[ad_1]

alvarez/E+ by way of Getty Pictures

The week, ending Feb. 3, noticed Federal Reserve mountain climbing its coverage fee by 25 foundation factors however Chair Jerome Powell warned that the central financial institution nonetheless has “extra work to do” to convey down inflation.

The Industrial Choose Sector SPDR (XLI) completed the week within the inexperienced (+1.69%). XLI was among the many eight, out of the 11 S&P 500 sectors, which closed the week with features. Zim topped the commercial gainers (in our phase) this week but it surely was earnings that performed a significant function among the many majority of gainers and decliners.

The SPDR S&P 500 Belief ETF (SPY) rose +1.64% for the week, which witnessed ISM Manufacturing fall greater than anticipated in January. ISM companies rose greater than anticipated whereas the PMI Manufacturing Index confirmed a shock improve in January.

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +14% every this week.

ZIM Built-in Delivery Companies (NYSE:ZIM) +22.78%. The Israeli transport firm’s inventory rose all through the week, probably the most on Thursday (+7.90%). ZIM has an SA Quant Ranking — which takes into consideration components reminiscent of Momentum, Profitability, and Valuation amongst others — of Maintain. The inventory had an element grade of A+ for Profitability however F for Progress. The common Wall Avenue Analysts’ Ranking agrees with a Maintain ranking of its personal, whereby 5 out of seven analysts see the inventory as such.

W.W. Grainger (GWW) +18.19%. The inventory surged probably the most on Feb. 2 +12.96% after the upkeep and restore merchandise distributor forecast ongoing progress for 2023. The corporate’s This autumn adjusted EPS beat consensus however income, although rising Y/Y, narrowly missed out.

The SA Quant Ranking on GWW is Maintain, with a rating of C+ for Momentum however D- for Valuation. The common Wall Avenue Analysts’ Ranking concurs with a Maintain ranking too, whereby 9 out of 17 analysts view the inventory the identical.

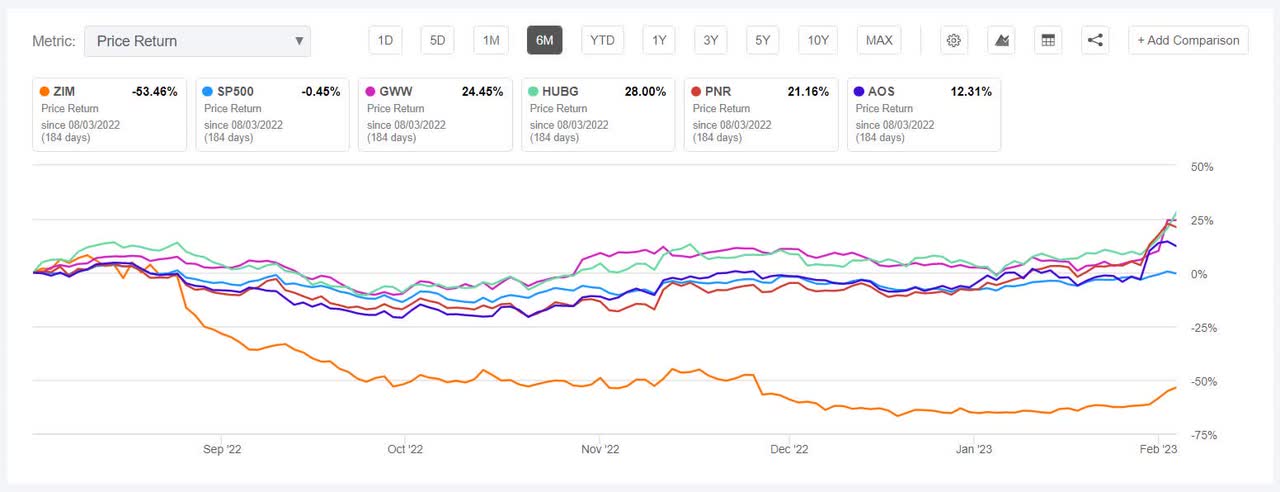

The chart under reveals previous 6-month price-return efficiency of the highest 5 gainers and SP500:

Hub Group (HUBG) +16.58%. The Oak Brook, Unwell.-based trucking companies supplier additionally gained following its earnings outcomes (Feb. 2 put up market) as GAAP EPS beat estimates and the inventory rose Friday (+6.05%).

The SA Quant Ranking on HUBG is Purchase, with a rating of B+ for each Profitability and Momentum. The common Wall Avenue Analysts’ Ranking has a Purchase ranking of its personal, whereby 8 out of 18 analysts tag the inventory as Sturdy Purchase.

Pentair (PNR) +15.21%. The water options supplier’s inventory soared on Tuesday (+9.23%) after This autumn adjusted EPS and income surpassed analysts estimates. The London-based firm has a SA Quant Ranking of Maintain, whereas the typical Wall Avenue Analysts’ Ranking is Purchase.

