to export nations reminiscent of Germany. Even the short-term reducing off of Russian power is a Herculean job. Decoupling from China on the identical time appears troublesome to think about. However burying one’s head within the sand is not going to be sufficient.

Neither nations nor companies will have the ability to escape the strain from Washington and Beijing. Sooner or later, essential financial, technological, and infrastructural selections will more and more be topic to geopolitical concerns. Subsequently, decreasing one-sided vulnerabilities by way of diversification is the fitting factor to do.

Then again, a few of the classes drawn from the over-reliance on Russian power earlier than the conflict appear short-sighted. For many years, the German financial system has built-in itself extra deeply into the world financial system than many different nations, with the aim of avoiding violent conflicts by way of interdependence.

It can not get away of those interdependencies from sooner or later to the following. Lowering financial vulnerabilities by way of diversification is subsequently the fitting transfer, whereas decoupling for ideological causes is the unsuitable one. Germany ought to subsequently watch out for sacrificing its financial future to a very bold value-based overseas coverage.

It is because losses of prosperity translate into fears of the longer term and social decline at dwelling – a fertile breeding floor for right-wing populists and conspiracy theorists.

The geopolitical race, digital automation and the reorganization of provide chains in line with resilience standards are mutually reinforcing processes. It’s not solely firms that need to rethink their enterprise fashions – total nationwide economies must adapt their improvement fashions so as to have the ability to survive in a quickly altering world financial system.

The actual issue lies in having to make funding selections at present with out with the ability to foresee precisely what the world of tomorrow will appear like. Trying into the crystal ball, some assume they will see an age of de-globalization. And actually, within the wake of the 2008 monetary disaster, the height of globalization, as measured by the amount of world commerce and capital exports has already handed.

Nonetheless, de-globalization just isn’t synonymous with a relapse into autarkic nationwide economies. A stronger regionalization of the extra networked world financial system is extra possible. In view of the political, social and cultural upheavals of turbo-globalization, this needn’t be the worst of potential outcomes.

One factor is for certain: A geoeconomic tsunami will roll across the globe, crushing previous buildings in its path. The hope is that out of the ‘inventive destruction’ that Joseph Schumpeter spoke of, there’ll emerge a extra resilient, sustainable and diversified world financial system.

Nonetheless, with out political shaping of the brand new world financial order, the other may additionally happen. Politically, this implies adapting the rule-based world order in order that it stays a secure framework for an open world financial system as a result of even the group of a regionalised world financial system wants world guidelines of the sport that everybody adheres to.

Subsequently, with few exceptions, almost all nations have an important curiosity within the functioning of rules-based multilateralism. Nonetheless, within the International South, there may be already an excessive amount of mistrust in the direction of the prevailing world order.

In actuality, in line with some, this quantities to the creation of the previous and new colonial powers, whose supposedly common norms don’t apply to everybody however are as an alternative violated at will by the everlasting members of the UN Safety Council.

With a purpose to break by way of present blockages, reminiscent of these of the World Commerce Group (WTO), the rising powers should be granted illustration and a voice within the multilateral establishments that will be commensurate with their newfound significance.

Europe should settle for a relative lack of affect as a result of, as a rule-based supranational entity, its survival and prosperity rely on an open, rule-based world (financial) order.

As an alternative of morally elevating itself above others, Europe should focus all its energies on sustaining the situations for the success of its financial and social mannequin. With a purpose to forestall the regionalization of the world financial system from turning into the formation of competing blocs with excessive prosperity losses for everybody, there’s a want for brand new partnerships on an equal footing past the presently fashionable comparisons of democracies and autocracies.

To ensure that new belief to develop, the worldwide challenges (local weather change, pandemics, starvation, migration) that notably have an effect on the International South should lastly be tackled with dedication.

Marc Saxer coordinates the regional work of the Friedrich-Ebert-Stiftung (FES) within the Asia Pacific. Beforehand, he led the FES workplaces in India and Thailand and headed the FES Asia Pacific division

Supply: Worldwide Politics and Society (IPS)-Journal revealed by the Worldwide Political Evaluation Unit of the Friedrich-Ebert-Stiftung, Hiroshimastrasse 28, D-10785 Berlin

IPS UN Bureau

Observe @IPSNewsUNBureau

Observe IPS Information UN Bureau on Instagram

© Inter Press Service (2023) — All Rights ReservedAuthentic supply: Inter Press Service

[ad_2]