[ad_1]

US shopper inflation continues to ease, however much less so than anticipated in January. Yesterday’s replace means that the Federal Reserve will see the newest numbers as new signal that pricing stress isn’t cooling quick sufficient. In flip, the case might have strengthened on the central financial institution for protecting rates of interest larger for longer.

One central financial institution official on Tuesday suggested that lifting charges “for an extended interval than beforehand anticipated” could also be on the desk. “When inflation repeatedly is available in larger than the forecasts, because it did final yr, or when the roles report is available in with lots of of hundreds extra jobs than anybody anticipated, as occurred a pair weeks in the past, it’s onerous to believe in any outlook,” says Dallas Fed President Lorie Logan, a voting member on the rate-setting Federal Open Market Committee in 2023.

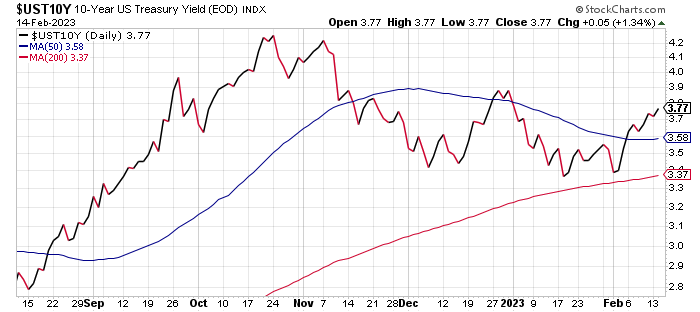

Regardless of situations that seem to supply help for the next US 10-year Treasury yield, the benchmark price stays reasonably under its latest peak. The ten-year yield ticked as much as 3.77% on Tuesday (Feb. 14), roughly a half proportion level under October’s excessive.

In the meantime, CapitalSpectator.com’s fair-value mannequin for the 10-year yield continues to mirror a decrease estimate vs. the market yield.

A decrease fair-value estimate has prevailed in latest months, providing helpful steering for anticipating a restricted upside bias for the 10-year price. In November, for instance, when the 10-year market price was trending larger, the fair-value mannequin instructed that “macro headwinds are pushing again on larger yields in a stronger diploma.” Since then, the 10-year price has roughly traded in a spread under its October peak.

The query is whether or not incoming inflation information will change the calculus and persuade the Fed to strengthen its hawkish bias? That would push the 10-year price larger because the market components in a extra restrictive financial coverage. Alternatively, the market might value in softer financial situations because of the Fed’s course correction, which can encourage new funding flows into Treasuries as a safe-haven commerce, thereby placing extra draw back stress on bond yields.

No matter lies forward, the present fair-value estimate of the 10-year price, which displays financial and market information by way of January, suggests comparatively low odds for a big, sustained rise within the benchmark price. Let’s see if the still-evolving macro profile for February suggests in any other case.

Study To Use R For Portfolio Evaluation

Quantitative Funding Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Threat and Return

By James Picerno

[ad_2]