A. O. Smith (AOS) +14.40%. This autumn outcomes of the water heater merchandise developer exceeded expectations sending the inventory surging +13.67% on Tuesday. The SA Quant Ranking on AOS and the typical Wall Avenue Analysts’ Ranking, each, have a Maintain ranking.

This week’s prime 5 decliners amongst industrial shares (market cap of over $2B) all misplaced greater than -6% every.

Kanzhun (NASDAQ:BZ) -12.52%. The Beijing-based on-line recruitment platform’s inventory had seen volatility all through 2022 with appreciable ups and downs. This week the inventory fell probably the most on Friday (-6.17%).

The SA Quant Ranking on BZ is Maintain with B- rating for Profitability and a C+ for Progress. The ranking is in stark distinction to the typical Wall Avenue Analysts’ Ranking of Sturdy Purchase, whereby 9 out of 13 analysts see the inventory as such.

CNH Industrial (CNHI) -8.36%. The agricultural and building automobiles developer’s inventory slumped -8.83% on Thursday regardless of This autumn outcomes beat estimates. The corporate additionally famous that it’ll delist from Euronext Milan.

The SA Quant Ranking on CNHI is Sturdy Purchase, with a rating of A for Momentum and C for Valuation. The common Wall Avenue Analysts’ Ranking is Purchase, whereby 10 out of 18 analysts tag the inventory as Sturdy Purchase.

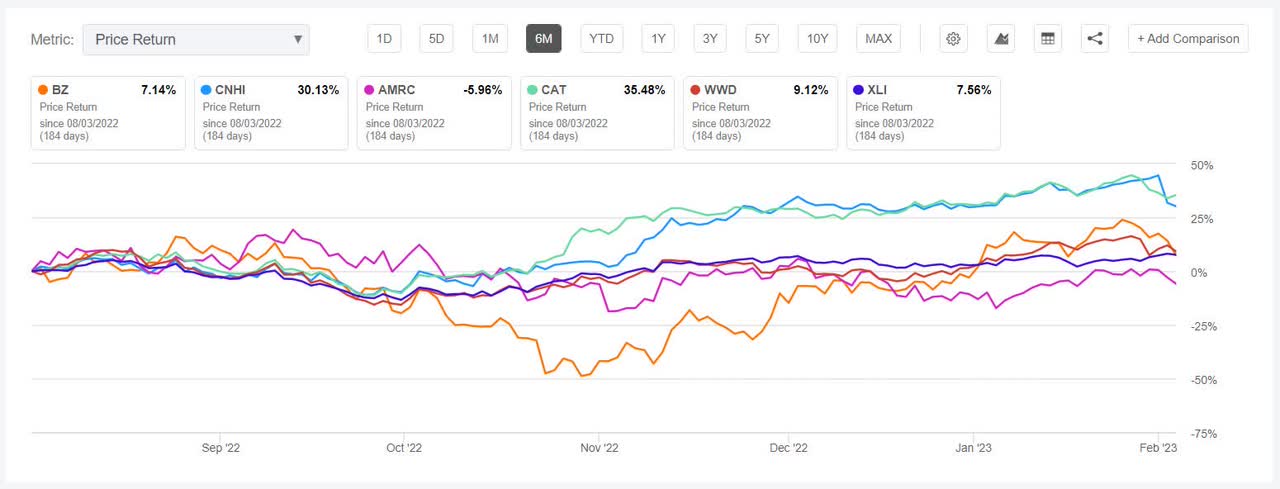

The chart under reveals previous 6-month price-return efficiency of the worst 5 decliners and XLI:

Ameresco (AMRC) -6.84%. The inventory dipped most on Thursday (-3.45%). The renewable vitality provide options supplier has an SA Quant Ranking of is Maintain, with a rating of D+ for Profitability however A- for Progress. The common Wall Avenue Analysts’ Ranking differs with a Sturdy Purchase ranking, whereby 9 out of 12 analysts see the inventory as such.

Caterpillar (CAT) -6.34%. The inventory fell -3.52% on Tuesday after the corporate mentioned its quarterly revenue was negatively affected by modifications within the worth of the U.S. greenback, in comparison with currencies in different nations. This autumn non-GAAP EPS missed analysts estimates. The SA Quant Ranking on CAT is Sturdy Purchase, whereas the typical Wall Avenue Analysts’ Ranking is Purchase.

Woodward (WWD) -6.15%. The aerospace merchandise maker’s Q1 income beat estimates however non-GAAP EPS missed estimates which made the inventory see pink on Tuesday (-6.47%). The SA Quant Ranking on WWD is Promote, which is in distinction to the typical Wall Avenue Analysts’ ranking of Maintain.

[ad_2]